An ATM is an electronic banking outlet that enables customers to perform financial transactions without a bank teller, including cash withdrawals, deposits, transfers, and account balance inquiries.

What is an ATM?

Most people used ATM i.e. Automated Teller Machine to withdraw cash.

In other words, it is an electronic banking machine where a person can take out money from a machine after inserting his or her debit or credit card without involving any human presence.

Some other Services provided by ATM

ATMs offer a range of services beyond just dispensing cash, such as:

- Customers can deposit cash and checks directly into their accounts, which is a convenient alternative to waiting in line at a bank branch.

- Many ATMs allow customers to transfer funds between their accounts or to other individuals.

- Some ATMs also provide the option to pay bills, such as utilities, credit cards, or loans, using the machine’s bill payment feature.

- Account holders can also check their account balances, view transaction history, print mini-statements, and sometimes even update their account information.

- Some ATMs offer additional services like selling prepaid cards, stamps, or foreign currency exchange.

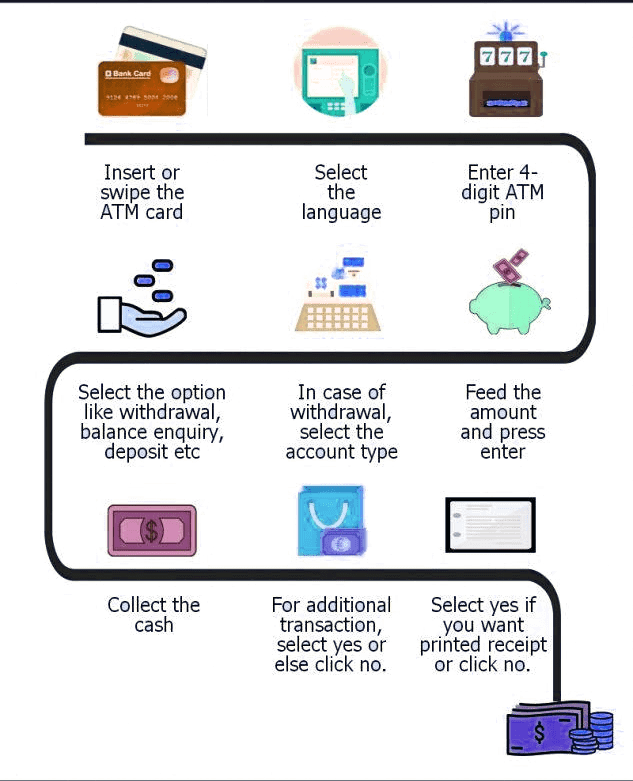

Steps to withdraw money from an ATM

Withdrawing money from ATM is not so complex. All you need is an active ATM card and a nearby ATM center. Follow these steps to withdraw money from an ATM.

Step 1: To begin, insert your ATM card into the green slot with the blinking light and arrow. Make sure you insert the card correctly, with the chip facing inwards and the magnetic stripe downwards, as it contains encrypted information that the card reader will send to the server.

Step 2: An option appears for different transactions, after displaying the card details in the screen . Select the option for cash withdrawal from the available options.

Step 3: Choose the type of account you have, whether it is a savings account or a current account. Some ATMs like SBI ask you to enter a number between 0 and 99.

Step 4: Enter the amount you wish to withdraw from the ATM. Different banks have different cash withdrawal limits for daily transactions through ATMs or amounts that you can withdraw at one transaction. You can enter the amount to be withdrawn from the number keyboard given near the cash dispenser or the touchscreen keyboard, depending on the ATM.

Step 5: Enter the 4-digit ATM PIN that you have set for ATM transactions. You can enter the PIN either from the number keyboard or the touchscreen keyboard.

Step 6: If the PIN is correct, the cash dispenser will dispense the cash amount you wanted to withdraw. You will then be given the option to print a receipt of the transaction on paper or not.

Step 7: After the withdrawal, press ‘Cancel’ or ‘Cross’ from the keyboard to log out of your bank ATM account. The card reader’s light will blink again, indicating that you can insert a new card for a new transaction.

It’s important to note that some of these steps, such as choosing the type of account, PIN details, and the amount you wish to withdraw, may differ in sequence depending on the ATM and bank you use.

Also, most banks offer a few free transactions before charging a small fee for ATM withdrawals. Overall, withdrawing money from an ATM is easy and hassle-free if you follow the steps explained above, you will able to withdraw money without any complexity.

Types of Automated Teller Machines (ATM)

You can categorize ATMs by their location as onsite or offsite.

What are onsite ATMs?

Onsite ATMs are located within or close to bank branches and offer convenient access to banking services such as cash withdrawals, deposits, transfers, and balance inquiries. They are available during bank hours and typically free or low-cost for customers, depending on their account type and banking relationship with the institution. Onsite ATMs are an essential part of modern banking, providing customers with fast and secure banking services.

What are Offsite ATMs?

Offsite ATMs are located outside of bank branches and offer easy access to banking services such as cash withdrawals, deposits, transfers, and balance inquiries. One can typically find them in public places, and they operate 24/7. However, fees may be higher, especially for non-customers. Despite this, they are a popular choice for people looking for convenient and quick banking services.

In addition to this, we categorize ATMs based on different criteria, which include:

- Green Label: These ATMs facilitate agricultural-related transactions.

- White Label: Non-Bank Entities operate these ATMs but brand them under a bank’s name.

- Brown Label: These outsourced ATMs are managed by a sponsor bank.

- Yellow Label: Public Sectors Banks of India own and operate these ATMs.

- Orange Label: Both Non-Banking Entities and Sponsorship Banks own and operate these ATMs in a partnership way. Also, it is used for share transactions.

- Pink Label: To avoid waiting in long queues, women can use these specially designed ATMs

- Red Label: To provide interbank transactions, different banks share networks using these ATMs.

Each type of ATM with its labels represents a specific category of ATMs that offer unique services and benefits to customers.

Summary of an ATM

The ease and accessibility provided by Automated Teller Machines have revolutionized banking by allowing people to withdraw, transfer, and check their balances with just a few simple steps. Even if you hold an account in any other bank, you can access any ATM across the country at any time. This technology has not only made banking more convenient for customers but has also lightened the workload of bank officials. All in all, ATMs have become a crucial part of our daily lives, making money transactions hassle-free and easily accessible.

Don’t miss out on our Upcoming Master-Class on Stocks Option Strategy with Implied Volatility.

Register now and take your Trading game to the next level. *Click Here To Register*

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.