In today’s stock market, Nifty slips to 24,850, Sensex drops 260 points; pharma stocks fall after Trump’s tariff warning.

Stock Market Nifty Chart Prediction

On June 17, Sensex fell by 212.85 points to 81,583.30, while the Nifty dropped 93.10 points to 24,853.40. Around 1,443 stocks advanced, 2,384 declined, and 134 remained unchanged.

Top Nifty gainers: Tech Mahindra, Infosys, Asian Paints, TCS, Maruti Suzuki.

Top Nifty Losers : Adani Enterprises, Dr Reddy’s Labs, Sun Pharma, Eternal, ONGC

All sectoral indices ended lower except IT, with pharma, metal, oil & gas, auto, realty, and PSU Bank falling between 0.5 and 2 points.

The BSE Midcap and Smallcap indices each dropped by 0.5 points.

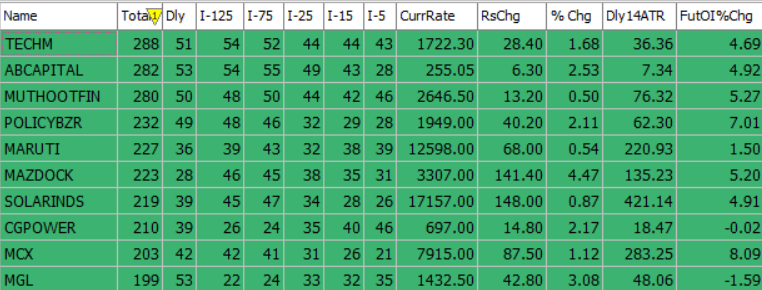

Best Stocks of the day according to AI (Delta Dash)

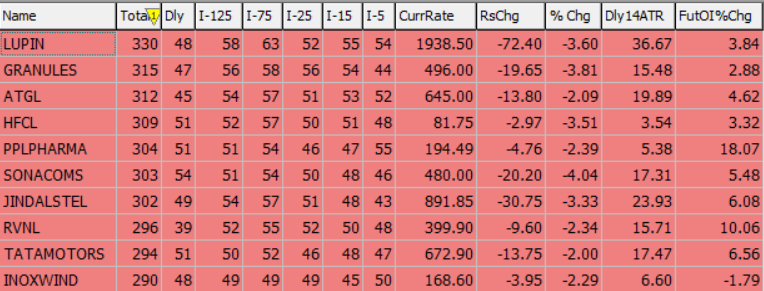

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 18th June 2025

| STOCK | Good Above | Weak Below |

| CGPOWER | 702 | 695 |

| HDFCLIFE | 777 | 770 |

| INFY | 1642 | 1625 |

| MARUTI | 12650 | 12550 |

Prediction for Wednesday NIFTY can go up if it goes above 24,900 or down after the level of 24,750, but it also depends upon the Global cues.

The positive momentum from the previous session quickly faded, lasting just one trading day. After a quiet start, the market saw a sharp drop early on and then moved within a narrow range for the rest of the day, finally closing at 24,853.40, down by 93.10 points.

The rupee weakened by 0.18 to 86.22, pressured by rising global risk sentiment due to growing Israel-Iran tensions. Weakness in the equity markets also hinted at possible foreign investor outflows, further weighing on the currency. Key resistance levels are seen at 24,900–25,500, with immediate support between 24,750 and 24,450.

| Highest Call Writing at | 24,900 (98.5 Lakh) |

| Highest Put Writing at | 24,750 (1.0 cr) |

Nifty Support and Resistance

| Support | 24,750 and 24,450 |

| Resistance | 24,900–25,500 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday, BANKNIFTY can go up if it goes above 56,000 or down after the level of 55,100, but it also depends upon the Global cues.

BANKNIFTY (55,714) is currently trading in a negative trend. If you have existing short positions, it’s advisable to hold them with a daily closing stoploss at 56,052. Fresh long positions should only be considered if Banknifty closes above 56,052. On the upside, resistance is expected between 56,000 and 56,600, while key support levels are seen around 55,100 to 54,300.

| Highest Call Writing at | 56,000 (16.4 lakh) |

| Highest Put Writing at | 55,100 (13 lakh) |

Bank Nifty Support and Resistance

| Support | 55,100 to 54,300 |

| Resistance | 56,000 and 56,600 |

Join our exclusive one-day seminar for serious traders ready to level up. Whether you’re into intraday, options, or algo trading, gain the edge, discipline, and mastery to excel in the markets. Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()