In today’s stock market, Nifty has dropped below 25,900, and the Sensex has fallen by 100 points. PSU banks are performing better.

Stock Market Nifty Chart Prediction

On Dec 17, Sensex was down 120.21 points at 84,559.65, and the Nifty was down 41.55 points at 25,818.55. About 1,326 shares advanced, 2,498 shares declined, and 144 shares were unchanged.

Top Nifty gainers: Bharti Airtel, Tata Consumer, Titan Company, M&M, Bajaj Auto.

Top Nifty Losers : Axis Bank, Eternal, HCL Technologies, Tata Steel, JSW Steel

Among sectors, PSU Bank index added 1.2%, while media index shed 2%, while Private Bank, Realty, Consumer Durables, FMCG, Healthcare down 0.4-1%.

BSE Midcap index fell 0.6%, while smallcap index shed nearly 1%.

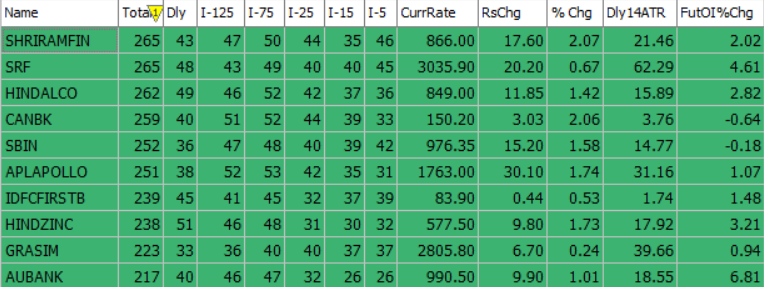

Best Stocks of the day according to AI (Delta Dash)

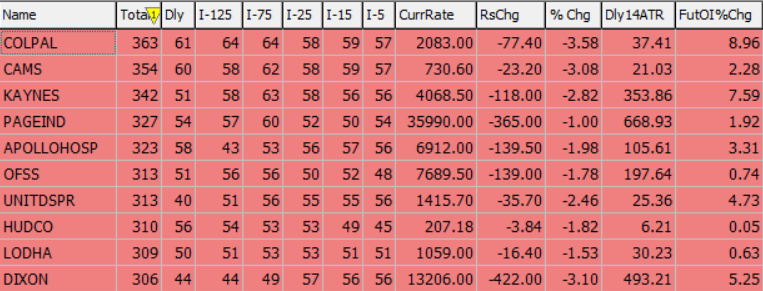

Worst Stocks of the day according to AI (Delta Dash)

Stock Prediction for 18th December 2025

| STOCK | Good Above | Weak Below |

| APLAPOLLO | 1770 | 1752 |

| LUPIN | 2122 | 2100 |

| SBIN | 980 | 970 |

| SHRIRAMFIN | 870 | 862 |

Prediction for Thursday NIFTY can go up if it goes above 25,900 or down after the level of 25,700, but it also depends upon the Global cues.

The Nifty remains under pressure as it stayed below the 21 EMA for another session, signaling a weak short-term trend. The RSI also continues to indicate bearish momentum.

The index has taken support near the 50 EMA, but repeated testing weakens this support. Immediate resistance lies between 25,900 and 26,500, while support is seen in the 25,700–25,200 range.

| Highest Call Writing at | 25,900 (1.3 Cr) |

| Highest Put Writing at | 25,700 (64.8 Lk) |

Nifty Support and Resistance

| Support | 25,700–25,200 |

| Resistance | 25,900 and 26,500 |

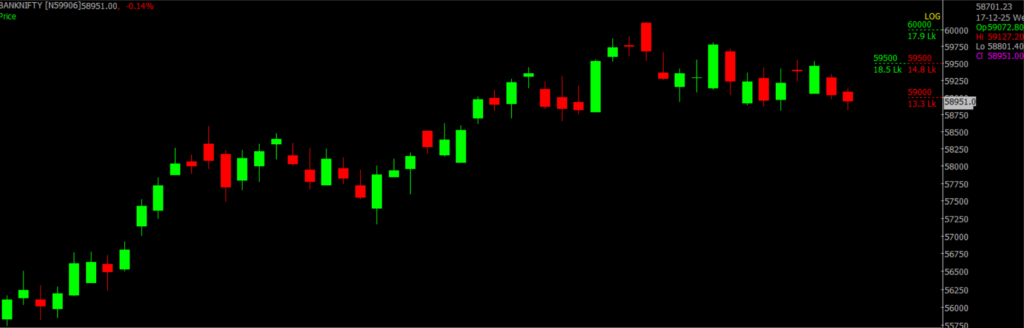

Bank Nifty Daily Chart Prediction

Prediction For Thursday BANKNIFTY can go up if it goes above 59,000 or down after the level of 58,800, but it also depends upon the Global cues.

BANKNIFTY (58,927): Bank Nifty entered a negative trend in the last trading session. Short positions can be considered with a stop loss at 59,459 on a daily closing basis. The index remains bearish as long as it stays below 59,459. Resistance is placed between 59,000 and 59,500, while support lies in the 58,800–58,200 range.

| Highest Call Writing at | 59,000 (17.9 Lk) |

| Highest Put Writing at | 58,800 (14.8 Lk) |

Bank Nifty Support and Resistance

| Support | 58,800–58,200 |

| Resistance | 59,000 and 59,500 |

Voice Of Traders by Spider Software

HDFC Securities’ SECRET Stock Picking Formula! (STRATEGY REVEALED)

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()