In today’s stock market, Dalal Street Tumbles Sharply Amid Global Weakness: Sensex Crashes 1,380 Points, Nifty Slips to 25,400.

Stock Market Nifty Chart Prediction

On Feb 19, Sensex was down 1,236.11 points at 82,498.14, and the Nifty fell 365 points at 25,454.35. About 1,248 shares advanced, 2,790 shares declined, and 149 shares remained unchanged.

Top Nifty gainers: Dr Reddy’s Laboratories, ONGC, HDFC Life and Hindalco Industries.

Top Nifty Losers : Interglobe Aviation, M&M, Bharat Electronics, UltraTech Cement and Trent

All the sectoral indices ended in the red with Auto, Capital Goods, Realty, Power, Consumer Durables, Media down 2% each.

The Nifty midcap index shed 1.6 percent and smallcap index fell 1.3 percent.

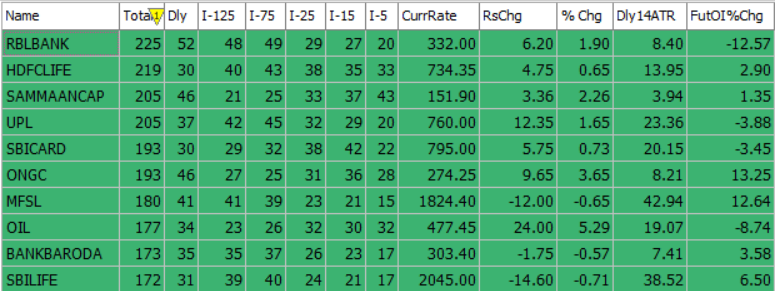

Best Stocks of the day according to AI (Delta Dash)

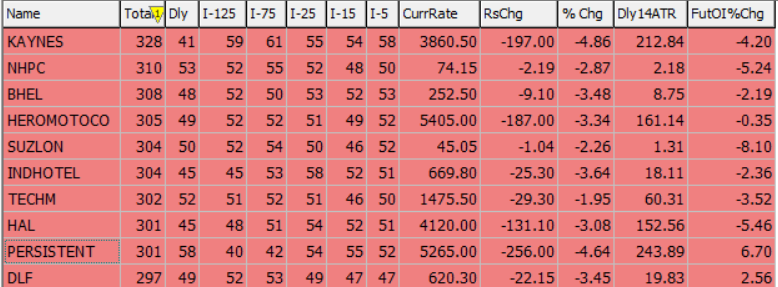

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 20th February 2026

| STOCK | Good Above | Weak Below |

| IRCTC | 631 | 625 |

| OIL | 478 | 473 |

| SBICARD | 800 | 790 |

| UPL | 763 | 756 |

Prediction for Friday NIFTY can go up if it goes above 25,400 or down after the level of 25,300, but it also depends upon the Global cues.

The Nifty witnessed a sharp sell-off on Thursday amid rising geopolitical tensions between the US and Iran, declining 365 points. After opening on a positive note, the index failed to sustain near the 25,900 level and slipped from the highs. The weakness intensified in the mid-to-late part of the session, with the Nifty closing near the day’s low.

A long-range bearish candle was formed on the daily chart (around a 500-point high–low range), closing near the February 16 swing low. Technically, this signals a ‘Bearish Engulfing’ pattern and a swift retracement of the previous four sessions gains in a single session, which is not a positive sign. Immediate resistance is seen in the 25,400–25,800 zone, while support is placed between 25,300 and 25,000.

| Highest Call Writing at | 25,400 (1.5 Cr) |

| Highest Put Writing at | 25,300 (1.0 Cr) |

Nifty Support and Resistance

| Support | 25,300 and 25,000 |

| Resistance | 25,400–25,800 |

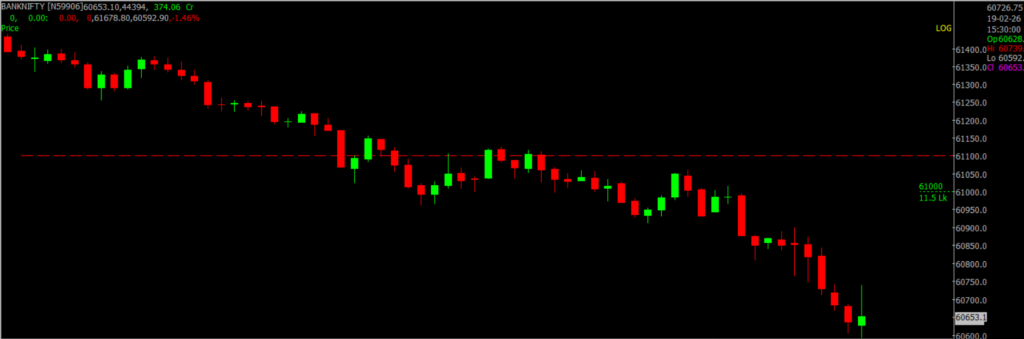

Bank Nifty Daily Chart Prediction

Prediction For Friday BANKNIFTY can go up if it goes above 60,400 or down after the level of 61,100, but it also depends upon the Global cues.

The Bank Nifty index faced significant selling pressure on Thursday, erasing the strong outperformance it had shown relative to the benchmark indices in recent sessions. The sharp decline not only reversed gains from the previous two days but also led to the formation of a large bearish candle on the daily chart. This price pattern signals a clear shift in momentum, indicating that bulls have temporarily ceded control after an extended upward move.

Going forward, the 20-day EMA, positioned in the 60,400–60,300 range, is expected to act as an important support zone. A decisive break below this level could intensify selling pressure and trigger further short-term downside. On the upside, the 61,100–61,200 range is likely to act as a key resistance area.

| Highest Call Writing at | 60,400 (10.1 Lk) |

| Highest Put Writing at | 61,100 (14.1 Lk) |

Bank Nifty Support and Resistance

| Support | 60,400–60,300 |

| Resistance | 61,100–61,200 |

Voice Of Traders by Spider Software

Stop Using 9 & 21 EMA ❌ Use this instead… (Full Strategy Explained)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()