In today’s stock market, Nifty slips below 24,800 on expiry day; Sensex falls by 296 points market ends weak amid volatility.

Stock Market Nifty Chart Prediction

On July 31, Sensex was down 296.28 points at 81,185.58, and the Nifty was down 86.70 points at 24,768.35. About 1490 shares advanced, 2365 shares declined, and 135 shares remained unchanged.

Top Nifty gainers: HUL, Jio Financial, Eternal, JSW Steel, ITC

Top Nifty Losers : Adani Enterprises, Dr Reddy’s Labs, Adani Ports, Tata Steel, Sun Pharma.

Among sectors, FMCG rose 1.4, while IT, metal, oil & gas, PSU Bank, pharma, realty, and telecom declined between 0.5 to 1.8.

BSE Midcap and Smallcap indices dropped 0.7 each.

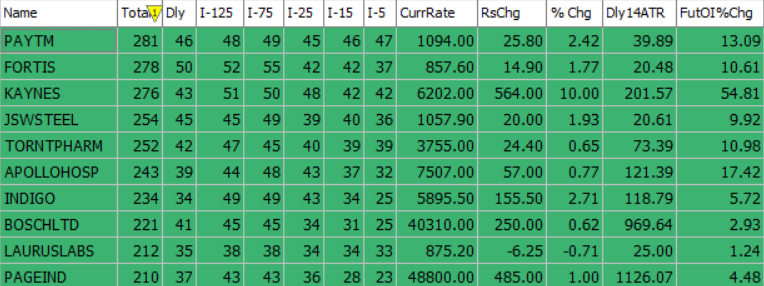

Best Stocks of the day according to AI (Delta Dash)

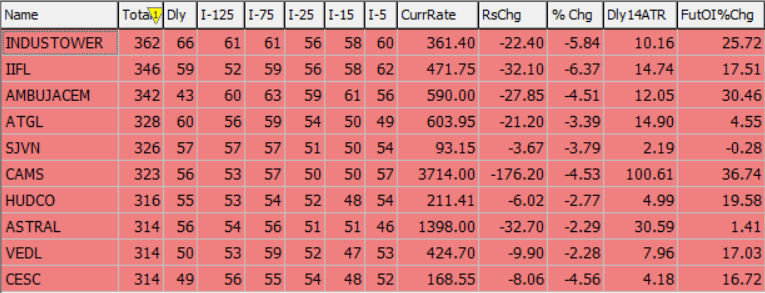

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 01st August 2025

| STOCK | Good Above | Weak Below |

| CUMMINSIND | 3575 | 3540 |

| GODREJCP | 1261 | 1241 |

| JIOFIN | 333 | 327 |

| DELHIVERY | 431 | 424 |

Prediction for Friday NIFTY can go up if it goes above 24,800 or down after the level of 24,400, but it also depends upon the Global cues.

The index opened with a gap-down but quickly recovered and moved above 24,900. However, it couldn’t hold at higher levels. Nifty is still trading below the 50 EMA, which signals a bearish trend. RSI also shows a bearish crossover. Despite these negative signs, a hidden positive divergence has appeared over the last 2–3 days, hinting at a possible bullish reversal. Resistance is at 24,800 and 25,200, support at 24,400 and 24,000.

| Highest Call Writing at | 24,800 (95.3 Lk) |

| Highest Put Writing at | 24,400 (2.0 Cr) |

Nifty Support and Resistance

| Support | 24,400 and 24,000 |

| Resistance | 24,800 and 25,200 |

Bank Nifty Daily Chart Prediction

Prediction For Friday, BANKNIFTY can go up if it goes above 56,200 or down after the level of 56,000, but it also depends upon the Global cues.

BANKNIFTY (55,962) remains in a negative trend; hold shorts with a closing stoploss at 56,512 fresh long only above 56,512; key support at 56,000 and 55,500, resistance at 56,200 and 56,600 as volatility continues ahead of expiry week amid weak global cues.

| Highest Call Writing at | 56,200 (17.7 lakh) |

| Highest Put Writing at | 56,000 (15.6 lakh) |

Bank Nifty Support and Resistance

| Support | 56,000 and 55,500 |

| Resistance | 56,200 and 56,600 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()