In today’s stock market, Sensex falls 600 points from intraday high, Nifty dips below 24,600 on first Tuesday expiry.

Stock Market Nifty Chart Prediction

On September 2, Sensex is down 206.61 points to 80,157.88, while Nifty down 45.45 points to 24,579. Around 1,929 stocks advanced, -1,117 declined, and 86 remained unchanged.

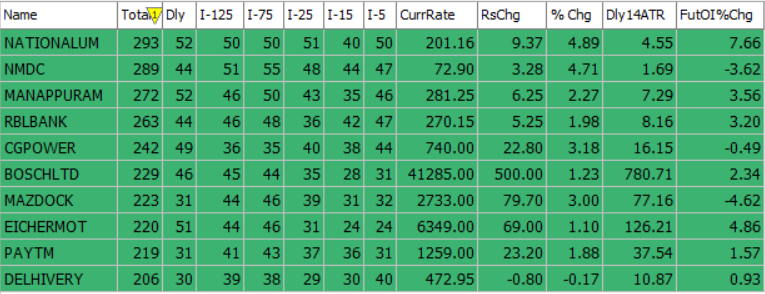

Top Nifty gainers: NMDC, RBL Bank, EicherMotors, Paytm

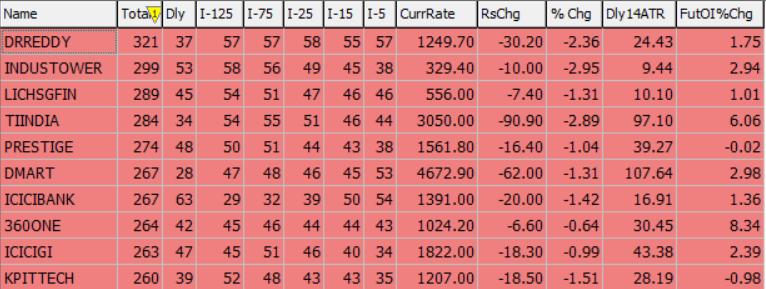

Top Nifty Losers : Dr Reddy, D Mart, ICICI Bank

BSE Midcap index up 0.27% and smallcap index down 0.64%.

Best Stocks of the day according to AI (Delta Dash)

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 3rd September 2025

| STOCK | Good Above | Weak Below |

| EXIDEIND | 416 | 412 |

| HINDALCO | 724 | 716 |

| PIDILITIND | 3140 | 3108 |

| TATACONSUM | 1111 | 1100 |

Prediction for Wednesday NIFTY can go up if it goes above 24,600 or down after the level of 24,300, but it also depends upon the Global cues.

The Nifty index faced strong selling pressure at the 21-day EMA, which led to a sharp fall during the day. The market is still in a “sell-on-rise” phase and will likely remain weak unless it moves back above 24,850. The daily RSI is showing a bearish signal, staying below 50.

In the short term, the trend looks weak. Despite strong economic data in the morning, domestic markets gave up early gains due to profit booking and caution ahead of the GST Council meeting and F&O expiry. Banking stocks were the main drag on the market.

Nifty now has resistance between 24,600 and 25,000, and support is expected between 24,300 and 24,000.

| Highest Call Writing at | 24,600 (1.6 Cr) |

| Highest Put Writing at | 24,300 (1.5 Cr) |

Nifty Support and Resistance

| Support | 24,300 and 24,000 |

| Resistance | 24,600 and 25,000 |

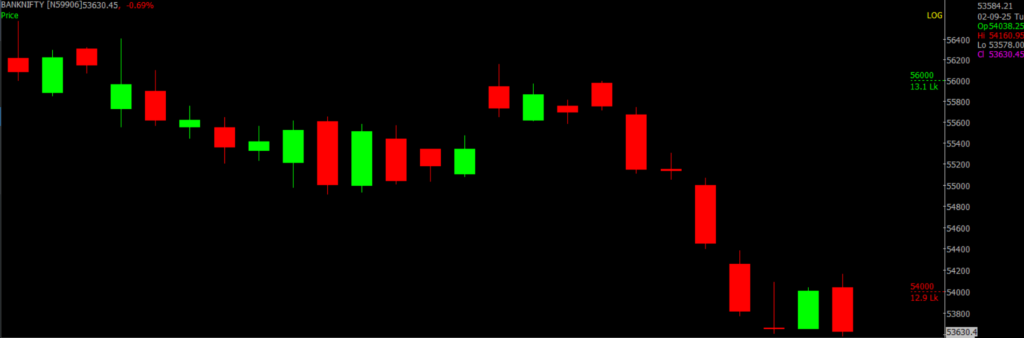

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 54,000 or down after the level of 53,600, but it also depends upon the Global cues.

BANKNIFTY (53,661) is currently in a downtrend. If you’re holding short (sell) positions, you can continue to hold them, but keep a daily closing stoploss at 54,346 meaning if it closes above that level, consider exiting your short.

New long (buy) positions should only be considered if Banknifty closes above 54,346.

On the upside, resistance is expected between 54,000 and 54,500, while on the downside, support is seen between 53,600 and 53,000.

| Highest Call Writing at | 54,000 (13.1 Lk) |

| Highest Put Writing at | 53,600 (10.4 Lk) |

Bank Nifty Support and Resistance

| Support | 53,600 and 53,000 |

| Resistance | 54,000 and 54,500 |

Power of Algorithms in Options Trading, Try Spider Now: Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()