In today’s stock market, Nifty slips below 25,100, Sensex falls 100 points; auto and IT stocks drag, realty sector sees gains.

Stock Market Nifty Chart Prediction

On September 15, The Sensex was down 118.96 points at 81,785.74, and the Nifty was down 44.80 points at 25,069.20. About 2,052 shares advanced, 1,756 shares declined, and 163 shares remained unchanged.

Top Nifty gainers: Jio Financial, UltraTech Cement, Bajaj Finance, Eternal, Adani Ports

Top Nifty Losers :Shriram Finance, Asian Paints, M&M, Cipla, Dr Reddy’s Labs.

On the sectoral front, Consumer Durables, Auto, IT, and Pharma declined by 0.3 to 0.6 points, while Capital Goods, Realty, Power, and Telecom indices rose by 0.5 to 2.5 points.

BSE Midcap index up 0.4 percent and smallcap index up 0.7 percent.

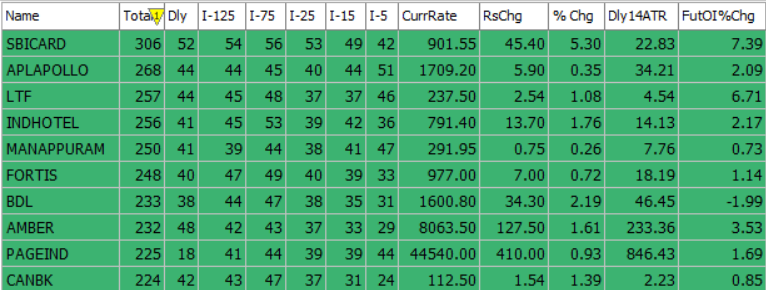

Best Stocks of the day according to AI (Delta Dash)

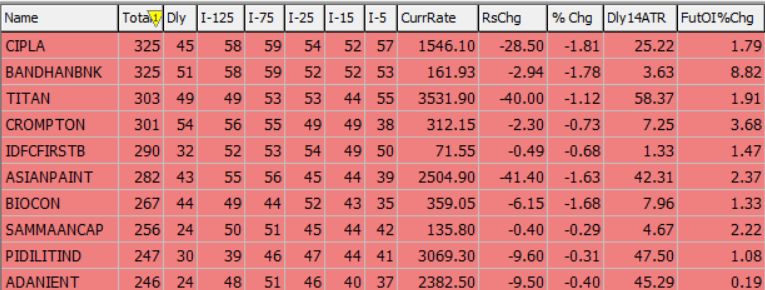

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 15th September 2025

| STOCK | Good Above | Weak Below |

| BAJAJFINSV | 2090 | 2070 |

| HAL | 4810 | 4760 |

| INDHOTEL | 795 | 788 |

| VOLTAS | 1425 | 1410 |

Prediction for Tuesday NIFTY can go up if it goes above 25,000 or down after the level of 24,900, but it also depends upon the Global cues.

The Indian stock market closed slightly lower today, ending its recent winning streak as both the Sensex and Nifty 50 saw modest declines. This drop was mainly due to global uncertainty ahead of the upcoming US Federal Reserve meeting, which made investors cautious and led to limited activity across Asian markets. Many traders also booked profits after the recent rally, especially in IT and consumer-related stocks. Market sentiment was cautious, and overall participation was weak, with more stocks falling than rising.

The trading session remained quiet, with indices moving in a narrow range. Looking ahead, the market is expected to stay flat or move within a limited range until there is more clarity from the US Fed on its interest rate plans. Investors are likely to remain focused on global developments and key economic data from India. Buying interest may return on dips, especially in strong sectors like banking, auto, and consumer goods. The Nifty 50 is expected to face resistance between 25,100 and 25,500, while support lies between 25,000 and 24,600.

| Highest Call Writing at | 25,100 (2.4 Cr) |

| Highest Put Writing at | 25,000 (1.7 Cr) |

Nifty Support and Resistance

| Support | 25,000 and 24,600 |

| Resistance | 25,100 and 25,500 |

Bank Nifty Daily Chart Prediction

Prediction For Tuesday BANKNIFTY can go up if it goes above 55,100 or down after the level of 54,900, but it also depends upon the Global cues.

Bank Nifty is currently trading in a positive trend at 54,888. If you already have long positions, it is advisable to continue holding them with a daily closing stoploss set at 54,490. A fresh short position should only be considered if Bank Nifty closes below this level. On the upside, resistance is expected between 55,100 and 55,600, while support is seen in the range of 54,900 to 54,200.

| Highest Call Writing at | 55,100 (17.7 Lk) |

| Highest Put Writing at | 54,900 (10.6 Lk) |

Bank Nifty Support and Resistance

| Support | 54,900 to 54,200 |

| Resistance | 55,100 and 55,600 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()