In today’s stock market, Nifty 50 crossed 25,800, and BSE Sensex rose 283 points, mainly driven by gains in metal, FMCG, and PSU bank stocks.

Stock Market Nifty Chart Prediction

On Feb 18, Sensex was up 283.29 points at 83,734.25, and Nifty 50 was up 93.95 points at 25,819.35. About 2,135 shares advanced, 1,902 shares declined, and 172 shares remained unchanged.

Top Nifty gainers: Tata Steel, HDFC Life, ITC, Tata Consumer, Bajaj Auto

Top Nifty Losers : ONGC, Eternal, Wipro, Infosys, Adani Enterprises.

On the sectoral front, except IT (down 1.2) all other indices ended higher with metal, FMCG, PSU Bank indices up 1% each, while Private Bank, realty, auto, oil & gas up 0.5% each.

Nifty Midcap and smallcap indices up 0.5% each.

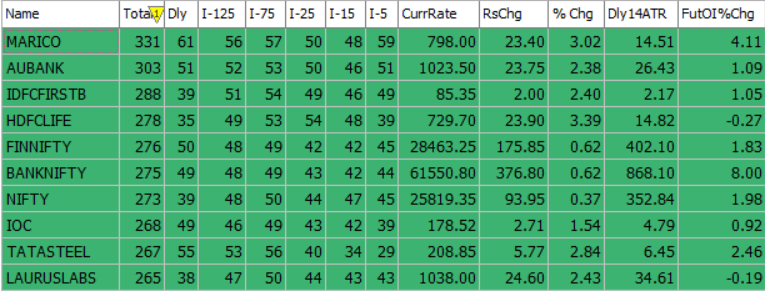

Best Stocks of the day according to AI (Delta Dash)

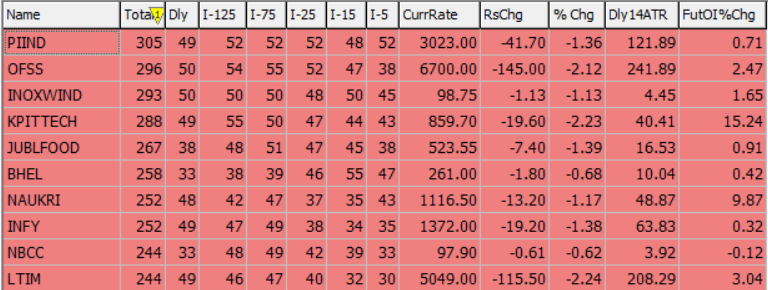

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 19th February 2026

| STOCK | Good Above | Weak Below |

| CAMS | 736 | 728 |

| HDFCLIFE | 732 | 725 |

| LT | 4330 | 4290 |

| NESTLEIND | 1306 | 1295 |

Prediction for Thursday NIFTY can go up if it goes above 25,800 or down after the level of 25,700, but it also depends upon the Global cues.

On the daily chart, NIFTY 50 formed a small-bodied candle with a long lower wick, showing strong buying at lower levels. This support area also matches the 20-day EMA, which continues to act as a key short-term support.

The NIFTY Smallcap 100 reclaimed its 20-day EMA in the previous session and followed it with another higher close, showing continued strength. Broader markets outperformed the frontline indices during the session.

Market breadth remained strong, with the advance-decline ratio favoring bulls. A total of 274 stocks from the NIFTY 500 closed in the green. Immediate resistance is seen in the 25,800–26,000 zone, while support is placed between 25,700 and 25,400.

| Highest Call Writing at | 25,800 (1.1 Cr) |

| Highest Put Writing at | 25,700 (92.4 Lk) |

Nifty Support and Resistance

| Support | 25,700 and 25,400 |

| Resistance | 25,800–26,000 |

Bank Nifty Daily Chart Prediction

Prediction For Thursday BANKNIFTY can go up if it goes above 61,800 or down after the level of 61,100, but it also depends upon the Global cues.

NIFTY Bank traded in a narrow sideways range during the first half of the session. Momentum picked up later after a strong breakout above the key resistance level near 61,300, leading to a sharp intraday rise. The index closed at 61,551, up 0.62%.

After taking support at its 20-day EMA three sessions ago, the index has been moving higher and has now recorded three consecutive higher closes, indicating improving short-term strength.

Immediate resistance is seen in the 61,800–61,900 zone. A sustained move above this range could push the index towards 62,300, followed by 62,700 in the short term. On the downside, the 61,100–61,000 zone is expected to act as immediate support.

| Highest Call Writing at | 61,800 (12.9 Lk) |

| Highest Put Writing at | 61,100 (13.8 Lk) |

Bank Nifty Support and Resistance

| Support | 61,100–61,000 |

| Resistance | 61,800–61,900 |

Voice Of Traders by Spider Software

Stop Using 9 & 21 EMA ❌ Use this instead… (Full Strategy Explained)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()