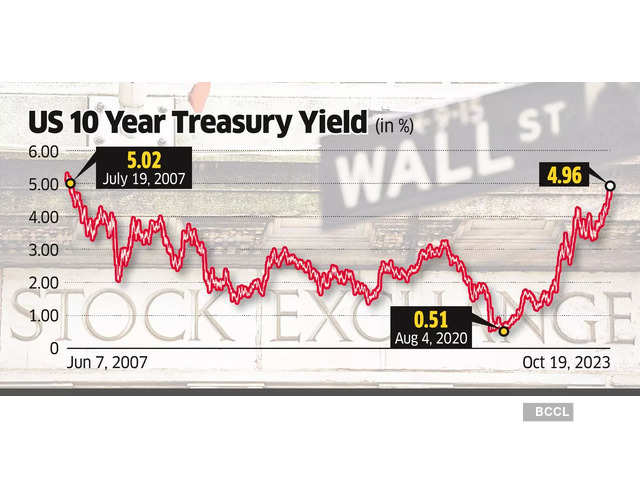

Amid the highest US bond yields since 2007, the unusual simultaneous rise in gold and crude prices is attributed to escalating global geopolitical uncertainties.

The unexpected surge in US benchmark 10-year bond yields has the potential to overshadow riskier assets like equities, currencies, and commodities worldwide, with many analysts viewing US treasuries as an attractive and secure investment option, offering approximately 5 percent returns, which might lead investors to shift allocations from other asset classes into US bonds. This prospect concerns market participants who fear that a prolonged increase in US bond yields could prompt capital outflows from global markets, particularly emerging markets like India, as investors seek higher and more secure returns.

Why the sudden surge?

Yields on the US benchmark 10-year bonds have consistently risen over the past week, surpassing the 5 percent mark, which is the highest level since 2007. Brokerage firm Emkay Institutional Equities attributes the increase in US bond yields to three major factors. First, there has been an increase in the supply of bonds in recent quarters due to the high deficit in the US. When the government borrows more money, investors demand a higher premium to lend that money, thereby raising yields on the bonds.

Second, the yields on US 10-year bonds were already at elevated levels before the recent surge, as the market was pricing in higher interest rates for a longer tenure, with inflation not decreasing as quickly as expected and fresh concerns about persistent price increases keeping investors worried. Thus, the recent surge in yields pushed them to levels last seen in 2007.

Third, the Federal Reserve’s optimism about achieving a soft landing has raised concerns that the central bank will continue its rate hike campaign until inflation cools down to the targeted level of two percent in the US. Additionally, other factors, including the spike in oil prices and heightened geopolitical concerns due to the Israel-Hamas crisis, are also contributing to the rise in bond yields.

How it will impact Indian equities

The increasing US bond yields present a clear drawback for equities, particularly in emerging markets like India, as it diminishes the appeal of investing in these markets when factoring in currency adjustments.

In line with this trend, foreign institutional investors (FIIs) have been selling local equities, with net sales amounting to Rs 13,412 crore this month. This follows two consecutive months of net selling by FIIs, where they offloaded local equities worth Rs 47,313 crore. Many market participants are concerned that a prolonged rise in US bond yields could negatively impact domestic equities, potentially intensifying FII selling.

The impact of rising US bond yields has already affected domestic equities, as both key benchmarks, the Nifty 50 and the Sensex, experienced declines for the sixth consecutive session on October 26, with the Nifty even slipping below the 19,000 mark.

“Increasing interest rates are inherently unfavorable for equity markets. With US government bonds providing a 5 percent return in dollars, the required return for equities significantly rises when factoring in risk premium and currency hedging,” Risk premium is the additional return that investors anticipate when opting for riskier assets such as emerging market stocks.

An Opportunity to Learn Live Trading and Training on Monthly Expiry by Clicking Here

Also check out the Upcoming IPO’s.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.