In today’s stock market, Sensex drops 560 points, Nifty falls below 25,900; metal, IT, and financial stocks lead the decline.

Stock Market Nifty Chart Prediction

On Dec 16, Sensex was down 533.50 points at 84,679.86, and the Nifty fell 167.20 points to 25,860.10. About 1,573 shares advanced, 2,412 shares declined, and 154 shares remained unchanged.

Top Nifty gainers: Bharti Airtel, Tata Consumer, Titan Company, M&M, Bajaj Auto.

Top Nifty Losers : Axis Bank, Eternal, HCL Technologies, Tata Steel, JSW Steel

Barring Consumer Durables, FMCG, and Telecom, all other sectoral indices closed in the red, with Realty, Oil & Gas, Metal, IT, PSU Bank, and Private Bank stocks declining by 0.5–1%.

BSE Midcap and smallcap indices down nearly 1 percent each.

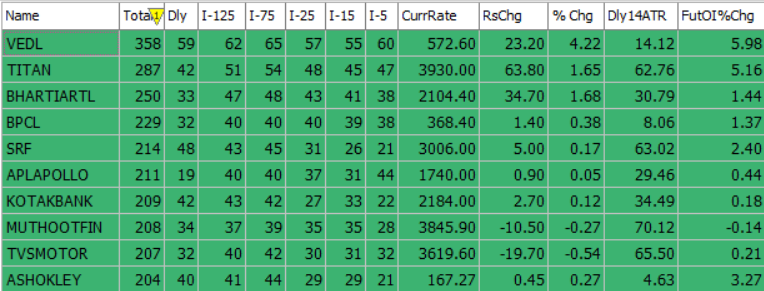

Best Stocks of the day according to AI (Delta Dash)

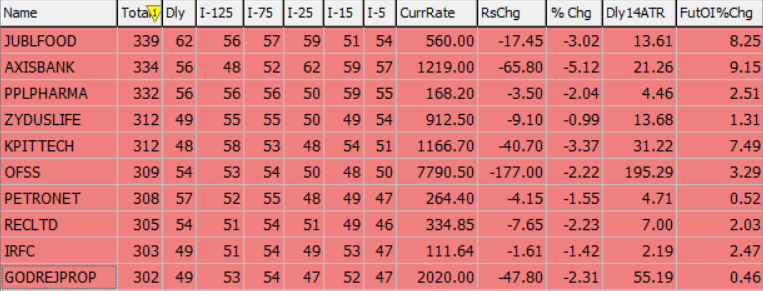

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 17th December 2025

| STOCK | Good Above | Weak Below |

| ASTRAL | 1466 | 1452 |

| BHARTIARTL | 2115 | 2090 |

| TATACONSUM | 1176 | 1165 |

| UNOMINDA | 1260 | 1248 |

Prediction for Wednesday NIFTY can go up if it goes above 25,900 or down after the level of 25,800, but it also depends upon the Global cues.

The session remained firmly in favor of the bears, with the Nifty trading below the crucial 200-hour SMA throughout the day. The index also failed to retest the morning high, reflecting strong bearish control.

On the downside, a break below the 25,870 support further strengthened negative sentiment. On Tuesday, the benchmark Nifty opened with a sharp gap-down and continued to drift lower, closing at 25,860, down 0.64%. The index formed a strong bearish candle, indicating sustained selling pressure, and slipped below its 20-day EMA, signaling a weakening short-term trend. Immediate resistance is placed at 25,900–26,300, while support is seen in the 25,800–25,400 zone.

| Highest Call Writing at | 25,800 (1.3 Cr) |

| Highest Put Writing at | 25,900 (1.2 Cr) |

Nifty Support and Resistance

| Support | 25,800–25,400 |

| Resistance | 25,900–26,300 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 59,500 or down after the level of 59,200, but it also depends upon the Global cues.

The banking benchmark Bank Nifty closed below its 20-day EMA, indicating a loss of near-term momentum. More importantly, the daily RSI faced strong resistance near the 60 level, suggesting a shift in the momentum range from bullish to sideways as per RSI range-shift principles. This points to weakening buying strength, and the index may enter a consolidation phase unless it decisively reclaims key resistance levels with strong follow-through. Immediate resistance is placed at 59,500–60,000, while crucial support is seen in the 59,200–58,800 zone.

| Highest Call Writing at | 59,500 (18.4 Lk) |

| Highest Put Writing at | 59,200 (14.0 Lk) |

Bank Nifty Support and Resistance

| Support | 59,200–58,800 |

| Resistance | 59,500–60,000 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()