In today’s stock market, Sensex drops 200 points as Nifty falls below 22,950; all sectors remain in negative territory.

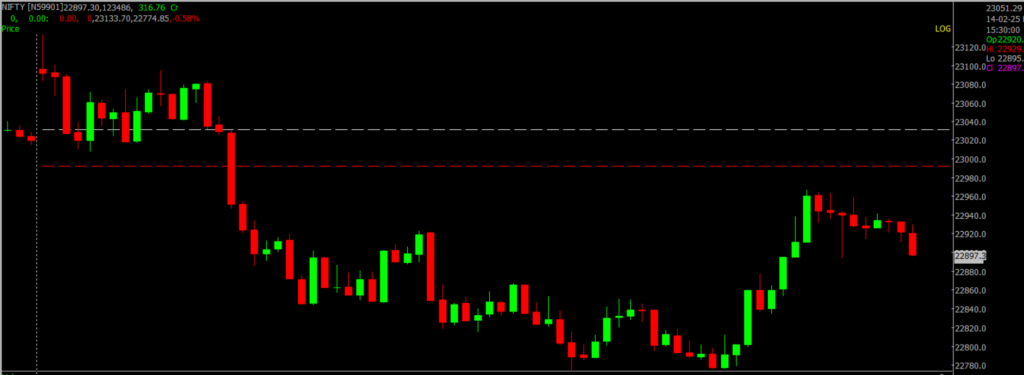

Stock Market Nifty Chart Prediction

On February 14, Sensex dropped by 199.76 points to settle at 75,939.21, while the Nifty slipped 102.15 points to reach 22,929.25. About 642 shares advanced, -3200 shares declined, and 73 shares unchanged.

Top Nifty gainers: Britannia Industries, ICICI Bank, Nestle India, Infosys, TCS,

Top Nifty Losers: Bharat Electronics, Adani Enterprises, Adani Ports, Sun Pharma, Trent.

All sectoral indices closed in negative territory, with declines of 1-3% seen in media, metal, oil & gas, pharma, PSU banks, real estate, consumer durables, auto, and energy sectors.

Nifty Midcap index shed 2.4%, while smallcap index down 3.5%

Stock Prediction for 17th Feb 2025

| STOCK | Good Above | Weak Below |

| BAJAJFINSV | 1265 | 1252 |

| JUBLFOOD | 675 | 668 |

| SBICARD | 862 | 854 |

| TATACONSUM | 1024 | 1014 |

Prediction for Monday NIFTY can go up if it goes above 23,200 or down after the level of 23,000, but it all depends upon the Global cues.

The Nifty opened with an upward gap but failed to hold onto higher levels, ending the day with a loss of 102 points. On the daily charts, it tested the 22,800 swing low for the third time in a month. Resistance is seen in the 23,200-23,500 range, while support lies between 22,800 and 22,400.

| Highest Call Writing at | 23,200 (1.1 Cr) |

| Highest Put Writing at | 23,000 (1.0 Cr) |

Nifty Support and Resistance

| Support | 23,000 and 22,500 |

| Resistance | 23,200 and 23,700 |

Bank Nifty Daily Chart Prediction

Prediction For Monday, Bank NIFTY can go up if it goes above 49,700 or down after the level of 49,000, but it all depends upon the Global cues.

Bank Nifty started the session with a gap-up opening but faced volatility-driven profit booking, closing in the red at 49,099. From a technical perspective, a red candle has emerged on both daily and weekly charts, signaling weakness. Resistance is positioned between 49,700 and 50,000, while support is in the 49,000-48,500 range.

| Highest Call Writing at | 49,700 (20.7 Lakh) |

| Highest Put Writing at | 49,000 (13.2 Lakh) |

Bank Nifty Support and Resistance

| Support | 49,000 and 48,500 |

| Resistance | 49,700 and 50,000 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()