In today’s stock market, Markets pull back after a three-day rally; Nifty slips below 25,300, Sensex down 250 points.

Stock Market Nifty Chart Prediction

On Jan 30, Sensex was down 296.59 points at 82,269.78, and the Nifty slipped 98.25 points to 25,320.65. About 2,319 shares advanced, 1,716 shares declined, and 149 shares remained unchanged.

Top Nifty gainers: Tata Consumer, Apollo Hospitals, Nestle, M&M, ITC

Top Nifty Losers : Hindalco, Tata Steel, Coal India, ONGC, ICICI Bank

Among sectors, metal index shed 5%, oil & gas, Bank, IT, Energy shed 0.5-1%, while pharma, media, consumer durables, FMCG rose 0.7-1.8%.

Nifty Midcap index fell 0.2%, while smallcap index added 0.3%.

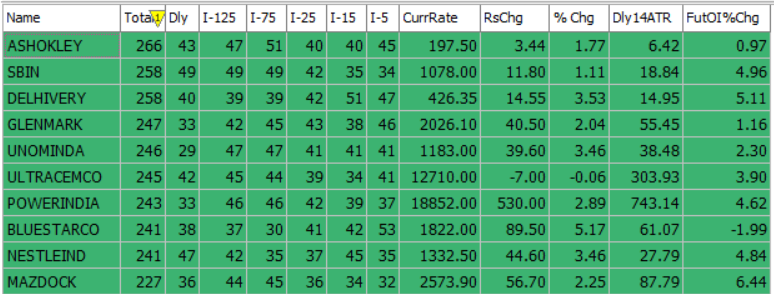

Best Stocks of the day according to AI (Delta Dash)

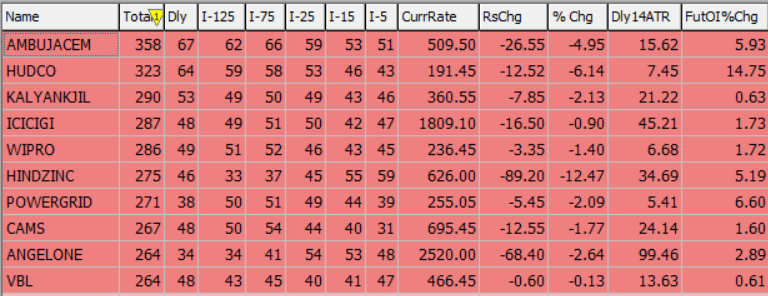

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 1st February 2026

| STOCK | Good Above | Weak Below |

| CUMMINSIND | 4110 | 4070 |

| HAL | 4648 | 4600 |

| LUPIN | 2160 | 2138 |

| NESTLEIND | 1340 | 1325 |

Prediction for Sunday NIFTY can go up if it goes above 25,300 or down after the level of 25,100, but it also depends upon the Global cues.

Indian equity markets stayed volatile ahead of the Union Budget, with benchmark indices slipping amid weakness in IT and metal stocks. The IT sector underperformed on global growth concerns and higher U.S. bond yields, while gold and silver prices eased due to a stronger dollar. Persistent FII selling and continued rupee depreciation kept sentiment cautious, with broader global uncertainty adding to the pressure. Concerns over a potential U.S. government shutdown and a cautious U.S. Federal Reserve outlook further weighed on risk appetite. Although the Fed held rates steady, its commentary pointed to limited scope for rate cuts in 2026, dampening sentiment in rate-sensitive sectors.

Looking ahead, attention shifts to the Union Budget on February 1. On the technical front, resistance is seen in the 25,300–25,600 zone, while support lies between 25,100 and 24,800.

| Highest Call Writing at | 25,300 (1.0 cr) |

| Highest Put Writing at | 25,100 (1.2 cr) |

Nifty Support and Resistance

| Support | 25,100 and 24,800 |

| Resistance | 25,300–25,600 |

Bank Nifty Daily Chart Prediction

Prediction For Sunday BANKNIFTY can go up if it goes above 59,900 or down after the level of 59,500, but it also depends upon the Global cues.

Bank Nifty largely mirrored Nifty’s price movement during the session. The index opened on a weak note and traded sideways for most of the day before finding strong intraday support in the 59,550–59,500 zone. A late-session recovery helped it close at 59,610, down 0.58%. Overall, price action remained range-bound, indicating the absence of fresh directional triggers.

On the technical front, immediate resistance is seen in the 60,000–60,100 zone, which remains a key supply area. A sustained move above this level could extend the uptrend towards 60,400, followed by 60,800 in the near term. Broad resistance is placed between 60,000 and 60,500, while support is seen in the 59,800–59,400 range.

| Highest Call Writing at | 60,000 (16.7 Lk) |

| Highest Put Writing at | 59,800 (15.9 Lk) |

Bank Nifty Support and Resistance

| Support | 59,800–59,400 |

| Resistance | 60,000 and 60,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()