In today’s stock market, Sensex and Nifty close largely unchanged amid AI-related concerns; IT stocks slide.

Stock Market Nifty Chart Prediction

On Feb 4, Sensex was up 78.56 points at 83,817.69, and the Nifty rose 48.45 points to 25,776. About 2,626 shares advanced, 1,413 shares declined, and 143 shares remained unchanged.

Top Nifty gainers: ONGC, Eternal, Trent, Adani Ports and NTPC

Top Nifty Losers : Infosys, TCS, Tech Mahindra, HCL Technologies and Wipro

Broader markets outperformed, with the Nifty Midcap index rising 0.6 percent and the Smallcap index gaining 1.2 percent.

Sectorally, the IT index plunged 6 percent amid AI-led concerns, while auto, energy, consumer durables, PSU, realty, metal, oil & gas and power advanced 1–2 percent.

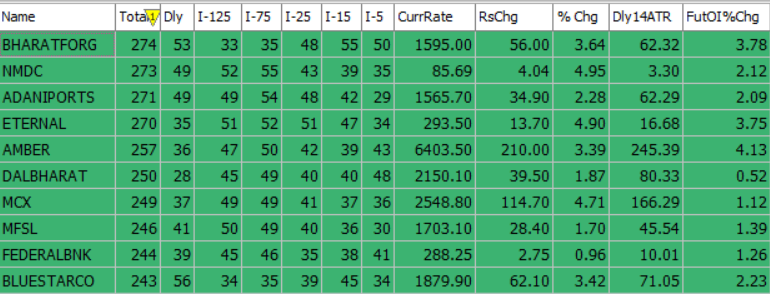

Best Stocks of the day according to AI (Delta Dash)

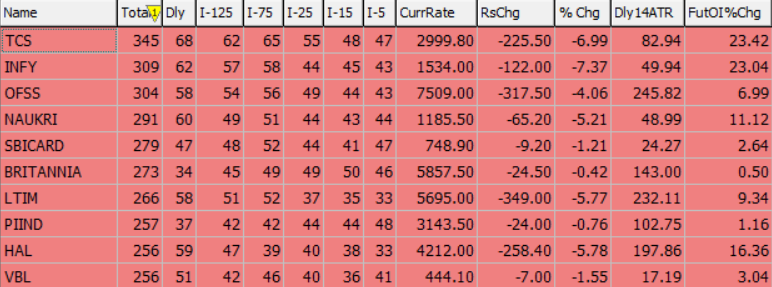

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 5th February 2026

| STOCK | Good Above | Weak Below |

| CHOLAFIN | 1740 | 1720 |

| GODREJPROP | 1720 | 1700 |

| HAVELLS | 1350 | 1335 |

| ICICIBANK | 1414 | 1400 |

Prediction for Thursday NIFTY can go up if it goes above 25,700 or down after the level of 25,600, but it also depends upon the Global cues.

Markets moved in a narrow range on Wednesday as investors evaluated follow-through buying after Tuesday’s strong rally sparked by the India–US trade deal. After opening flat, the Nifty traded within a tight band for most of the session and closed marginally higher at 25,779.5.

Sectoral performance was mixed. Auto, metal and energy stocks saw buying interest, while IT stocks witnessed sharp selling and lagged the broader market. Overall market breadth remained positive, aided by a continued rebound in midcap and smallcap shares.

Sentiment stayed cautious amid mixed global cues and some profit booking after the recent relief rally. Weakness in global technology stocks weighed on domestic IT names, leading to sectoral divergence. However, optimism around the India–US trade agreement and expectations of better foreign participation continued to support cyclical stocks and select heavyweights.

Following recent volatility, a phase of consolidation would be healthy as long as the Nifty holds the 25,400–25,500 zone. On the upside, the index could attempt a move towards 26,000, with a gradual push towards record highs thereafter. Banking, energy, metal and auto sectors remain relatively resilient, while pharma, FMCG and IT continue to underperform. Resistance is seen in the 25,700–26,000 range, while support lies between 25,600 and 25,200.

| Highest Call Writing at | 25,700 (1.0 cr) |

| Highest Put Writing at | 25,600 (78.8 Lk) |

Nifty Support and Resistance

| Support | 25,600 and 25,200 |

| Resistance | 25,700–26,000 |

Bank Nifty Daily Chart Prediction

Prediction For Thursday BANKNIFTY can go up if it goes above 60,200 or down after the level of 60,000, but it also depends upon the Global cues.

Tracking the Nifty’s movement, Bank Nifty also remained range-bound for most of the session and ended at 60,238, up 198 points. The 58,800–58,900 zone continues to provide strong support, holding firm over the past two trading sessions. Staying above this area has kept the broader structure intact, despite subdued momentum. On the upside, resistance is placed in the 60,200–60,400 range, while support is seen between 60,000 and 59,400.

| Highest Call Writing at | 60,200 (15.6 Lk) |

| Highest Put Writing at | 60,000 (8.1 Lk) |

Bank Nifty Support and Resistance

| Support | 60,000 and 59,400 |

| Resistance | 60,200–60,400 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()