In today’s stock market, Nifty slipped under 25,900; Sensex fell 314 points. IT dragged, metals and PSU banks gained.

Stock Market Nifty Chart Prediction

On Nov 25, Sensex was down 313.70 points at 84,587.01, and the Nifty was down 74.70 points at 25,884.80. About 2,022 shares advanced, 1,972 declined, and 149 remained unchanged.

Top Nifty gainers: Hindalco Industries, SBI, Bharat Electronics, Shriram Finance, HDFC Life

Top Nifty Losers : Adani Enterprises, TMPV, Infosys, HDFC Bank and Trent

On the sectoral front, metal, pharma, PSU Bank and realty added 0.5-1%, while consumer durables, IT, media shed 0.5% each.

BSE Midcap and smallcap indices ended higher.

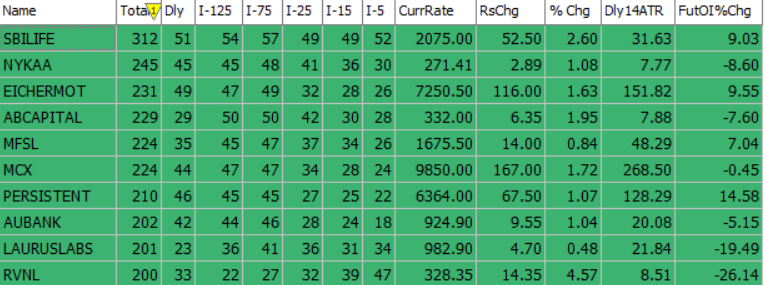

Best Stocks of the day according to AI (Delta Dash)

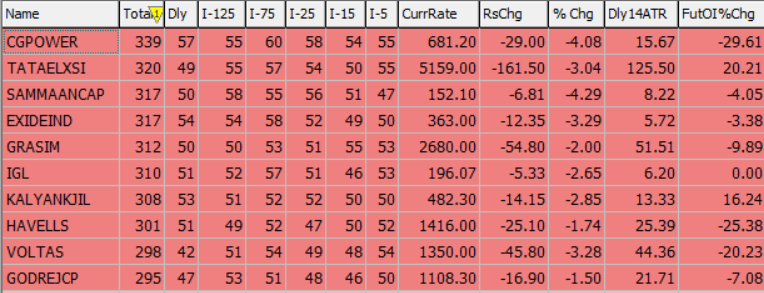

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 26th November 2025

| STOCK | Good Above | Weak Below |

| AUBANK | 950 | 940 |

| COFORGE | 1840 | 1820 |

| LUPIN | 2050 | 2030 |

| MPHASIS | 2810 | 2780 |

Prediction for Wednesday NIFTY can go up if it goes above 25,900 or down after the level of 25,700, but it also depends upon the Global cues.

On the monthly expiry day, Nifty traded choppily for most of the session before a late-hour decline pulled the index down to close at 25,885. The RSI slipping below 60 signals a pause in bullish momentum after the recent rally, while a flat ADX shows weak trend strength and no clear market direction. With the earnings season over, markets will now watch key triggers such as the US Fed’s December policy, commentary on rate-cut expectations, progress on the US-India trade deal, and domestic macro data like GDP, CPI, and IIP. Going ahead, Nifty may face resistance at 25,900–26,200, and support at 25,700–25,300

| Highest Call Writing at | 25,900 (2.0 Cr) |

| Highest Put Writing at | 25,700 (1.1 Cr) |

Nifty Support and Resistance

| Support | 25,700–25,300 |

| Resistance | 25,900–26,200 |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 58,800 or down after the level of 58,700, but it also depends upon the Global cues.

For the second session in a row, Bank Nifty formed a small-bodied candle with long upper wicks, showing selling pressure at higher levels and a short pause in momentum. BANKNIFTY (58,820) remains in a positive trend. If you hold long positions, continue with a daily closing stop-loss at 58,814. Fresh short positions can be considered only if Bank Nifty closes below 58,814. The index may face resistance at 58,800–59,200 and find support at 58,700–58,200.

| Highest Call Writing at | 58,800 (19.4 Lk) |

| Highest Put Writing at | 58,700 (13.5 Lk) |

Bank Nifty Support and Resistance

| Support | 58,700–58,200 |

| Resistance | 58,800–59,200 |

Voice Of Traders by Spider Software

This 2% Trading Rule can make you RICH (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()