In the Stock Market Today, Nifty hits 22,600 as Sensex rises 268 points; realty and FMCG sectors each up 1%.

Stock Market Nifty Chart Prediction.

On May 22, Sensex climbed 267.75 points, to reach 74,221.06, while the Nifty gained 68.80 points, closing at 22,597.80.

Top Nifty gainers: Cipla, HUL, Tata Consumer Products, HUL, Coal India and Britannia Industries

Top Nifty Losers: SBI, Hindalco Industries, Shriram Finance, Hero MotoCorp and Apollo Hospitals.

Among sectoral, Realty and FMCG sectors each saw a 1 percent increase, while capital goods, IT, and media sectors each rose by 0.5 percent. Conversely, the bank index fell by 0.5 percent, and the metal index dropped by 0.4 percent.

BSE midcap index closed flat, while the smallcap index rose by 0.2%

Stock Prediction for 23rd May 2024.

| STOCK | Good Above | Weak Below |

| BRITANNIA | 5292 | 5225 |

| ITC | 441 | 436 |

| GODREJPROP | 2836 | 2790 |

| JSWSTEEL | 923 | 908 |

Prediction For Thursday, NIFTY can go up if it goes above 22,700 or down after the level of 22,500 but all depends upon the Global cues.

Nifty maintains its bullish trend, with support at 22,500. The index is advancing within an upward channel, and this strength is expected to continue as long as it remains above 22,500. On the upside, resistance is noted between 22,700 and 22,800, while the support zone ranges from 22,500 to 22,300.

| Highest Call Writing at | 22,700 (59.9 Lakhs) |

| Highest Put Writing at | 22,500 (80.3 Lakhs) |

Nifty Support and Resistance

| Support | 22,500, 22,300 |

| Resistance | 22,700, 22,800 |

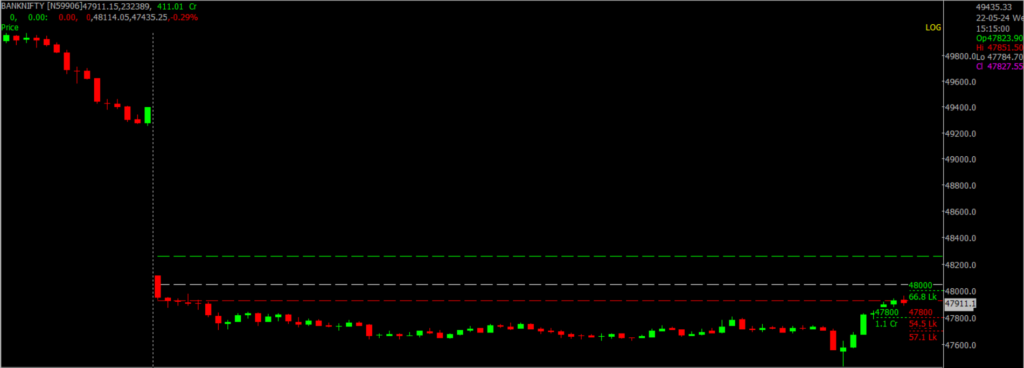

Bank Nifty Daily Chart Prediction.

Prediction For Thursday, Bank NIFTY can go up if it goes above 48,000 or down after the level of 47,800 but it all depends upon the Global cues.

Bank Nifty was trading at 47,781.95, down 0.55%. Today, it fluctuated between 48,114.05 and 47,435.25. By the end of the day, Bank Nifty closed at 48,048.2, marking a 0.32% decline from its previous close. Resistance is seen between 48,000 and 48,300, with support ranging from 47,800 to 47,500.

| Highest Call Writing at | 48,000 (1.1 Crore) |

| Highest Put Writing at | 47,800 (54.5 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47,800, 47,500 |

| Resistance | 48,000, 48,300 |

Click here to learn the Stocks to Watch as Tensions Between Israel and Iran Escalates.

New Options Trading Software by Spider is here, Try GChart demo for free. Register Now

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.