Futures trading manages risk and enhances returns. Learn 5 key essential strategies for success in 2025.

What is Futures Trading?

A futures contract is a legally binding agreement to buy or sell a specific asset, commodity, or security at a predetermined price on a future date. To streamline trading on futures exchanges, these contracts are standardized in terms of quantity and quality.

When a futures contract is bought, the buyer commits to purchasing and receiving the underlying asset upon the contract’s expiration. Conversely, the seller agrees to deliver the asset at that agreed-upon future date.

Nifty Futures Trading Strategy

For investors focusing on Indian markets, Nifty Futures present valuable opportunities. The Nifty index, which tracks the top 50 companies listed on the National Stock Exchange (NSE), serves as a key market benchmark and is a favorite among Indian traders.

Top 5 Futures Trading Strategies

1. Trend Following Strategy

The trend following strategy is one of the easiest and most popular ways to trade futures. Basically, you look for the market’s current direction—whether it’s going up (bullish) or down (bearish)—and then trade along with that trend. The idea is simple: once a trend gets going, it usually keeps moving for a while, so you can ride that momentum and hopefully make some good profits.

How It Works

Uptrend: This happens when prices keep making higher highs and higher lows—basically, the market is climbing steadily.

Downtrend: This is when prices make lower highs and lower lows, showing the market is sliding down.

To spot these trends, traders often rely on tools like Moving Averages, MACD (Moving Average Convergence Divergence), or simple trendlines drawn on charts.

2. Momentum Trading in Futures

Momentum trading is all about jumping on the bandwagon when an asset is moving strongly in one direction. The idea is that if a price is showing strong momentum, it’s likely to keep going that way for a while. This strategy focuses on assets that have high relative strength—basically, ones that are really picking up speed. While you can use momentum trading with any asset, it’s especially popular in futures because of the high leverage involved, which can amplify gains.

How It Works

Momentum trading is about spotting when prices are moving strongly, either up or down. The goal is to jump in when momentum is high and stay in the trade until you see it starting to lose steam.

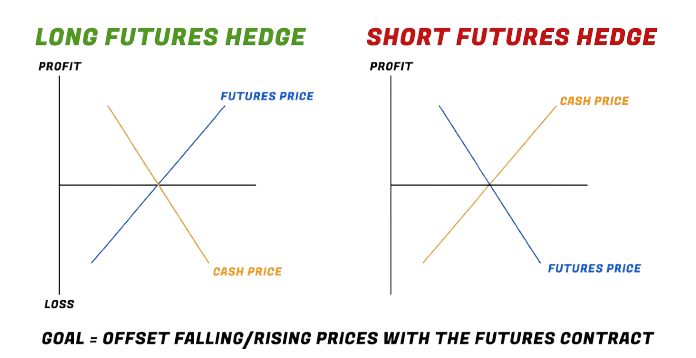

3. Hedging with Futures and Options

Hedging is a smart defensive move designed to reduce risk, not necessarily to boost profits. Both individual traders and big investors use it to protect their holdings from unexpected price drops. In futures trading, this usually means taking opposite positions in futures or options to balance out potential losses.

How It Works:

You keep your main investment, then take a secondary position in a related asset that can help cover any losses.

Example:

A wheat farmer might sell wheat futures contracts to lock in a price for their crop. This way, if prices fall later, they’re protected from losing money.

Using options alongside futures adds extra flexibility options let you protect yourself from downside risk without the commitment to buy or sell if the market moves in your favor.

4. Mean Reversion Strategy

The mean reversion strategy is based on the idea that prices don’t stay far from their average forever—they eventually come back to it. So, when prices move way above or below their usual level, it creates a chance to trade and potentially make a profit as they return to normal. This approach works best in markets where prices tend to swing within a certain range.

How It Works

Traders using this strategy watch for assets whose prices have moved far away from their usual average—either too high or too low. They then trade with the expectation that prices will eventually bounce back towards that average.

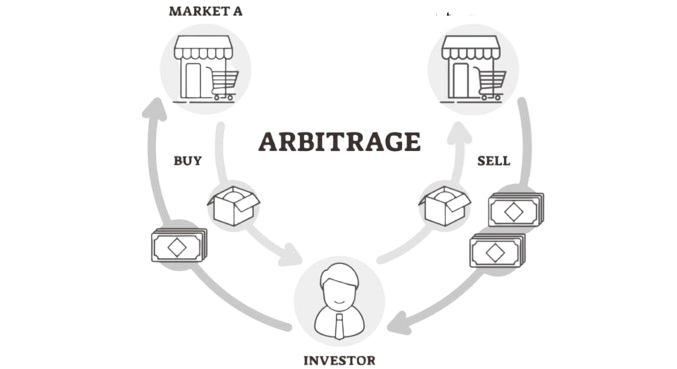

5. Arbitrage Strategy

Arbitrage is all about spotting price differences between two or more markets and taking advantage of them. In futures trading, this happens when related markets or contracts have different prices. The goal? Buy low in one market and sell high in another to secure a risk-free profit.

How It Works

Arbitrageurs buy and sell the same or related assets at the same time but in different markets to profit from price gaps. Because these differences are usually small and don’t last long, trades need to happen fast to lock in the gain.

Join our exclusive one-day seminar for serious traders ready to level up. Whether you’re into intraday, options, or algo trading, gain the edge, discipline, and mastery to excel in the markets. Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()