In the Stock Market Today, Sensex and Nifty closed flat on expiry day, with gains observed in the auto, oil & gas, and media sectors.

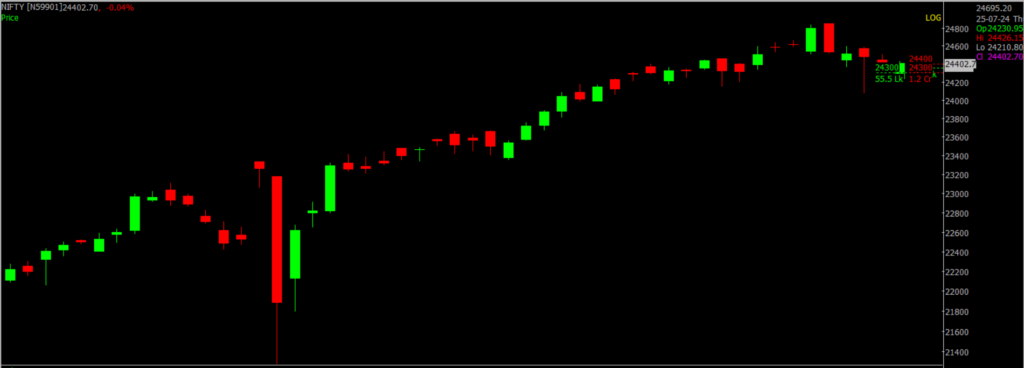

Stock Market Nifty Chart Prediction.

On July 25, The Sensex fell by 109.08 points, settling at 80,039.80, while the Nifty dropped by 7.40 points, to close at 24,406.10. There were 1791 advancing shares, -1635 declining shares, and 77 shares remained unchanged.

In terms of sectors, auto, capital goods, power, oil & gas, healthcare, and media saw gains of 0.5-3 percent. Conversely, the bank, IT, metal, realty, and telecom sectors declined by 0.5-1 percent.

Top Nifty gainers: Tata Motors, ONGC, SBI Life Insurance, BPCL and Sun Pharma,

Top Nifty Losers: Axis Bank, Nestle India, Titan Company, ICICI Bank and Tata Steel.

BSE Midcap and smallcap indices ended marginally lower.

Stock Prediction for 26th July 2024.

| STOCK | Good Above | Weak Below |

| APOLLOTYRE | 541 | 535 |

| ITC | 495 | 489 |

| JUBLFOOD | 582 | 576 |

| NTPC | 395 | 390 |

Prediction For Friday, NIFTY can go up if it goes above 24,400 or down after the level of 24,300 but it all depends upon the Global cues.

The Nifty opened with a gap down but experienced a pullback, closing slightly in the red with a 7 point loss. After the gap down at the open, it did not face continued selling pressure and managed a recovery. We believe the Index is in a counter-trend pullback, potentially extending towards 24,500 – 24,550. Resistance levels are between 24,400 and 24,500, while support levels range from 24,300 to 24,100.

| Highest Call Writing at | 24,400 (2.3 Crore) |

| Highest Put Writing at | 24,300 (2.2 Crore) |

Nifty Support and Resistance

| Support | 24,300-24,100 |

| Resistance | 24,400- 24,500 |

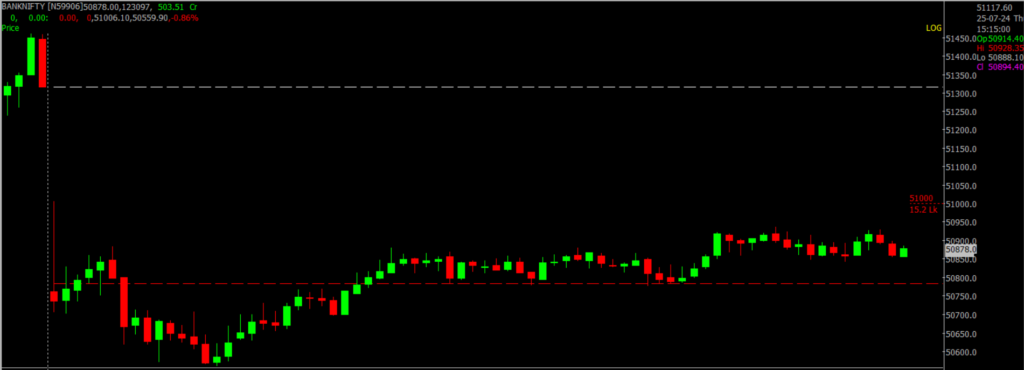

Bank Nifty Daily Chart Prediction.

Prediction For Friday, Bank NIFTY can go up if it goes above 51,500 or down after the level of 51,000 but it all depends upon the Global cues.

Bank Nifty has been at the forefront of this decline, hitting our short-term target of 50,600 today before consolidating. Given that it has reached a significant support level, the decline may become less severe, and we might see consolidation in the near term. The resistance level is between 51,500 and 52,000, while the support level ranges from 51,000 to 50,500.

| Highest Call Writing at | 51,500 (21.6 Lakhs) |

| Highest Put Writing at | 51,000 (15.2 Lakhs) |

Bank Nifty Support and Resistance

| Support | 51,000-50,500 |

| Resistance | 51,500-52,000 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()