In today’s stock market: the Nifty closes over 21,150, and the Sensex is up 929 points, with IT and realty stocks leading.

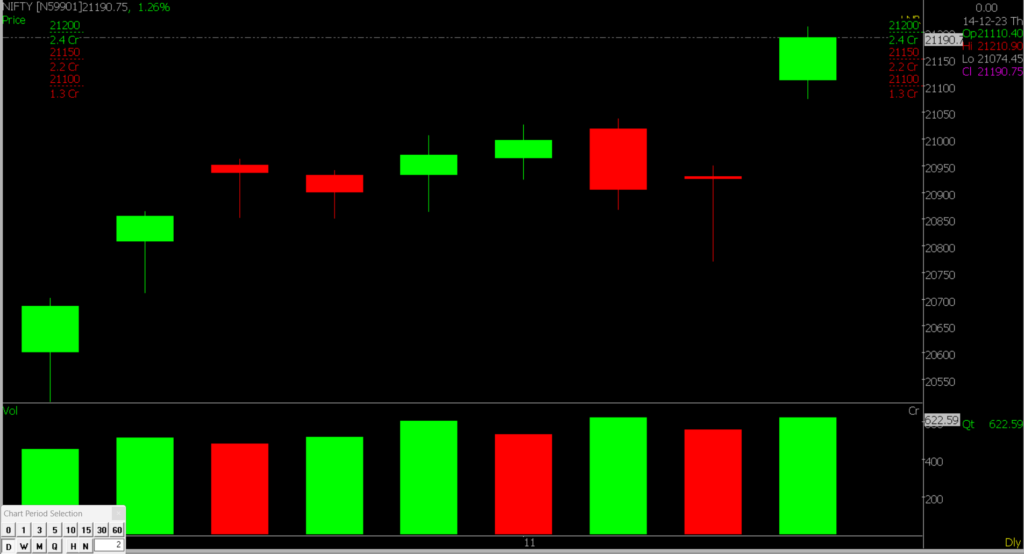

Stock Market Nifty Chart Prediction.

The optimistic outlook from the US Federal Reserve for 2024, hinting at potential rate cuts, brought joy to investors. By the closing bell, the Nifty rose by 256.40 points (1.23%), closing at 21,182.70, and the Sensex gained 929.60 points (1.34%), reaching 70,514.20. Market breadth favored gainers, with 1,851 stocks advancing, 1,363 declining, and 86 remaining unchanged.

BSE-listed companies’ market capitalization hit a record high of Rs 355 lakh crore, mirroring the overall record high for all listed companies. Notably, 19 Nifty stocks reached 52-week or multi-year highs on December 14 that is Today.

Top Nifty Gainers included:

- Tech Mahindra

- LTI Mindtree

- Wipro

- Infosys

- HCL Technologies.

Realty stocks, especially Godrej Properties and DLF, surged up to 7 percent amid expectations of rate cuts.

Top Nifty Losers included:

- Powergrid

- Hdfclife

- Nestleind

- Cipla

- Jswsteel

Prediction For Friday NIFTY can go up if it goes above 21200 or down after the level of 21150 but all depends upon the Global cues.

Today’s stock market saw a 1% gain, driven by positive global cues, particularly from strong US markets. Nifty started strong, closing at 21,182.70, with expectations to reach 21,500 influenced by resilient US indices. The focus is advised on banking & IT majors, and caution is urged in other sectors due to overbought conditions in midcap and smallcap stocks. The breakout in Nifty, fueled by increased long positions, signals a positive sentiment. Key support lies at 21,150-21,100, and there’s potential for Nifty to surpass 21,200 upon breaking the resistance.

| Highest Call Writing at | 21200 (2.4 Crores) |

| Highest Put Writing at | 21150 (2.2 Crores) |

Nifty Support and Resistance

| Support | 21150, 21100 |

| Resistance | 21200, 21500 |

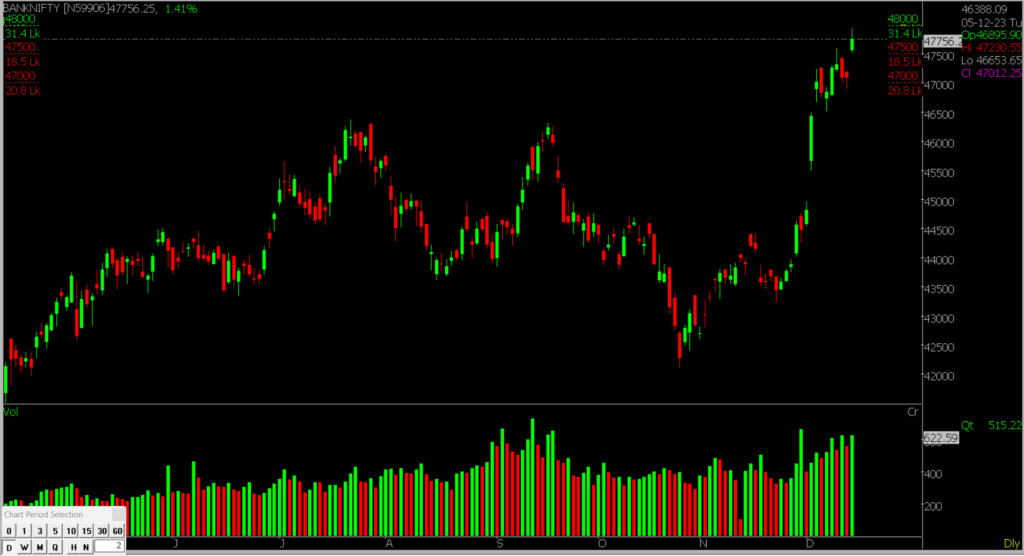

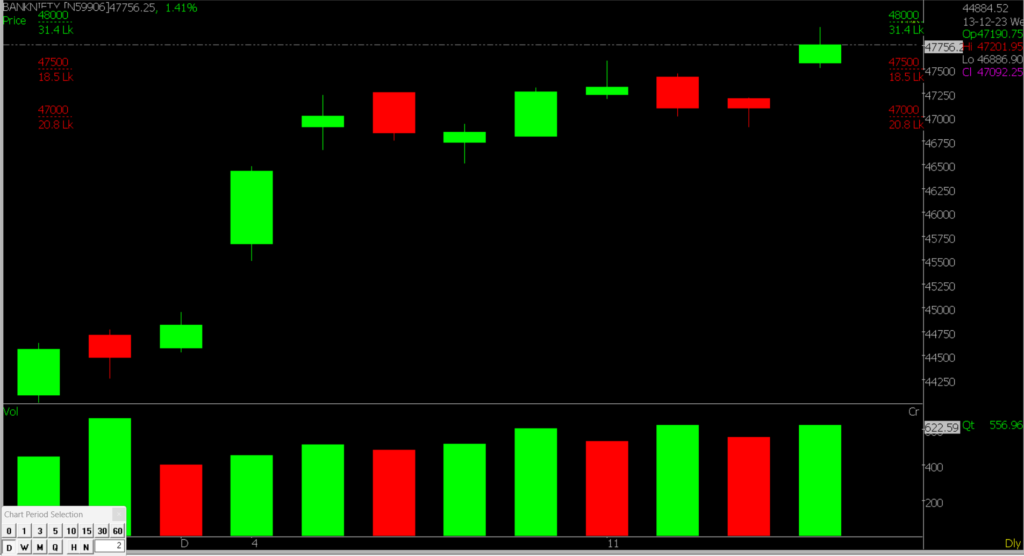

Bank Nifty Daily Chart Prediction

Prediction For Friday Bank NIFTY can go up if it goes above 48000 or down after the level of 47500 but it all depends upon the Global cues.

The Bank Nifty opened with a gap up, influenced by the strong performance of the US market. It showed strength compared to Nifty and both followed a similar consolidation channel throughout the day. The Bank Nifty closed above its crucial support at 47,500, and a break below this level could lead to a potential decline to 47,000. The major resistance lies at 48,000, and a breakthrough could propel it to 48,100. However, the outcome depends on global cues.

| Highest Call Writing at | 48000 (31.4 Lakhs) |

| Highest Put Writing at | 47000 (20.8 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47500, 47000 |

| Resistance | 48000, 48100 |

Also, check our Article on the Top Traded Strategies used in Bank Nifty.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.