In today’s stock market, Market fell for the fifth day in a row, with the Sensex down 605 points and the Nifty going below 25,700.

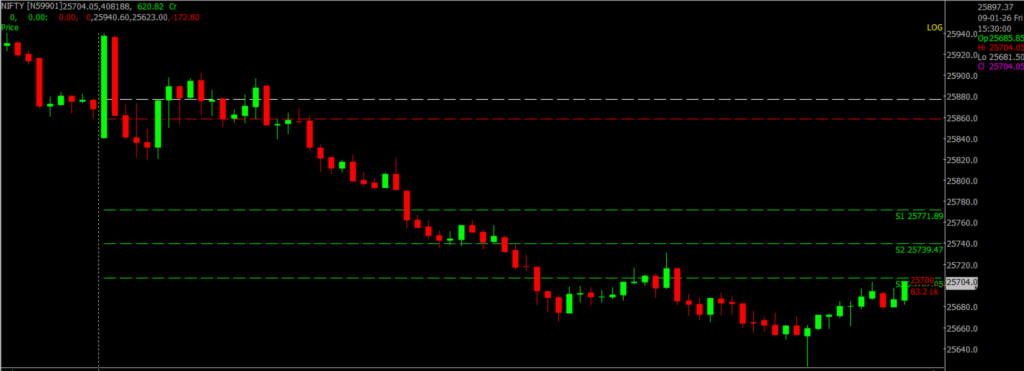

Stock Market Nifty Chart Prediction

On Jan 9, the Sensex was down 604.72 points at 83,576.24, and the Nifty was down 193.55 points at 25,683.30. About 918 shares advanced, 2889 shares declined, and 131 shares unchanged.

Top Nifty gainers: Asian Paints, ONGC, Bharat Electronics, HCL Technologies, Eternal

Top Nifty Losers : Adani Enterprises, Shriram Finance, NTPC, ICICI Bank, Jio Financial

Among sectors, except IT, PSU Bank, Oil & Gas, all other indices ended lower with auto, FMCG, realty, consumer durables down 1-2 percent.

BSE Midcap index shed 0.9%, while smallcap index fell 1.7%.

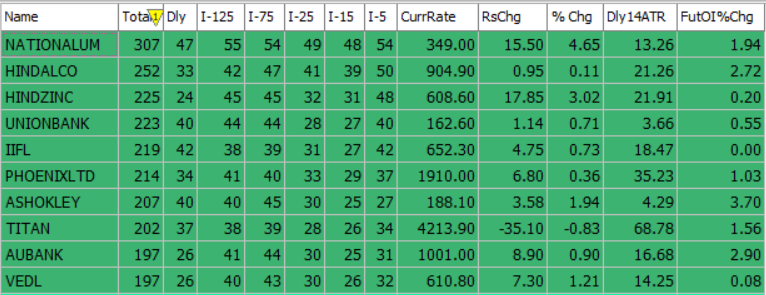

Best Stocks of the day according to AI (Delta Dash)

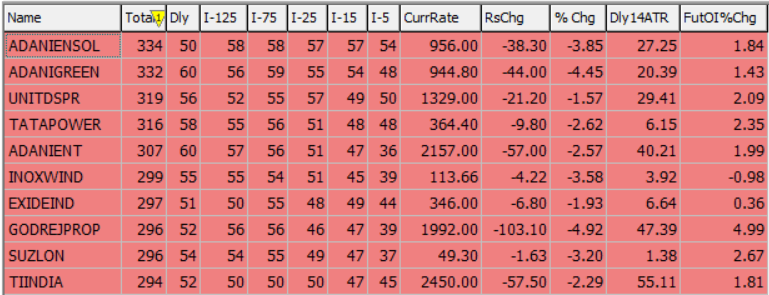

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 12th January 2026

| STOCK | Good Above | Weak Below |

| ASIANPAINT | 2855 | 2825 |

| DABUR | 526 | 520 |

| OBEROIRLTY | 1668 | 1652 |

| VOLTAS | 1476 | 1462 |

Prediction for Monday NIFTY can go up if it goes above 26,000 or down after the level of 25,800, but it also depends upon the Global cues.

Nifty remains under selling pressure and the trend looks cautious for 12th January. The index has slipped below key short-term levels, indicating weak sentiment. On the downside, 25,800 is the first important support, and a decisive break below this could open the door for a further decline towards 25,500, where some buying interest may emerge. On the upside, any pullback is likely to face resistance near 26,000, and a stronger hurdle is placed in the 26,200–26,300 zone, which may attract fresh selling unless there is strong follow-through buying. Overall, the market may remain range-bound to weak, with volatility expected and traders advised to be cautious near resistance levels.

| Highest Call Writing at | 26,000 (2.2 Cr) |

| Highest Put Writing at | 25,800 (83.2 Lk) |

Nifty Support and Resistance

| Support | 25,800 and 25,500 |

| Resistance | 26,000 – 26,300 |

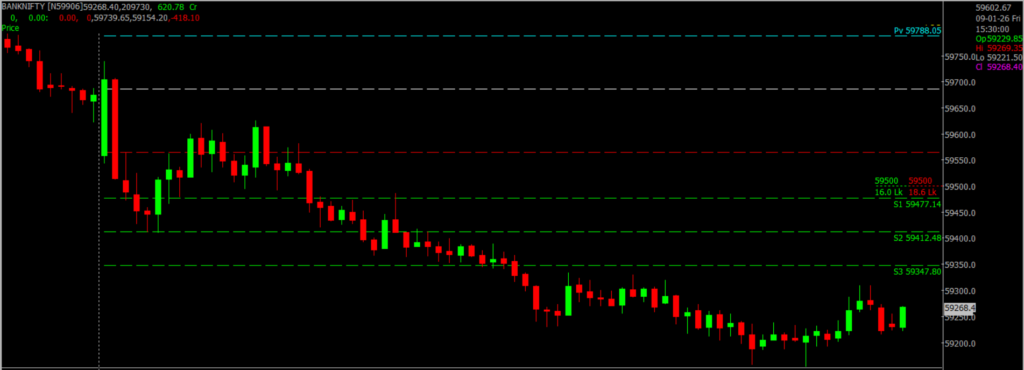

Bank Nifty Daily Chart Prediction

Prediction For Monday BANKNIFTY can go up if it goes above 59,500 or down after the level of 59,000, but it also depends upon the Global cues.

Bank Nifty is showing a weak to range-bound bias for 12th January. The index has been facing selling pressure at higher levels, indicating cautious sentiment among traders. On the downside, 59,000 remains a crucial support, and a breakdown below this level could extend the fall towards 58,800, where some buying support may emerge. On the upside, any recovery is likely to face stiff resistance near 59,500, while a stronger hurdle is placed in the 60,000–60,400 zone, which may limit further upside unless there is strong buying momentum. Overall, Bank Nifty may continue to trade volatile, with traders advised to stay cautious near resistance levels.

| Highest Call Writing at | 59,500 (14.7 Lk) |

| Highest Put Writing at | 59,000 (19.4 Lk) |

Bank Nifty Support and Resistance

| Support | 59,000 and 58,800 |

| Resistance | 59,500 – 60,400 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()