In today’s stock market, Sensex & Nifty slipped slightly on the monthly F&O expiry day, as IT stocks weakened while PSU banks moved higher.

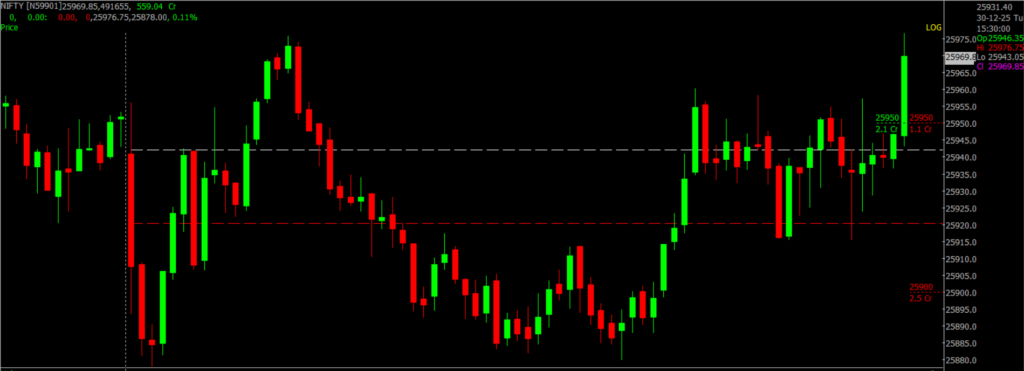

Stock Market Nifty Chart Prediction

On Dec 30, the Sensex was down 20.46 points at 84,675.08, and the Nifty was down 3.25 points at 25,938.85. About 1718 shares advanced, 2113 shares declined, and 137 shares unchanged.

Top Nifty gainers: Shriram Finance, Tata Steel, Hindalco Industries, M&M, Bajaj Auto.

Top Nifty Losers : Max Healthcare, Eternal, Apollo Hospitals, Interglobe Aviation, Tata Consumer.

On the sectoral front, auto index rose 1 percent, metal index added 2 percent, PSU Bank gained nearly 2 percent, however, IT, realty, consumer durables, healthcare, defence down 0.5-1%.

BSE Midcap index shed 0.4% and smallcap index down 0.5%.

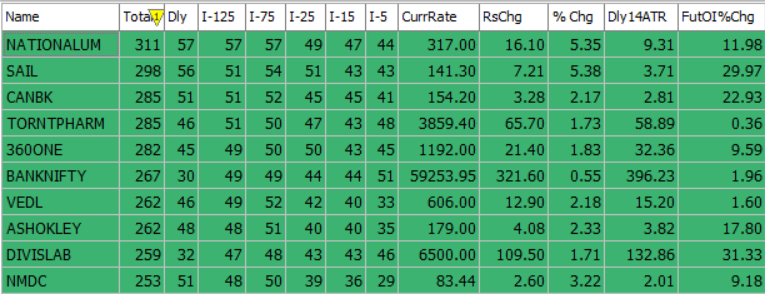

Best Stocks of the day according to AI (Delta Dash)

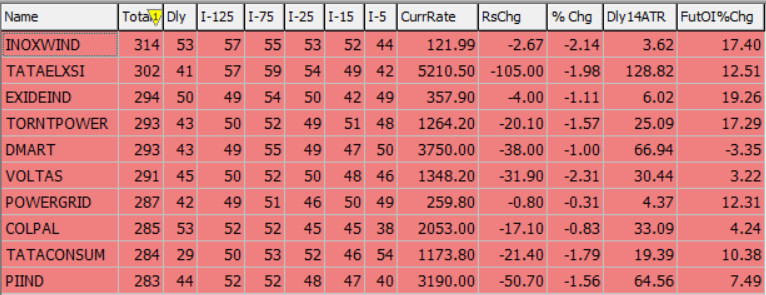

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 31st December 2025

| STOCK | Good Above | Weak Below |

| AXISBANK | 1252 | 1242 |

| BAJAJFINSV | 2048 | 2028 |

| DABUR | 498 | 493 |

| M&M | 3678 | 3642 |

Prediction for Wednesday NIFTY can go up if it goes above 26,100 or down after the level of 26,000, but it also depends upon the Global cues.

Nifty currently shows mild weakness on the daily chart, while the intraday chart indicates a short-term recovery. The candles suggest selling pressure, but buyers are trying to defend the downside, especially near the support zone of 26,000, with a deeper support placed around 25,500. As long as Nifty holds above these levels, it may attempt an upward move toward the resistance zone of 26,100 to 26,500. On the intraday timeframe, the index first declined and then bounced back with strong buying, showing that traders stepped in at lower levels. Overall, the outlook becomes positive only if Nifty sustains above resistance levels, while a break below support could again invite weakness.

| Highest Call Writing at | 26,100 (2.1 Cr) |

| Highest Put Writing at | 26,000 (1.1 Cr) |

Nifty Support and Resistance

| Support | 26,000 and 25,500 |

| Resistance | 26,100 – 26,500 |

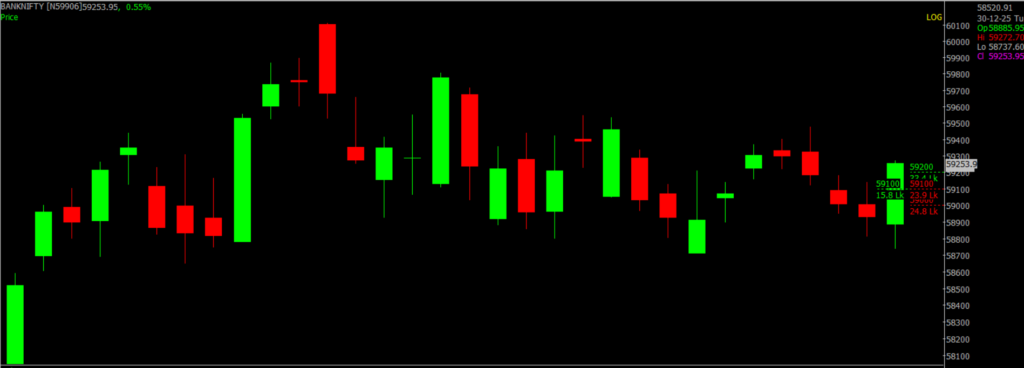

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 59,100 or down after the level of 59,000, but it also depends upon the Global cues.

Bank Nifty is showing signs of consolidation on the daily chart, while the intraday chart reflects buying interest emerging from lower levels. Although there has been some volatility, buyers are trying to defend the 59,000 support zone, with a deeper support placed near 58,500. As long as the index holds above these levels, it may continue to see recovery attempts toward the resistance range of 59,100 to 59,500. However, if Bank Nifty fails to sustain above support and turns lower again, selling pressure may return, so traders should stay cautious and focus on price behavior near these key levels.

| Highest Call Writing at | 59,100 (15.8 Lk) |

| Highest Put Writing at | 59,000 (23.9 Lk) |

Bank Nifty Support and Resistance

| Support | 59,000 and 58,500 |

| Resistance | 59,100 – 59,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()