In Stock Market Today, Nifty and Sensex edge up in a choppy market, led by gains in auto, power, and pharma sectors.

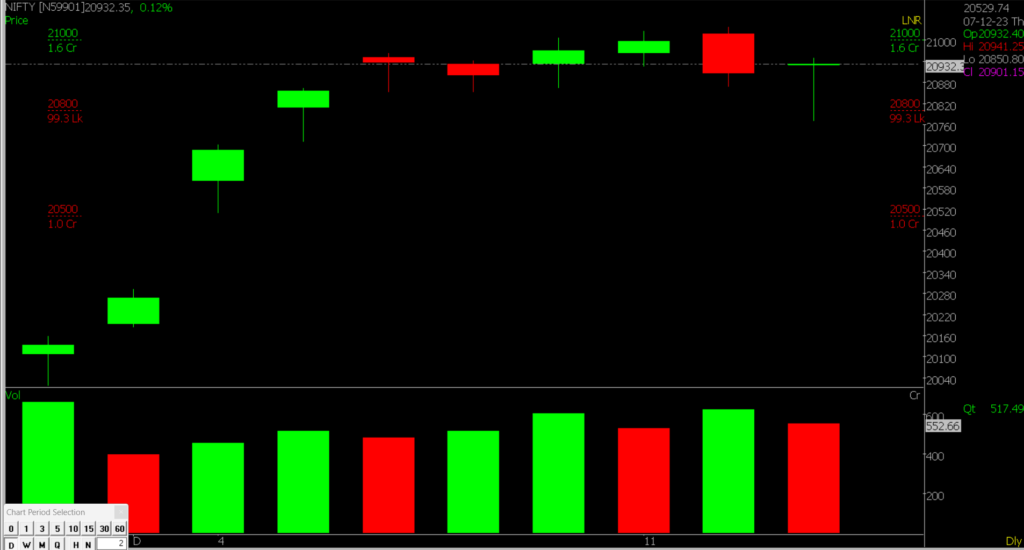

Stock Market Nifty Chart Prediction.

In the Stock Market Today, the main stock market indicators concluded with minimal changes, and the Nifty remained above 20,900.

At the closing bell, the Sensex increased by 33.57 points (0.05 percent) to 69,584.60, and the Nifty went up by 19.90 points (0.10 percent) to 20,926.30. Among the total stocks, 2087 went up, 1553 went down, and 111 remained unchanged.

Top Performance Stocks in Nifty were:

- NTPC

- Hero MotoCorp

- Power Grid Corporation

- Eicher Motors

- Adani Ports

Top Loser Stocks in Nifty were:

- TCS

- Infosys

- Bajaj Finserv

- HDFC Life

- Axis Bank

In various sectors, there were gains of 1 percent each in auto, power, pharma, capital goods, and realty, while the Information Technology sector saw a 1 percent decline.

The BSE midcap index increased by 1 percent, and the smallcap index added 0.7 percent.

Prediction For Thursday NIFTY can go up if it goes above 21000 or down after the level of 20800 but all depends upon the Global cues.

In Stock Market today, the day began with Nifty staying steady, but it faced ups and downs during trading. It saw a sudden drop and a quick rise, ending the day with about 26 points in gains. The fact that people bought during the dip suggests interest in buying at lower prices. Looking at the hourly momentum indicator, it’s about to show a positive change, possibly starting a new upward trend. The immediate challenge for Nifty is around 21,000–21,050, and once it crosses that, it might quickly go up to 21,202–21,447. On the downside, today’s lowest point of 20,800 is an important support from a short-term perspective, If breaks it then will go till 20500.

| Highest Call Writing at | 21000 (1.6 Crores) |

| Highest Put Writing at | 20500 (1.0 Crores) |

Nifty Support and Resistance

| Support | 20800, 20500 |

| Resistance | 21000, 20200 |

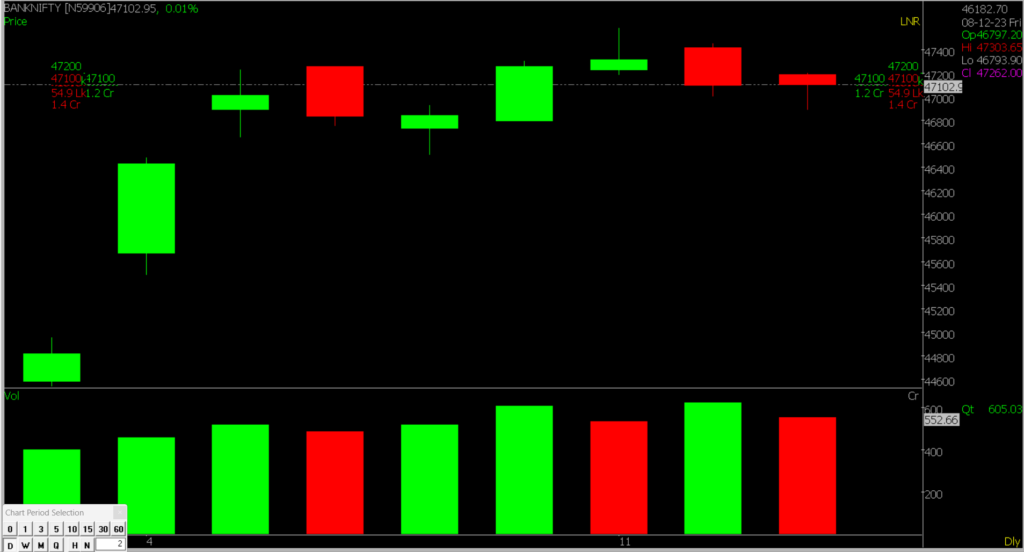

Bank Nifty Daily Chart Prediction

Prediction For Thursday Bank NIFTY can go up if it goes above 47200 or down after the level of 47000 but it all depends upon the Global cues.

Bank Nifty index demonstrated strength by maintaining its hold above the crucial support of 46800. It rebounded sharply from lower levels, affirming resilience. Sustaining and advancing the upward momentum now hinges on the index staying above 47200. A decisive closure above the active call writers’ zone at 47200 could initiate further gains, targeting levels of 47500/48000 in the upcoming period. Starting positively, Bank Nifty faced profit booking at higher levels, ultimately closing in the negative. Currently, it’s in a consolidation phase expected to span between 47,000 and 47,100 in the coming trading sessions

| Highest Call Writing at | 47200 (55.4 Lakhs) |

| Highest Put Writing at | 47000 (1.4 Crores) |

Bank Nifty Support and Resistance

| Support | 47100, 47000 |

| Resistance | 47100, 47200 |

Also, check our Article on the most common Indicators used in Swing Trading.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.