In the Stock Market Today, Nifty rises above 23,450, Sensex gains 182 points; IT stocks showing weak performance compared to other sectors.

Stock Market Nifty Chart Prediction.

On June 14 Sensex rose by 181.87 points, marking a 0.24 percent increase to reach 76,992.77, while the Nifty gained 66.70 points, reflecting a 0.29 percent rise, closing at 23,465.60. Among the traded shares, 2177 saw gains, -1598 declined, and 106 remained unchanged.

Top Nifty gainers: Eicher Motors, M&M, Adani Ports, Shriram Finance and Titan Company

Top Nifty Losers: TCS, Tech Mahindra, HCL Technologies, Wipro and Nestle.

All sectors, excluding IT which fell by 0.7 percent, closed higher. Industries such as auto, telecom, capital goods, healthcare, metal, oil & gas, power, and realty saw gains ranging from 0.5 to 1 percent.

BSE Midcap and smallcap gained 1% each.

Stock Prediction for 18th June 2024.

| STOCK | Good Above | Weak Below |

| ASTRAL | 2235 | 2200 |

| GAIL | 218 | 214 |

| JSWSTEEL | 924 | 913 |

| NAUKRI | 6290 | 6241 |

Prediction For Tuesday, NIFTY can go up if it goes above 23,400 or down after the level of 23,500 but it all depends upon the Global cues.

Nifty continued its consolidation streak for the fifth consecutive day, closing approximately 67 points higher. Analysis of the daily charts shows that the Nifty has been consolidating within a wide range of 23,200 to 23,500. Extended consolidation around this range suggests an increasing probability of a breakout in the upcoming week. With five days already passed, market analysts anticipate a potential shift towards a trending movement. Resistance is anticipated between 23,500 to 24,000, while support is expected between 23,400 to 23,000.

| Highest Call Writing at | 23,500 (42.3 Lakhs) |

| Highest Put Writing at | 23,400 (53.7 Lakhs) |

Nifty Support and Resistance

| Support | 23,400 – 23,000 |

| Resistance | 23,500 – 24,000 |

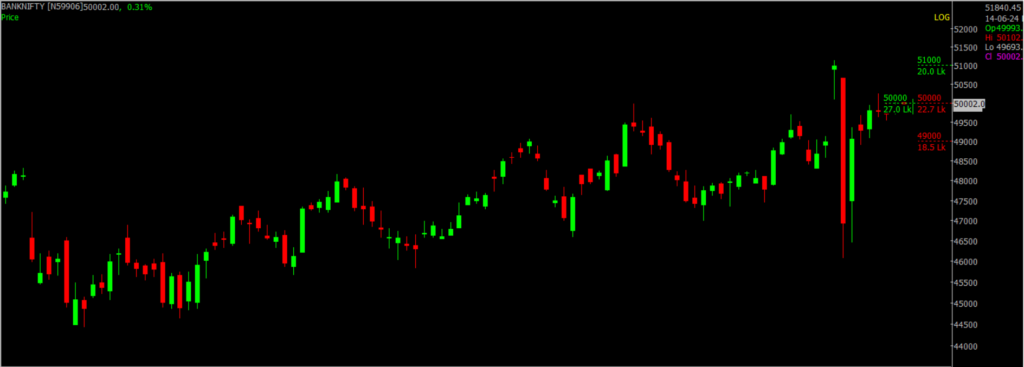

Bank Nifty Daily Chart Prediction.

Prediction For Tuesday, Bank NIFTY can go up if it goes above 51,000 or down after the level of 49,500 but it all depends upon the Global cues.

BankNifty remained in a consolidation phase and struggled to surpass the 50,000 mark. To signal a bullish breakout towards the 51,000-51,500 range, the index must convincingly breach the 50,200 level. Support at the lower end is identified around 49,500 to 49,000, and a breach below this range could potentially lead to further declines towards 49,000.

| Highest Call Writing at | 51,000 (27.0 Lakhs) |

| Highest Put Writing at | 49,500 (22.7 Lakhs) |

Bank Nifty Support and Resistance

| Support | 49,500 – 49,000 |

| Resistance | 51,000 – 51,500 |

Highly Profitable Algo Trading Strategies. Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()