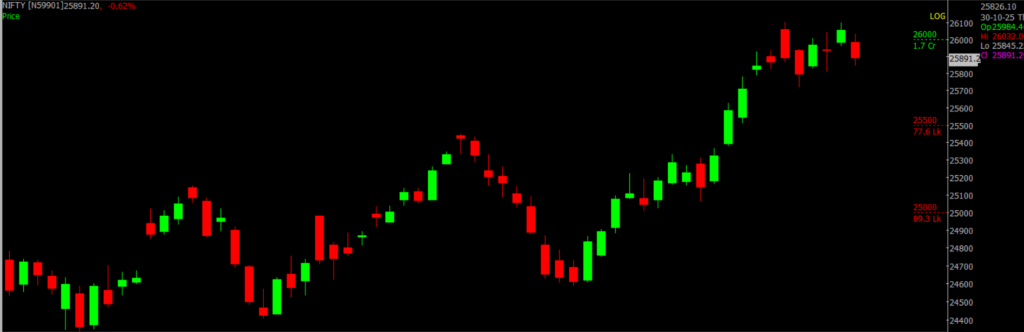

In today’s stock market, Nifty falls below 26,000, and the Sensex drops almost 600 points due to global concerns after the Fed’s decision.

Stock Market Nifty Chart Prediction

On October 30, Sensex down –592.67 points to 84,404, and Nifty down −176.05 points to 25,877. A total of 1,321 shares advanced, –1,748 shares declined, and 109 shares remained unchanged.

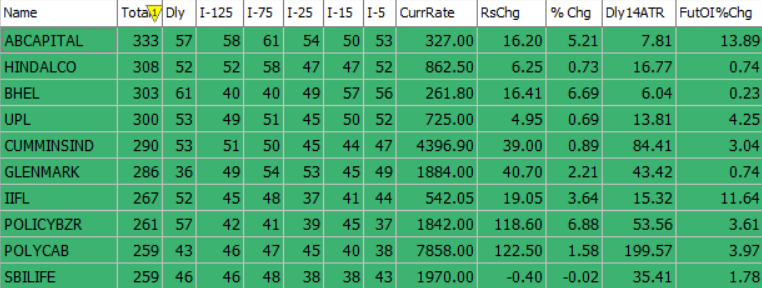

Top Nifty gainers: AB CAPITAL, HINDALCO, BHEL, UPL

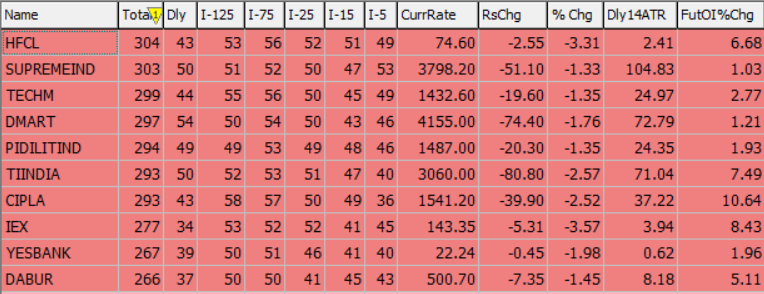

Top Nifty Losers : HFCL, SUPREMEIND, DMART, IEX

Among sectoral indices, Nifty Private Bank was the biggest laggard, down 0.7 percent, followed by Nifty Pharma, Nifty IT, and Nifty Bank, which declined 0.6 percent each. Nifty Metal, PSU Bank, Auto, and FMCG indices were also lower by 0.5 percent each.

BSE Midcap index added 0.16% and smallcap index rose 0.87%.

Best Stocks of the day according to AI (Delta Dash)

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 31st October 2025

| STOCK | Good Above | Weak Below |

| GLENMARK | 1892 | 1875 |

| JUBLFOOD | 617 | 611 |

| MARICO | 727 | 720 |

| MFSL | 1565 | 1550 |

Prediction for Friday NIFTY can go up if it goes above 26,000 or down after the level of 25,700, but it also depends upon the Global cues.

The Nifty fell 0.68% on Thursday to close below 25,900, as investor sentiment turned cautious after U.S. Fed Chair Jerome Powell’s hawkish comments raised fears of prolonged high interest rates. Global uncertainty also persisted ahead of the extended Trump–Xi meeting, which sparked hopes of progress on trade talks.

Coal India and L&T were the top gainers, while Dr. Reddy’s and Cipla led the losers. Most sectors ended in the red except Realty, with broader markets also declining. The advance-decline ratio showed weakness, with most Nifty 500 stocks closing lower.

Key resistance lies between 26,000–26,500, while support is seen in the 25,700–25,000 zone.

| Highest Call Writing at | 26,000 (1.7 crore) |

| Highest Put Writing at | 25,700 (77.6 lakh) |

Nifty Support and Resistance

| Support | 25,700–25,000 |

| Resistance | 26,000–26,500 |

Bank Nifty Daily Chart Prediction

Prediction For Friday BANKNIFTY can go up if it goes above 58,100 or down after the level of 57,900, but it also depends upon the Global cues.

BANKNIFTY (58,031): The index remains in a negative trend. Traders holding short positions can continue to do so with a daily closing stop-loss at 58,393. A fresh long position should be considered only if Banknifty closes above 58,393. Key resistance is placed at 58,100–58,500, while support lies in the 57,900–57,500 zone.

| Highest Call Writing at | 58,100 (9.7 Lk) |

| Highest Put Writing at | 57,900 (11.7 Lk) |

Bank Nifty Support and Resistance

| Support | 57,900–57,500 |

| Resistance | 58,100–58,500 |

Voice Of Traders by Spider Software

How Mr. Kundan Prajapati Made $5 Million with a Simple Strategy (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()