In today’s stock market, Nifty ended above 26,150, while the Sensex rose 638 points, supported by strong gains in IT and metal stocks.

Stock Market Nifty Chart Prediction

On Dec 22, the Sensex was up 638.12 points at 85,567.48, and the Nifty was up 206 points at 26,172.40. About 2601 shares advanced, 1363 shares declined, and 163 shares unchanged.

Top Nifty gainers: Shriram Finance, Trent, Wipro, Infosys, Bharti Airtel.

Top Nifty Losers : SBI, HDFC Life, SBI Life Insurance, Tata Consumer, Kotak Mahindra Bank.

All the sectoral indices ended in the green with auto, pharma, oil & gas, realty, telecom, healthcare rose 0.5-1 percent.

BSE Midcap index added 0.8% and smallcap index jumped 1%

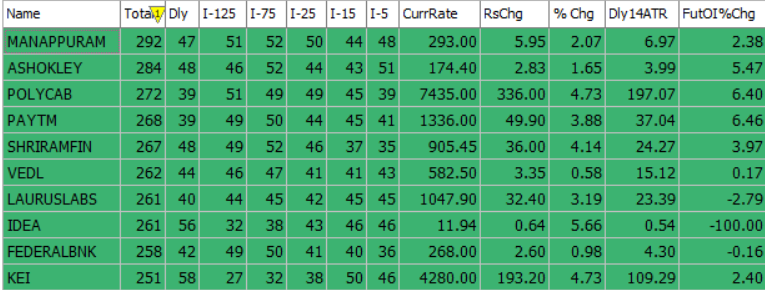

Best Stocks of the day according to AI (Delta Dash)

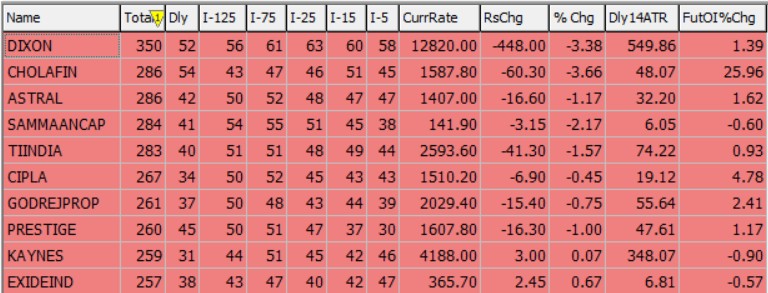

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 23rd December 2025

| STOCK | Good Above | Weak Below |

| ANGELONE | 2585 | 2560 |

| BDL | 1432 | 1416 |

| GLENMARK | 2045 | 2025 |

| INDHOTEL | 742 | 735 |

Prediction for Tuesday NIFTY can go up if it goes above 26,200 or down after the level of 26,100, but it also depends upon the Global cues.

The Nifty opened with a strong gap-up and saw steady buying throughout the session, closing firmly higher at 26,172. On the daily timeframe, the index printed a large bullish candle and moved clearly above the short-term hurdle near 26,050. The follow-through buying after the early rise reflects strength in the ongoing recovery, indicating accumulation rather than profit booking. On the upside, resistance is placed in the 26,200–26,400 zone, while key support lies between 26,100 and 25,800.

| Highest Call Writing at | 26,200 (1.2 Cr) |

| Highest Put Writing at | 26,100 (1.9 Cr) |

Nifty Support and Resistance

| Support | 26,100–25,800 |

| Resistance | 26,200 and 26,400 |

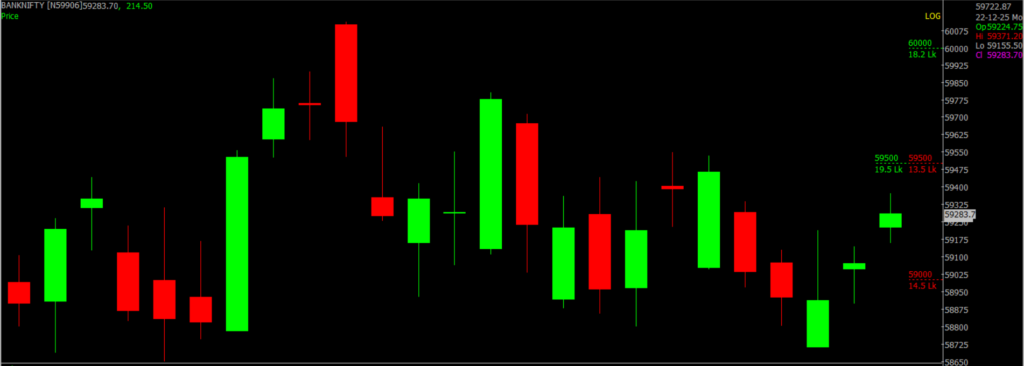

Bank Nifty Daily Chart Prediction

Prediction For Tuesday BANKNIFTY can go up if it goes above 59,500 or down after the level of 59,300, but it also depends upon the Global cues.

Bank Nifty started the session in the green and moved within a narrow range before ending higher at 59,304. On the daily chart, the index formed a small bullish candle and successfully closed above the high of the earlier hammer formation, along with crossing a short-term trendline resistance. Going ahead, the upside hurdle is seen in the 59,500–60,000 zone, while immediate support is placed between 59,400 and 59,000.

| Highest Call Writing at | 59,500 (19.5 Lk) |

| Highest Put Writing at | 59,300 (13.5 Lk) |

Bank Nifty Support and Resistance

| Support | 59,300–59,000 |

| Resistance | 59,500 and 60,000 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()