In today’s stock market, Sensex and Nifty remain flat amid market volatility; metal stocks gain while IT shares weigh on sentiment.

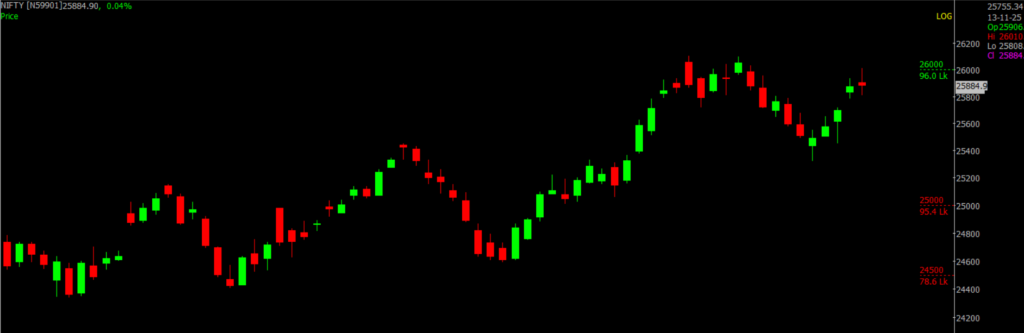

Stock Market Nifty Chart Prediction

On Nov 13, Sensex rose 12.16 points to 84,478.67, while the Nifty added 3.35 points to 25,879.15. Around 1,661 stocks advanced, 2,193 declined, and 107 remained unchanged.

Top Nifty gainers: Asian Paints, ICICI Bank, L&T, Interglobe Aviation, Hindalco

Top Nifty Losers : Eternal, Shriram Finance, Adani Ports, Bharat Electronics and M&M.

Among sectors, IT, media, PSU bank shed 0.5% each, while metal, pharma, realty rose 0.5% each.

BSE Midcap and smallcap indices were down 0.3 percent each.

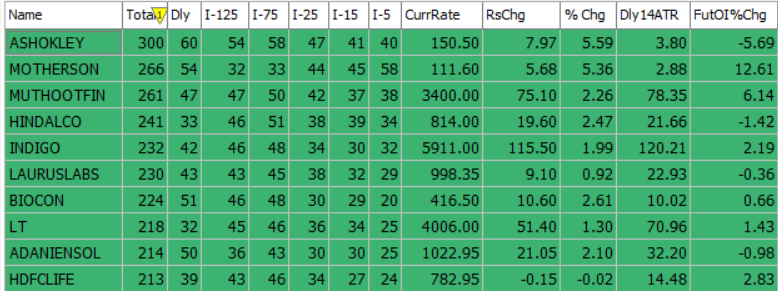

Best Stocks of the day according to AI (Delta Dash)

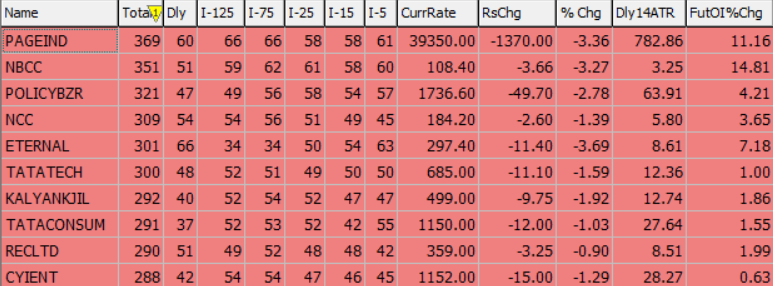

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 14th November 2025

| STOCK | Good Above | Weak Below |

| HDFCLIFE | 786 | 778 |

| ICICIBANK | 1390 | 1378 |

| LUPIN | 2066 | 2046 |

| LT | 4022 | 3980 |

Prediction for Friday NIFTY can go up if it goes above 25,900 or down after the level of 25,700, but it also depends upon the Global cues.

The Nifty index maintained a positive tone through most of the session, buoyed by upbeat sentiment and selective buying in key sectors. However, momentum waned near the crucial 26,000 level, prompting profit booking that wiped out early gains. Consequently, the index retreated from its intraday high and settled just below 25,900, posting a marginal rise of 0.01 points.

On the daily chart, Nifty has formed a high-wave candle for the second consecutive day a pattern that often reflects uncertainty and hesitation among traders. This cautious stance comes ahead of the Bihar state election results, which are likely to shape short-term market direction.

Looking ahead, immediate resistance is seen at 25,900–26,200, while key support lies between 25,700–25,200.

| Highest Call Writing at | 25,900 (96 Lk) |

| Highest Put Writing at | 25,700 (78.6 Lk) |

Nifty Support and Resistance

| Support | 25,700–25,200 |

| Resistance | 25,900–26,200 |

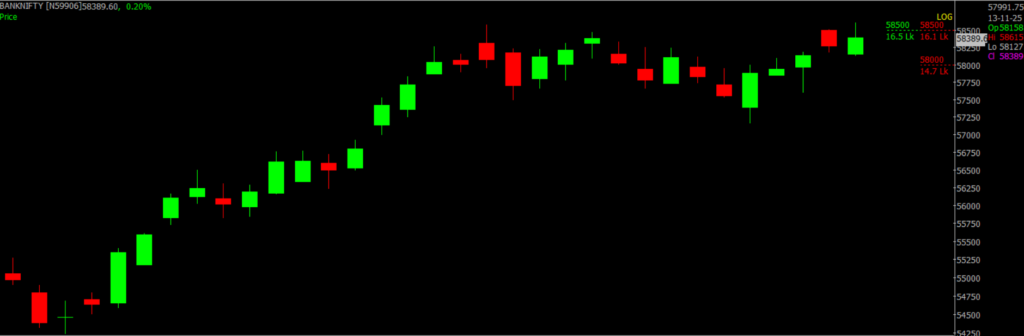

Bank Nifty Daily Chart Prediction

Prediction For Friday BANKNIFTY can go up if it goes above 58,500 or down after the level of 58,300, but it also depends upon the Global cues.

For the Bank Nifty index, the 57,900–57,800 zone is expected to act as immediate support. A sustained move below 57,800 could open the door for further downside toward 57,400.

At the current level of 58,382, Bank Nifty remains in a positive trend. Traders holding long positions are advised to maintain them with a daily closing stop-loss at 57,876. Fresh short positions may be considered only if the index closes below this level.

On the upside, key resistance is placed between 58,500 and 59,000, while support is seen in the 58,300–57,500 range.

| Highest Call Writing at | 58,500 (16.5 Lk) |

| Highest Put Writing at | 58,300 (16.1 Lk) |

Bank Nifty Support and Resistance

| Support | 58,300–57,500 |

| Resistance | 58,500 and 59,000 |

Voice Of Traders by Spider Software

This 2% Trading Rule can make you RICH (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()