In today’s stock market, Nifty slips below 26,000 & Sensex drops over 500 points as banks & the rupee weaken, pulling all market sectors into the red.

Stock Market Nifty Chart Prediction

On Dec 2, Sensex was down 503.63 points at 85,138.27, and the Nifty was down 143.55 points at 26,032.20. About 1518 shares advanced, 2453 shares declined, and 158 shares unchanged.

Top Nifty gainers: Asian Paints, Tech Mahindra, Dr Reddy’s Labs, SBI Life Insurance & Maruti Suzuki.

Top Nifty Losers : Interglobe Aviation, Reliance Industries, HDFC Bank, ICICI Bank, Axis Bank

All the sectoral indices ended in the red with metal, oil & gas, private Bank, consumer durables, media index down 0.5% each.

BSE Midcap index ended marginally lower, while Smallcap index fell 0.6%.

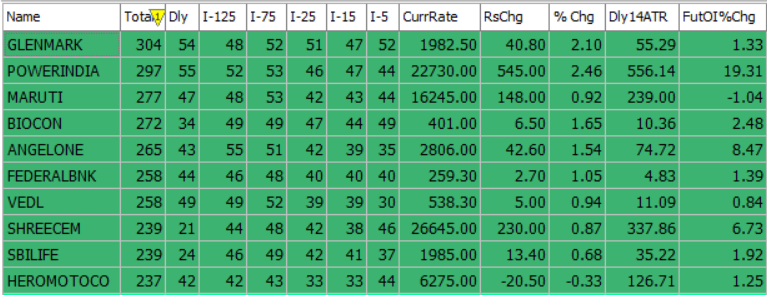

Best Stocks of the day according to AI (Delta Dash)

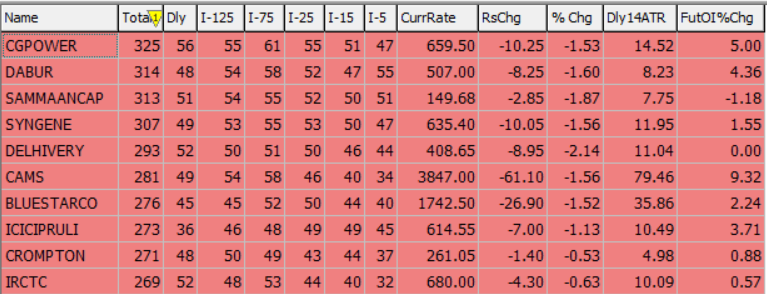

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 3rd December 2025

| STOCK | Good Above | Weak Below |

| ANGELONE | 2826 | 2782 |

| GLENMARK | 1990 | 1970 |

| HINDUNILVR | 2485 | 2460 |

| TVSMOTOR | 3685 | 3645 |

Prediction for Wednesday NIFTY can go up if it goes above 26,100 or down after the level of 26,000, but it also depends upon the Global cues.

The Nifty index opened sharply lower and faced persistent selling throughout the session, finally closing in the red at 26,032. The daily chart shows a small red candle with wicks on both ends, highlighting uncertainty in market sentiment. For the immediate trend, 26,100 and 26,300 act as key resistance zones, while 26,000–25,800 serve as crucial support levels for traders.

| Highest Call Writing at | 26,100 (2.7 Cr) |

| Highest Put Writing at | 26,000 (3.2 Cr) |

Nifty Support and Resistance

| Support | 26,000 – 25,800 |

| Resistance | 26,100 and 26,300. |

Bank Nifty Daily Chart Prediction

Prediction For Wednesday BANKNIFTY can go up if it goes above 59,500 or down after the level of 59,000, but it also depends upon the Global cues.

Bank Nifty (59,274) has turned negative in the last trading session. You can go short with a stop-loss at 59,937 on a daily closing basis, and the index will remain bearish as long as it stays below this level. Resistance is expected around 59,500–60,000, while support is seen near 59,000 and 58,500.

| Highest Call Writing at | 59,500 (12.9 Lk) |

| Highest Put Writing at | 59,000 (11.9 Lk) |

Bank Nifty Support and Resistance

| Support | 59,000 – 58,500 |

| Resistance | 59,500 – 60,000 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()