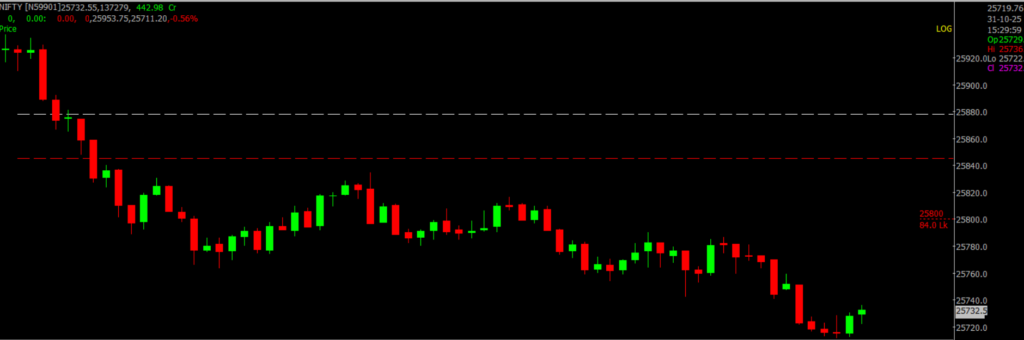

In today’s stock market, Nifty is below 25,750, and the Sensex has dropped by 450 points. However, PSU banks are performing well.

Stock Market Nifty Chart Prediction

On October 31, Sensex was down 465.75 points or 0.55 percent at 83,938.71, and the Nifty was down 155.75 points or 0.60 percent at 25,722.10. About 1731 shares advanced, 2240 shares declined, and 138 shares unchanged.

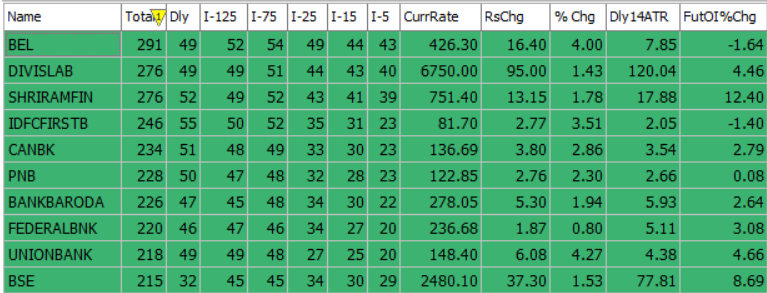

Top Nifty gainers: Bharat Electonics, Eicher Motors, Shriram Finance, L&T, TCS

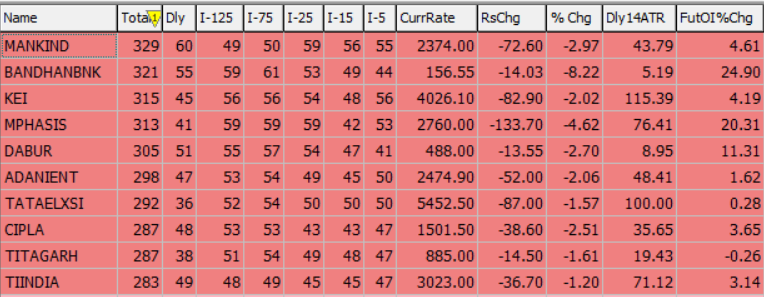

Top Nifty Losers : Cipla, Eternal, Max Healthcare, NTPC, Interglobe Aviation.

Among sectors, PSU Bank index rose 1.5%, while power, metal, media shed 1% each and IT, private bank, healthcare index down 0.5% each.

BSE Midcap index slipped 0.5% and Smallcap indices down 0.4%

Best Stocks of the day according to AI (Delta Dash)

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 3rd November 2025

| STOCK | Good Above | Weak Below |

| BEL | 428 | 424 |

| BPCL | 358 | 355 |

| BSE | 2500 | 2470 |

| LT | 4045 | 4000 |

Prediction for Monday NIFTY can go up if it goes above 25,800 or down after the level of 25,700, but it also depends upon the Global cues.

Markets extended their consolidation on Friday, with the Nifty slipping over half a percent to close at 25,722.10. Profit booking in heavyweight stocks dragged indices lower, and all major sectors ended in the red, led by metals, financials, and pharma.

Sentiment stayed cautious amid the Fed’s hawkish tone and weak FII inflows, while the Trump–Xi summit offered only brief relief. Technically, the Nifty is nearing key support around 25,600; holding above it is crucial to maintain a positive bias. Investors can use dips to buy quality stocks in metals, autos, banking, and energy. Resistance is seen at 25,800–26,100 and support at 25,700–25,400.

| Highest Call Writing at | 25,800 (2.2 crore) |

| Highest Put Writing at | 25,700 (86.6 lakh) |

Nifty Support and Resistance

| Support | 25,700–25,400 |

| Resistance | 25,800–26,100 |

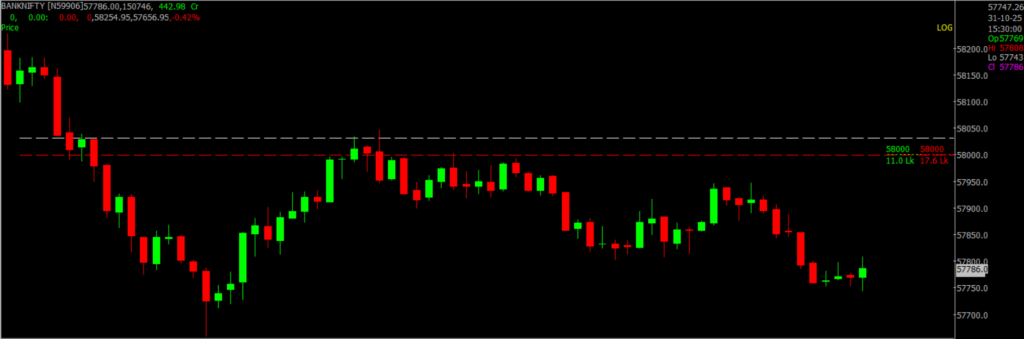

Bank Nifty Daily Chart Prediction

Prediction For Monday BANKNIFTY can go up if it goes above 57,900 or down after the level of 57,600, but it also depends upon the Global cues.

BANKNIFTY (57,776): Bank Nifty remains in a negative trend. Traders holding short positions can continue to do so with a daily closing stop-loss at 58,393. Fresh long positions should be considered only if the index closes above 58,393. Key resistance levels are at 57,900–58,500, while support is placed at 57,600–57,000.

| Highest Call Writing at | 57,900 (11.0 Lk) |

| Highest Put Writing at | 57,600 (11.9 Lk) |

Bank Nifty Support and Resistance

| Support | 57,600–57,000 |

| Resistance | 57,900–58,500 |

Voice Of Traders by Spider Software

How Mr. Kundan Prajapati Made $5 Million with a Simple Strategy (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()