In today’s stock market, Nifty slips below 26,150; Sensex falls 200 points. Pharma and IT gain, auto stocks decline.

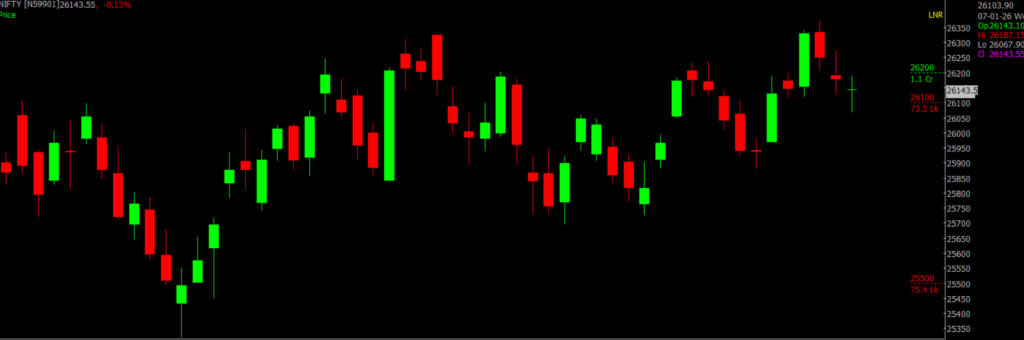

Stock Market Nifty Chart Prediction

On Jan 7, Sensex was down 102.20 points at 84,961.14, and Nifty slipped 37.95 points to 26,140.75. Around 1,939 shares advanced, 1,886 declined, and 140 remained unchanged.

Top Nifty gainers: Titan Company, Tech Mahindra, HCL Technologies, Wipro, Jio Financial

Top Nifty Losers : Cipla, Maruti Suzuki, Max Healthcare, Tata Motors Passenger Vehicles, Power Grid.

Consumer durables, IT, pharma gained 0.5-1.8%, while auto, oil & gas, realty, telecom shed 0.5 each.

BSE Midcap index added 0.5%, while smallcap index rose 0.12%.

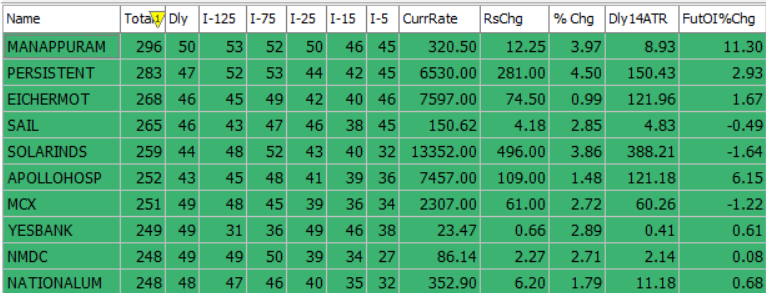

Best Stocks of the day according to AI (Delta Dash)

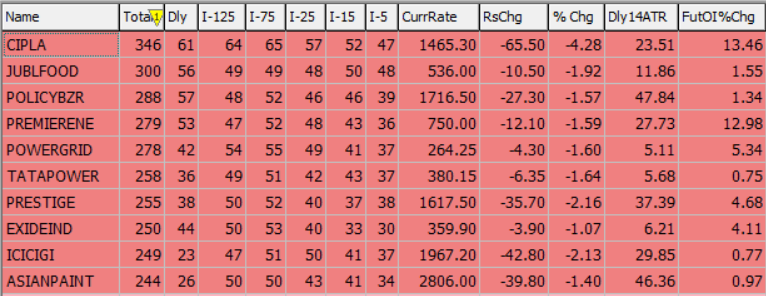

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 08th January 2026

| STOCK | Good Above | Weak Below |

| BLUESTARCO | 1860 | 1840 |

| COFORGE | 1712 | 1692 |

| LUPIN | 2225 | 2200 |

| HCLTECH | 1662 | 1646 |

Prediction for Thursday NIFTY can go up if it goes above 26,150 or down after the level of 26,000, but it also depends upon the Global cues.

Nifty started the session on a weak note and attempted a recovery but faced strong resistance twice near the 26,180–26,190 zone, leading to a gradual decline. The index later recovered steadily from the day’s low of 26,069 but still ended 0.14% lower at 26,140. Since hitting an all-time high of 26,373 on 5th January, Nifty has formed consecutive doji candles on the daily chart, indicating indecision at higher levels. However, the index continues to close above its 20-day EMA, suggesting underlying support remains intact despite intraday volatility. The Smallcap index has shown relative resilience by holding above its 100-day EMA for the past three sessions, reflecting buying interest on dips amid broader consolidation. It continues to trade below the key psychological level of 18,000, which remains a crucial hurdle; a decisive breakout above this level could extend the ongoing pullback rally, while the 100-DEMA is expected to act as an important near-term support. For Nifty, resistance is placed in the 26,150–26,350 zone, while support lies between 26,000 and 25,700.

| Highest Call Writing at | 26,150 (1.1 cr) |

| Highest Put Writing at | 26,000 (73.5 Lakh) |

Nifty Support and Resistance

| Support | 26,000 and 25,700 |

| Resistance | 26,150–26,350 |

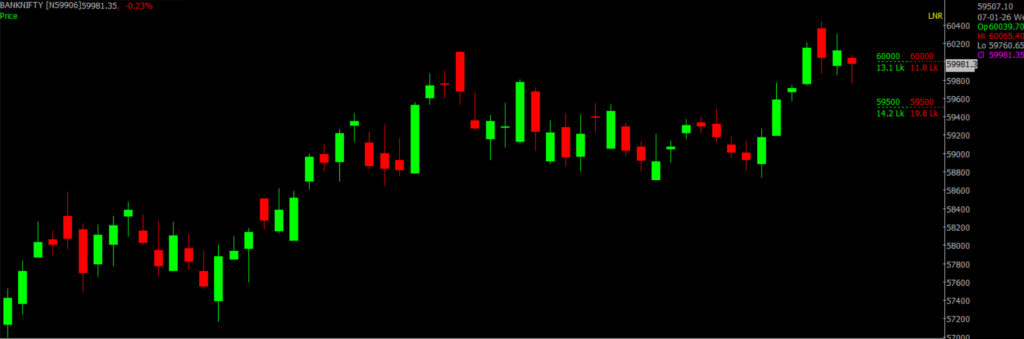

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 60,000 or down after the level of 59,900, but it also depends upon the Global cues.

Bank Nifty opened on a weak note and drifted lower in early trade before finding firm support in the 59,860–59,870 zone. A recovery from lower levels helped the index pare some losses; however, it failed to sustain above the day’s high as selling pressure resurfaced, dragging the index to an intraday low of 59,761. A late recovery attempt in the second half resulted in the formation of a thin-bodied candle with a relatively long lower shadow, indicating buying interest at lower levels. Bank Nifty ended the session at 59,991, down 0.21%. Resistance is seen in the 60,000–60,500 zone, while support is placed between 59,900 and 59,500.

| Highest Call Writing at | 60,000 (13.1 Lk) |

| Highest Put Writing at | 59,900 (19.6 Lk) |

Bank Nifty Support and Resistance

| Support | 59,900 and 59,500 |

| Resistance | 60,000–60,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()