In today’s stock market, Nifty is around 25,500, and Sensex drops 150 points. Stocks in metal, media, and real estate are leading losses.

Stock Market Nifty Chart Prediction

On Nov 06, Sensex was down 148.14 points at 83,311.01, and the Nifty was down 87.95 points at 25,509.70. About 1,174 shares advanced, 2,855 shares declined, and 130 shares were unchanged.

Top Nifty gainers: Asian Paints, Interglobe Aviation, M&M, Reliance Industries, UltraTech Cement

Top Nifty Losers : Hindalco, Grasim Industries, Adani Enterprises, Power Grid Corp and Eternal.

On the sectoral front, metal, power, realty, media down 1.5-2.5%. However, FMCG, auto and IT ended with marginal gains.

BSE Midcap index fell 1.2%, and smallcap index shed 1.5%.

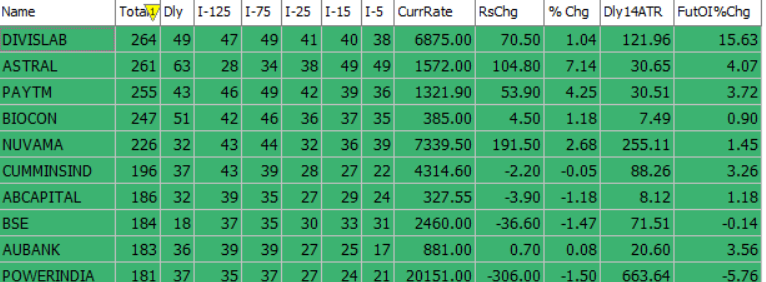

Best Stocks of the day according to AI (Delta Dash)

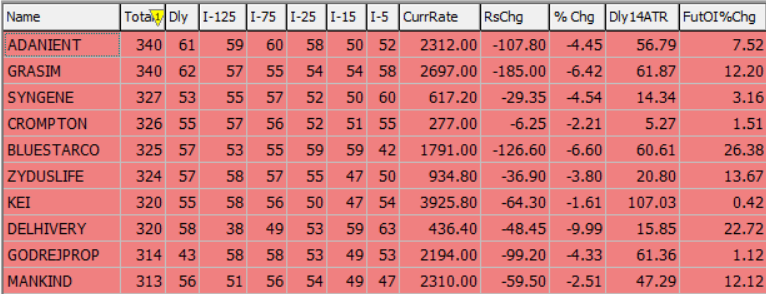

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 7th November 2025

| STOCK | Good Above | Weak Below |

| AUBANK | 885 | 876 |

| M&M | 3635 | 3600 |

| PAYTM | 1326 | 1314 |

| PIIND | 3756 | 3720 |

Prediction for Friday NIFTY can go up if it goes above 25,500 or down after the level of 25,400, but it also depends upon the Global cues.

Indian markets ended lower amid profit booking, with the Nifty 50 down 88 points at 25,509 and the Sensex slipping 148 points to 83,311. Broader indices also fell, showing widespread caution.

Selling by FIIs continued, with ₹1,067 crore offloaded on November 4, while DIIs bought ₹1,203 crore, limiting losses. Metal stocks led the decline after weak global cues.

Markets remain range-bound due to high valuations and global uncertainty. Focus now shifts to foreign inflows and Q2 FY26 earnings, including LIC’s results. The rupee stays stable around 88.6, with resistance at 25,500–25,900 and support at 25,400–25,100.

| Highest Call Writing at | 25,500 (1.3 crore) |

| Highest Put Writing at | 25,400 (75.9 Lakh) |

Nifty Support and Resistance

| Support | 25,400–25,100 |

| Resistance | 25,500–25,900 |

Bank Nifty Daily Chart Prediction

Prediction For Friday BANKNIFTY can go up if it goes above 58,700 or down after the level of 57,400, but it also depends upon the Global cues.

The Bank Nifty extended its decline for the second straight session and is now consolidating near its previous swing support zone. On the daily chart, it formed a bearish candle with a long upper shadow, signaling that buyers struggled to sustain higher levels as selling pressure persisted through the day.

Going forward, the 20-day EMA zone will be crucial. Key resistance levels are placed at 58,700–58,200, while support lies between 57,400 and 57,000.

| Highest Call Writing at | 58,700 (15.9 Lk) |

| Highest Put Writing at | 57,400 (11.0 Lk) |

Bank Nifty Support and Resistance

| Support | 57,400 and 57,000 |

| Resistance | 58,700–58,200 |

Voice Of Traders by Spider Software

This 2% Trading Rule can make you RICH (Watch Live Results)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()