In today’s stock market, market ends its 4-day decline, with the Nifty crossing 25,900 and the Sensex rising by 430 points.

Stock Market Nifty Chart Prediction

On Dec 19, Sensex was up 447.55 points at 84,929.36, and the Nifty rose 150.85 points to 25,966.40. About 2,538 shares advanced, 1,326 shares declined, and 127 shares remained unchanged.

Top Nifty gainers: Shriram Finance, Max Healthcare, Bharat Electronics, Power Grid Corp, Tata Motors

Top Nifty Losers : HCL Technologies, Adani Enterprises, Hindalco, JSW Steel, Kotak Mahindra Bank.

All the sectoral indices ended in the green with auto, pharma, oil & gas, realty, telecom, healthcare rose 0.5-1 percent.

The broader indices outperformed the main indices with BSE midcap and smallcap indices rising 1 percent each.

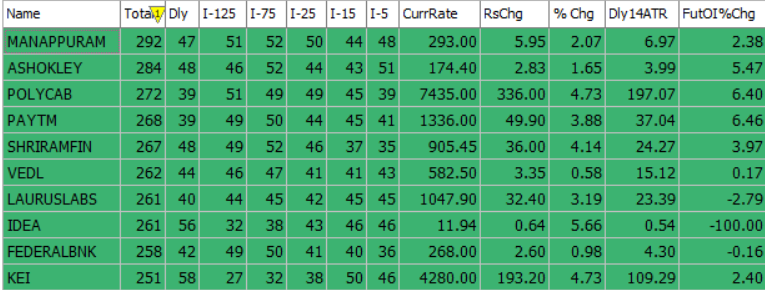

Best Stocks of the day according to AI (Delta Dash)

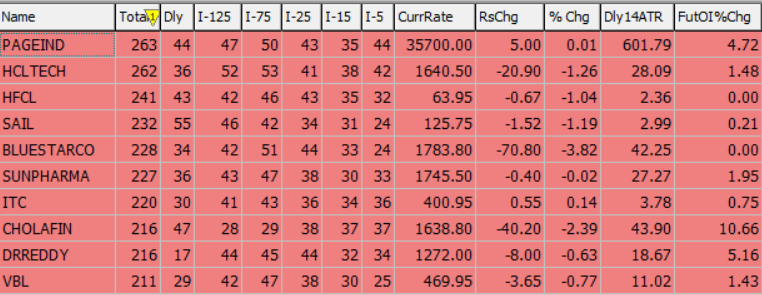

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 22nd December 2025

| STOCK | Good Above | Weak Below |

| LAURUSLAB | 1054 | 1042 |

| PAYTM | 1342 | 1328 |

| RELIANCE | 1570 | 1555 |

| TECHM | 1618 | 1600 |

Prediction for Monday NIFTY can go up if it goes above 25,900 or down after the level of 25,800, but it also depends upon the Global cues.

NIFTY (25,966): NIFTY is currently in a positive trend. Those holding long positions can continue to hold with a daily closing stop-loss of 25,794. Fresh short positions may be considered if NIFTY closes below 25,794. Key resistance is placed between 25,900–26,200, while immediate support is seen in the 25,800–25,500 range.

| Highest Call Writing at | 25,900 (1.4 Cr) |

| Highest Put Writing at | 25,800 (1.4 Cr) |

Nifty Support and Resistance

| Support | 25,800–25,500 |

| Resistance | 25,900 and 26,300 |

Bank Nifty Daily Chart Prediction

Prediction For Monday BANKNIFTY can go up if it goes above 59,000 or down after the level of 58,800, but it also depends upon the Global cues.

On the weekly chart, the Bank Nifty formed a doji candle, indicating indecision among investors. On Friday, the index again failed to close above its 10-day SMA, keeping short-term sentiment cautious. Key resistance is seen between 59,000–59,500, while immediate support lies in the 58,800–58,500 range.

| Highest Call Writing at | 59,000 (17.9 Lk) |

| Highest Put Writing at | 58,800 (12.4 Lk) |

Bank Nifty Support and Resistance

| Support | 58,800–58,500 |

| Resistance | 59,000 and 59,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()