In today’s stock market, Nifty is above 25,300, and the Sensex has risen by 575 points. All sectors are showing positive movement.

Stock Market Nifty Chart Prediction

On October 15, Sensex rose by 575.45 points to 82,605.43, and the Nifty gained 178.05 points, reaching 25,323.55. A total of 2,393 shares advanced, 1,587 shares declined, and 152 shares remained unchanged.

Top Nifty gainers: Bajaj Finserv, Bajaj Finance, Trent, Nestle India, Asian Paints

Top Nifty Losers :Infosys, Tata Motors, Bajaj Auto, Tech Mahindra, Axis Bank

All sectoral indices closed in the positive, with the realty index rising by 3%. The power, consumer durables, PSU Bank, metal, and telecom indices gained between 1% and 2%.

BSE midcap index added 1%, and smallcap index jumped 0.7%.

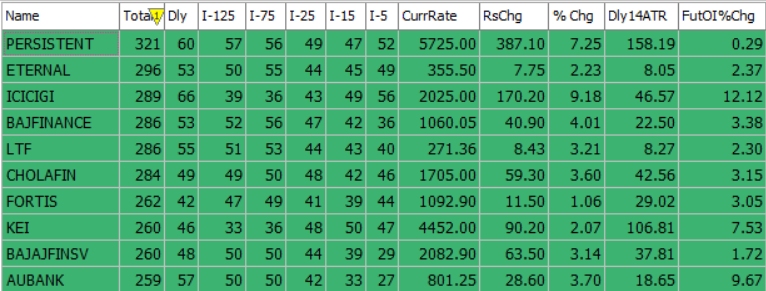

Best Stocks of the day according to AI (Delta Dash)

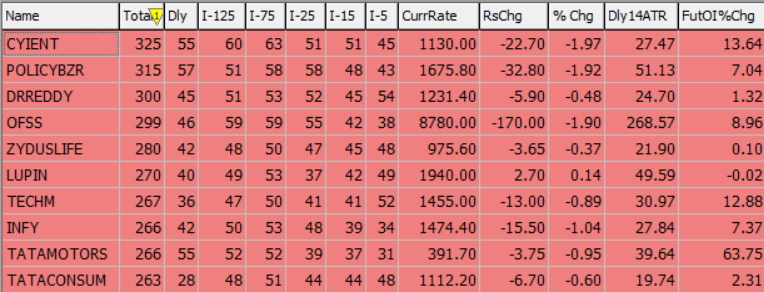

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 15th October 2025

| STOCK | Good Above | Weak Below |

| AUBANK | 805 | 796 |

| GODREJPROP | 2140 | 2120 |

| GRASIM | 2830 | 2800 |

| LT | 3844 | 3805 |

Prediction for Thursday NIFTY can go up if it goes above 25,300 or down after the level of 25,100, but it also depends upon the Global cues.

On October 15th, the index came close to testing its 20-day EMA range of 25,030–25,040 but managed to stay firmly above it, suggesting that the short-term trend remains positive and the recent dip was absorbed by the market.

Interestingly, the low of 25,061 from yesterday aligned with the middle line of the Bollinger Bands, which typically acts as dynamic support. The bounce from this level indicates that the index is respecting its average, and volatility is contained within the current uptrend.

However, the range between 25,310 and 25,330 has served as a strong resistance over the past few sessions, with the Nifty encountering selling pressure at these levels. While the index briefly moved past this resistance, it faced rejection at higher levels. A strong close above this zone will be crucial for the index to maintain its upward momentum. Resistance is expected in the 25,300 to 25,600 range, while support is likely to be between 25,100 and 24,600.

| Highest Call Writing at | 25,300 (80.6 Lk) |

| Highest Put Writing at | 25,100 (1.1 Cr) |

Nifty Support and Resistance

| Support | 25,100 and 24,600 |

| Resistance | 25,300 to 25,600 |

Bank Nifty Daily Chart Prediction

Prediction For Thursday BANKNIFTY can go up if it goes above 56,800 or down after the level of 56,200, but it also depends upon the Global cues.

BANKNIFTY (56,800) Banknifty is currently in a positive trend. If you’re holding long positions, continue to hold with a daily closing stoploss at 56,225. Bank Nifty continues to outperform Nifty, as shown by the rising Bank Nifty/Nifty ratio, indicating strong relative strength in banking stocks. The ADX indicator is also rising, suggesting that the current trend is gaining momentum and is likely to remain strong in the near term. You can consider initiating fresh short positions if Banknifty closes below the 56,225 level. On the upside, resistance is expected between 56,800 and 57,400, while support is seen in the range of 56,200 to 55,800.

| Highest Call Writing at | 56,800 (23.5 Lk) |

| Highest Put Writing at | 56,200 (15.4 Lk) |

Bank Nifty Support and Resistance

| Support | 56,200 to 55,800 |

| Resistance | 56,800 and 57,400 |

Voice Of Traders by Spider Software

How Mr. Kundan Prajapati Made $5 Million with a Simple Strategy (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()