In today’s blog, we will go over 5 top bearish options strategies you can use when you expect a stock or index to go down.

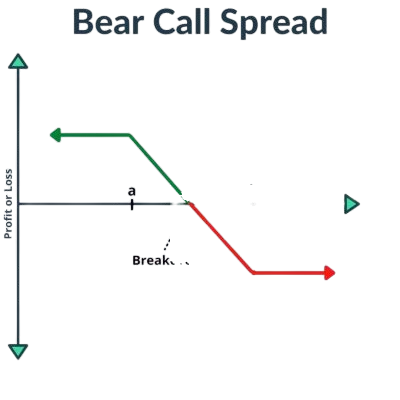

1.Bear Call Spread

What It Is:

This strategy involves selling a call option at a lower strike price and buying a call option at a higher strike price, both with the same expiration.

Why Use It:

You believe the stock will drop slightly or stay below a certain level. Since you collect more premium than you pay, the trade gives you a net credit.

Risk & Reward:

- Max Profit: Net credit received

- Max Loss: Difference between strike prices minus the credit.

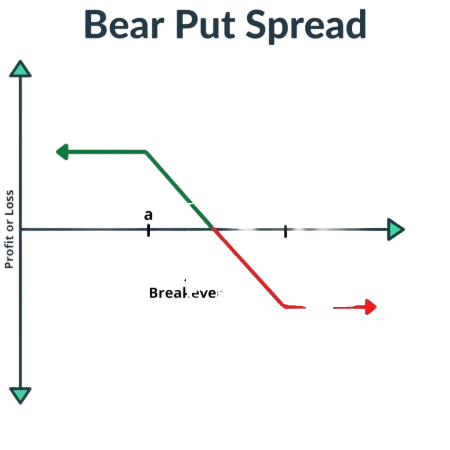

2. Bear Put Spread

What It Is:

You buy a higher strike put (in-the-money) and sell a lower strike put (out-of-the-money), both expiring at the same time.

Why Use It:

You expect the stock to drop. Selling the lower strike put reduces the cost of buying the higher strike one.

Risk & Reward:

- Max Profit: When stock falls to or below the lower strike

- Max Loss: Cost of the spread

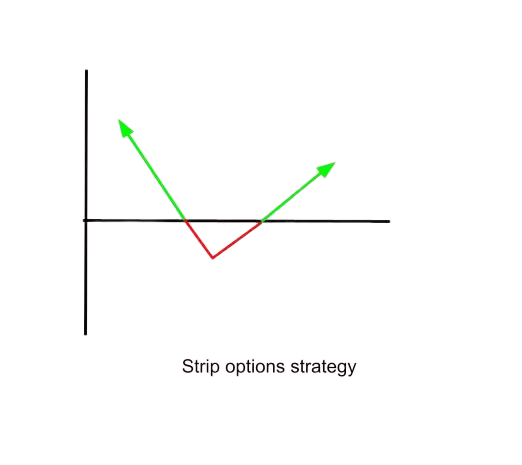

3. Strip Strategy

What It Is:

A more bearish version of a straddle. You buy 1 call and 2 puts at the same strike price and expiry.

Why Use It:

You expect a big move, mostly downward.

Risk & Reward:

- Max Profit: Unlimited if price drops a lot

- Max Loss: Happens if the stock stays at the strike price

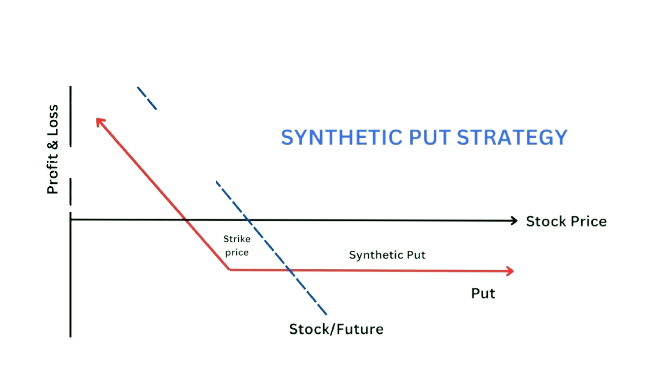

4. Synthetic Put

What It Is:

You short the stock and buy a call option on the same stock.

Why Use It:

To protect your short position if the stock rises. It behaves like owning a long put.

Risk & Reward:

- Max Profit: If the stock drops significantly

- Max Loss: Limited to the difference between stock price and call strike plus premium paid.

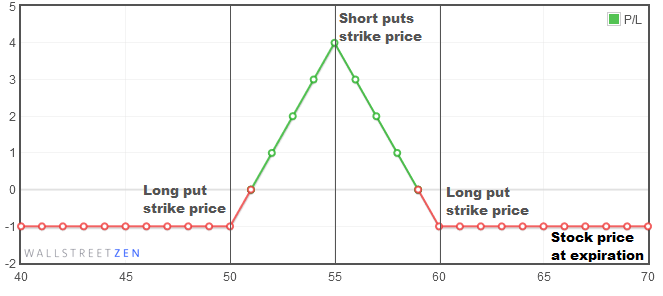

5. Bear Butterfly Spread

What It Is:

You create a spread using 2 long calls at the middle strike, and 1 short call each at a higher and lower strike.

Why Use It:

To profit when you expect low volatility and a drop in the stock price.

Risk & Reward:

- Max Profit: Net credit received

- Max Loss: Premium paid for the spread

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()