In today’s stock market, heavy selling hits Dalal Street as Sensex falls 1,060 points and Nifty slips below 25,250.

Stock Market Nifty Chart Prediction

On Jan 20, Sensex was down 1,065.78 points at 82,180.47, while the Nifty fell 353 points to 25,232.50. Around 748 shares advanced, 3,146 shares declined, and 100 shares remained unchanged.

Top Nifty gainers: Tata Consumer Products, Dr Reddy’s Lab and HDFC Bank

Top Nifty Losers : Eternal, Bajaj Finance, Coal India, Adani Enterprises, Jio Financial

All the sectoral indices ended in the red with Realty index falling 5%, while auto, IT, media, metal, PSU Bank, pharma, oil & gas, consumer durables fell 1.5-2.5 percent.

BSE Midcap and smallcap indices declined 2.5% each.

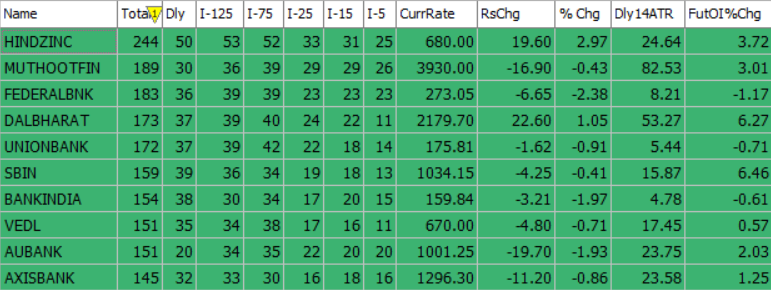

Best Stocks of the day according to AI (Delta Dash)

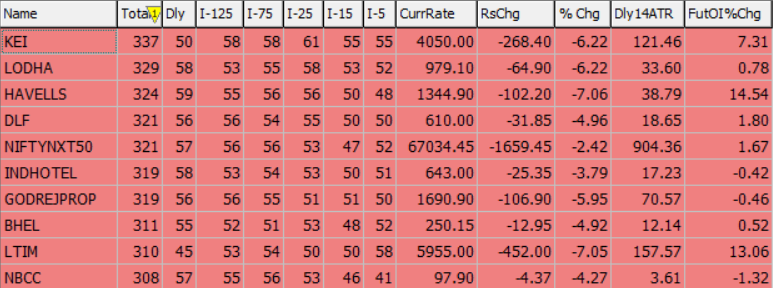

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 21st January 2026

| STOCK | Good Above | Weak Below |

| APLAPOLLO | 1920 | 1900 |

| DALBHARAT | 2190 | 2168 |

| HINDZINC | 682 | 676 |

| LUPIN | 2175 | 2154 |

Prediction for Wednesday NIFTY can go up if it goes above 25,500 or down after the level of 25,200, but it also depends upon the Global cues.

Bears regained control as buying interest weakened amid ongoing global trade tensions. The Nifty continued to break key support levels due to strong selling by institutional investors.

Technical indicators remain negative and are moving closer to the oversold zone. On the daily chart, the index is heading towards its 200-day moving average. If this level holds, a short-term rebound is possible. Resistance is seen between 25,500 and 26,000, while support lies in the 25,200 to 24,800 range.

| Highest Call Writing at | 25,500 (1.3 Cr) |

| Highest Put Writing at | 25,200 (1.8 Cr) |

Nifty Support and Resistance

| Support | 25,200 to 24,800 |

| Resistance | 25,500 and 26,000 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 60,000 or down after the level of 59,500, but it also depends upon the Global cues.

The banking benchmark index, Bank Nifty, came under pressure on Tuesday, extending the weakness witnessed across the broader market. The index slipped below its 20-day EMA, indicating a loss of short-term momentum after displaying resilience in recent sessions. Price action has turned subdued, while key momentum indicators and oscillators suggest a sideways to mildly corrective phase, reflecting a lack of clear directional conviction. On the upside, resistance is placed in the 60,000–60,500 zone, whereas immediate support is seen in the 59,500–59,000 range.

| Highest Call Writing at | 60,000 (18.8 Lk) |

| Highest Put Writing at | 59,500 (9.9 Lk) |

Bank Nifty Support and Resistance

| Support | 59,500–59,000 |

| Resistance | 60,000–60,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()