In today’s stock market, Markets bounced back post-Budget, with Sensex surging 910 points and Nifty near 25,100.

Stock Market Nifty Chart Prediction

On Feb 2, the Sensex was up 943.52 points at 81,666.46, and the Nifty was up 262.95 points at 25,088.40. About 1919 shares advanced, 2166 shares declined, and 159 shares unchanged.

Top Nifty gainers: Tata Consumer, Adani Ports, Power Grid, Bharat Electronics

Top Nifty Losers : Shriram Finance, Max Healthcare, Cipla, Axis Bank, Infosys.

On the sectoral front, FMCG, metal, oil & gas, energy, infra, realty jumped 1-2%, while IT index shed 0.5%.

Nifty midcap index rose 1%, while smallcap index added 0.6%.

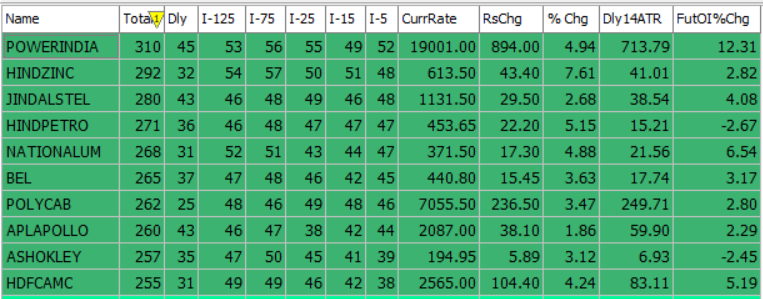

Best Stocks of the day according to AI (Delta Dash)

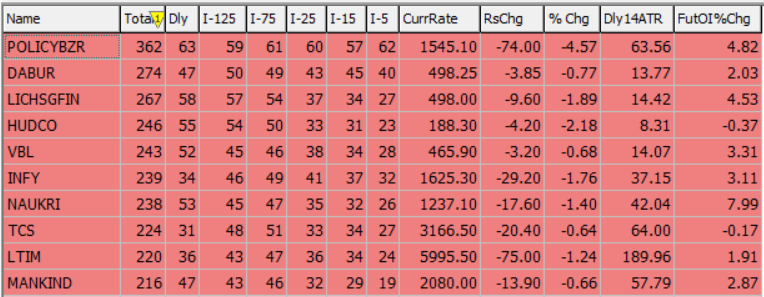

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 3rd February 2026

| STOCK | Good Above | Weak Below |

| BHARATFORG | 1446 | 1432 |

| HDFCAMC | 2575 | 2550 |

| RELIANCE | 1400 | 1380 |

| TCS | 1332 | 1320 |

Prediction for Tuesday NIFTY can go up if it goes above 25,500 or down after the level of 24,500, but it also depends upon the Global cues.

Nifty has shown a short-term rebound after defending lower levels, but the broader trend still remains cautious amid volatile price action. On the downside, 24,500 is the immediate and crucial support; holding above this zone can help the index stabilize and attempt a recovery. However, a decisive break below 24,500 may weaken sentiment further and expose the next major support near 24,000. On the upside, any pullback rally is likely to face strong resistance in the 25,500–26,000 zone, where selling pressure could re-emerge. A sustained move above 25,500 is needed to signal a meaningful trend reversal and open the path towards 26,000. Until then, the outlook remains range-bound with a cautious bias, favoring a sell-on-rise approach near resistance levels.

| Highest Call Writing at | 25,500 (1.7 cr) |

| Highest Put Writing at | 24,500 (1.4 cr) |

Nifty Support and Resistance

| Support | 24,500 and 24,000 |

| Resistance | 25,500–26,000 |

Bank Nifty Daily Chart Prediction

Prediction For Tuesday BANKNIFTY can go up if it goes above 60,000 or down after the level of 59,700, but it also depends upon the Global cues.

Bank Nifty is showing signs of consolidation after recent volatility, with price action indicating cautious optimism near current levels. On the downside, 59,700 remains the immediate support; a sustained hold above this level can keep the index stable and allow for gradual recovery. A breakdown below 59,700 may weaken momentum and expose the next major support near 58,000. On the upside, the 60,000–61,000 zone stands as a strong resistance area, where selling pressure is likely to emerge. A decisive breakout above 60,000 is essential to confirm renewed bullish strength and open the path towards 61,000. Until then, the outlook remains range-bound, with traders advised to adopt a cautious approach and monitor price behavior near key levels.

| Highest Call Writing at | 60,000 (18.9 Lk) |

| Highest Put Writing at | 59,700 (8.6 Lk) |

Bank Nifty Support and Resistance

| Support | 59,700 and 58,000 |

| Resistance | 60,000–61,000 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()