In today’s stock market, Sensex climbs 317 points as market breaks four-day losing streak; Nifty approaches 25,200

Stock Market Nifty Chart Prediction

On July 15, the Sensex was up 317.45 points at 82,570.91, and the Nifty was up 113.50 points at 25,195.80. About 2475 shares advanced, -1422 shares declined, and 148 shares unchanged.

Top Nifty gainers: Hero Motocorp, Sun Pharma, Bajaj Auto, Apollo Hospitals, Shriram Finance.

Top Nifty Losers : HCL Technologies, HDFC Life, SBI Life Insurance, Eternal and Tata Steel.

All sectoral indices closed higher, led by gains in pharma, auto, PSU banks, consumer durables, and realty sectors, each rising between 0.5% to 1%

The BSE Midcap and Smallcap indices rose nearly 1%.

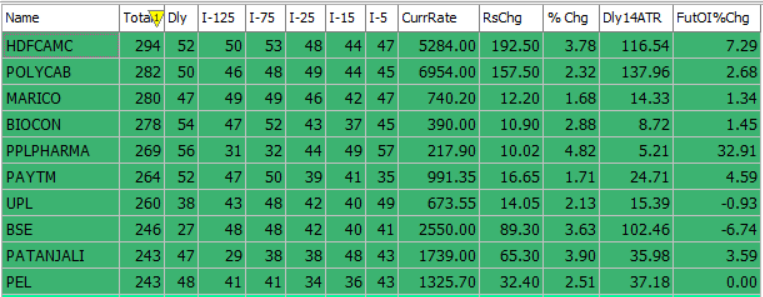

Best Stocks of the day according to AI (Delta Dash)

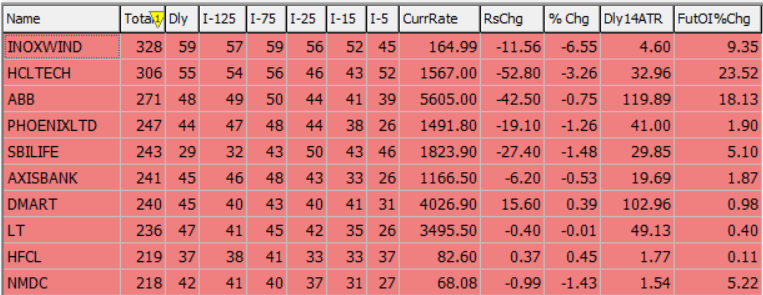

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 16th July 2025

| STOCK | Good Above | Weak Below |

| KEI | 3915 | 3875 |

| HEROMOTOCO | 4480 | 4430 |

| PATANJALI | 1750 | 1730 |

| SHRIRAMFIN | 690 | 682 |

Prediction for Wednesday NIFTY can go up if it goes above 25,500 or down after the level of 25,200, but it also depends upon the Global cues.

Nifty witnessed a strong rebound after retesting the crucial 25,000 support level, signaling renewed buying interest at lower levels. This recovery reflects improving sentiment and a potential shift in momentum. A sustained close above 25,250 — which also coincides with the 20-day Exponential Moving Average (EMA) — would confirm a bullish continuation and could mark the end of the recent consolidation phase.

Looking ahead, the index faces key resistance in the 25,500–26,000 range. A breakout beyond this zone may open the path for further upside. On the downside, initial support is seen at 25,200, with a stronger support base near 24,800. As long as Nifty holds above the 25,000 mark, the broader trend is expected to remain positive.

| Highest Call Writing at | 25,500 (1.2 crore) |

| Highest Put Writing at | 25,200 (95.2 Lakh) |

Nifty Support and Resistance

| Support | 25,200 and 24,800 |

| Resistance | 25,500–26,000 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday, BANKNIFTY can go up if it goes above 57,000 or down after the level of 56,500, but it also depends upon the Global cues.

Bank Nifty demonstrated solid strength during the session, closing decisively above the key 57,000 mark. A bullish Morning Star candlestick pattern has formed on the daily chart, signaling a potential reversal from the recent downtrend. This classic pattern reflects a shift in sentiment, with buyers starting to regain control after sustained selling pressure. Technically, the index now faces immediate resistance in the 57,000–57,300 range. A breakout above this zone could pave the way for further upside. On the downside, strong support is seen between 56,500 and 56,000, which may help cushion any short-term corrections

| Highest Call Writing at | 57,000 (13.8 lakh) |

| Highest Put Writing at | 56,500 (11.9 lakh) |

Bank Nifty Support and Resistance

| Support | 56,500 and 56,000 |

| Resistance | 57,000–57,300 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()