In today’s stock market, Nifty crossed 26,000 and the Sensex rose by 490 points, mainly boosted by IT and financial stocks.

Stock Market Nifty Chart Prediction

On Nov 19, Sensex was up 513.45 points at 85,186.47, and the Nifty was up 142.60 points at 26,052.65. About 1,756 shares advanced, 2,248 shares declined, and 152 shares were unchanged.

Top Nifty gainers: HCL Technologies, Max Healthcare, Infosys, Wipro, TCS

Top Nifty Losers : TMPV, Coal India, Maruti Suzuki, Adani Ports, Bajaj Finance.

In sectoral moves, the IT index gained 3%, the PSU Bank index advanced 1.2%, and the Nifty Bank index edged up 0.5%, while the media and realty indices slipped 0.3% and 0.4%, respectively.

BSE Midcap index rose 0.3%, while Smallcap index shed 0.4%.

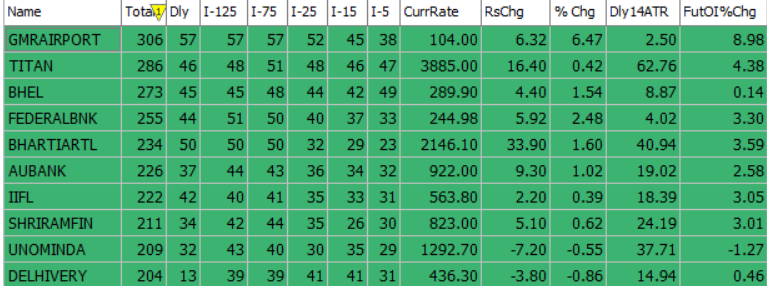

Best Stocks of the day according to AI (Delta Dash)

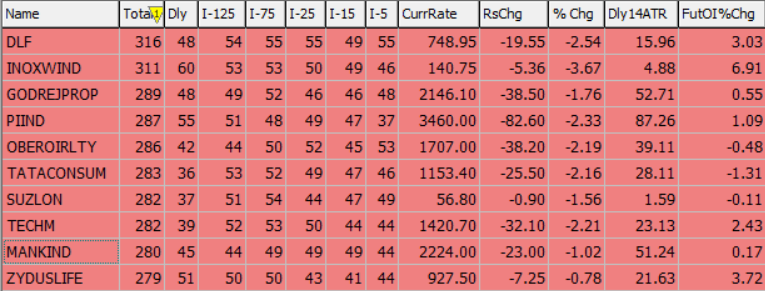

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 20th November 2025

| STOCK | Good Above | Weak Below |

| 360ONE | 1125 | 1114 |

| BHARTIARTL | 2170 | 2150 |

| NAUKRI | 1370 | 1356 |

| TCS | 3164 | 3130 |

Prediction for Wednesday NIFTY can go up if it goes above 26,000 or down after the level of 25,800, but it also depends upon the Global cues.

On the daily chart, Nifty has printed a bullish candle with a small lower wick, reflecting strong buying interest on declines. This pattern has persisted for the past three sessions, highlighting consistent dip-buying behavior.

For the last three trading days, Nifty has been attempting to break convincingly above the 26,050 mark but has repeatedly encountered tough resistance in that zone. Today, however, it managed to close just above this level. The index continues to trade comfortably above its key short-term moving averages — the 20-EMA and 50-EMA. Meanwhile, the RSI, which recently touched 60, has inched up to 64, indicating improving momentum and strengthening bullish undertones. Additionally, the narrowing red histogram bars on the MACD point to fading bearish pressure, suggesting the index may be preparing for further upside.

Immediate resistance is placed at 26,000–26,200, while support lies in the 25,800–25,500 zone.

| Highest Call Writing at | 26,000 (1.2 Cr) |

| Highest Put Writing at | 25,800 (1.3 Cr) |

Nifty Support and Resistance

| Support | 25,800–25,500 |

| Resistance | 26,000–26,200 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 59,200 or down after the level of 58,900, but it also depends upon the Global cues.

Bank Nifty saw robust buying on Wednesday, rebounding from its 20-EMA on the hourly chart—a sign of strong bullish control and solid underlying momentum. Even though the RSI has crossed into slightly overbought territory above 70, the index still isn’t showing signs of profit-taking or an imminent pullback.

From the derivatives perspective, heavy put writing at the 59,000 and 58,500 strikes signals firm bullish sentiment. This positions 58,500 coinciding with the 10-day EMA as key positional support, with 59,000 acting as immediate support. The index remains a buy-on-dips candidate as long as it holds above 58,000. Immediate resistance lies between 59,200–59,500, while support is seen at 58,900–58,500.

| Highest Call Writing at | 59,200 (10.9 Lk) |

| Highest Put Writing at | 58,900 (15.7 Lk) |

Bank Nifty Support and Resistance

| Support | 58,900–58,500 |

| Resistance | 59,200–59,500 |

Voice Of Traders by Spider Software

This 2% Trading Rule can make you RICH (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()