In Stock Market Today, Bulls drive Sensex up by 969 points, Nifty surpasses 21,400; Bank Nifty hits 48,000.

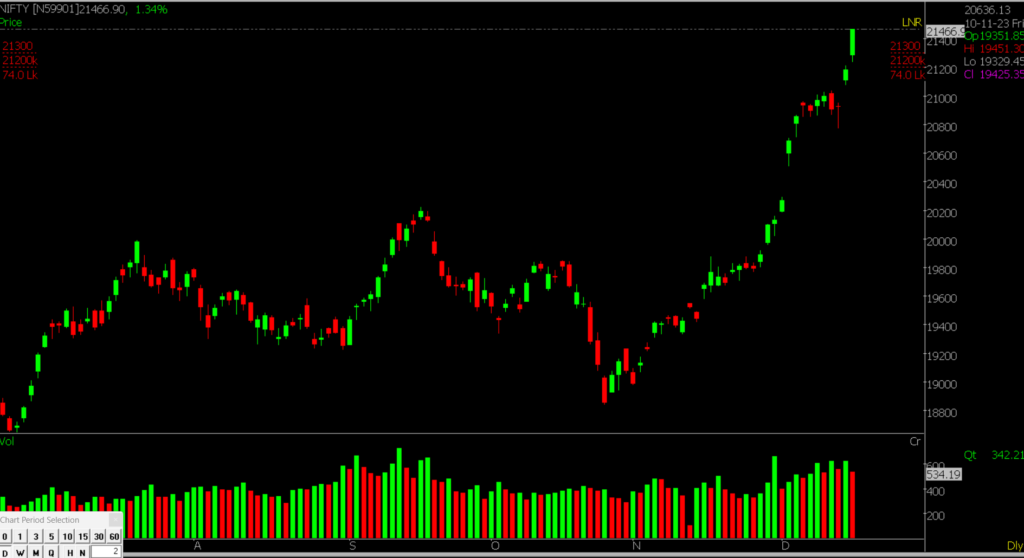

Stock Market Nifty Chart Prediction.

The stock market saw record highs for the second consecutive day, with Sensex and Nifty experiencing widespread buying and following a global rally triggered by the Fed. Nifty Metal and IT sectors were the top gainers, each rising by 1%.

Analyst VK Vijaykumar from Geojit Financial suggests that the market is likely to consolidate after a strong start this month, driven by positive news and buy-on-dips strategy. The sharp dip in the US bond yield is attracting significant capital flows to emerging markets like India. While large-cap financials and IT sectors remain favored, retail enthusiasm is keeping the broader market resilient, but caution is advised due to potential overvaluations.

Stock Prediction for 18th Dec 2023

1) COAL INDIA: Good Above 352, Weak Below: 346

2) SBICARD: Good Above 778, Weak Below 770

3) SRF: Good Above 2460, Weak Below 2426

4) VOLTAS: Good Above 863, Weak Below 855

Prediction For Monday NIFTY can go up if it goes above 21550 or down after the level of 21300 but all depends upon the Global cues.

Nifty continued its upward momentum, closing near the day’s high with a strong surge in the final hour, almost hitting 21,500 and ending at 21,449.60, a gain of 1.26%. Notably, the IT sector excelled, while metal & energy sectors recorded solid gains. Small-cap stocks also joined the positive movement, securing over half a percent increase. A potential pause is expected after the recent climb, with support likely around the 21,300-21,200 range. If the market opens higher and breaks the resistance at 21,500-21,550, there’s an anticipation of reaching a new milestone of 22,000. Banking and IT majors remain strong contributors.

| Highest Call Writing at | 21550 |

| Highest Put Writing at | 21300 (96.6 Lakh) |

Nifty Support and Resistance

| Support | 21300, 21200 |

| Resistance | 21550 |

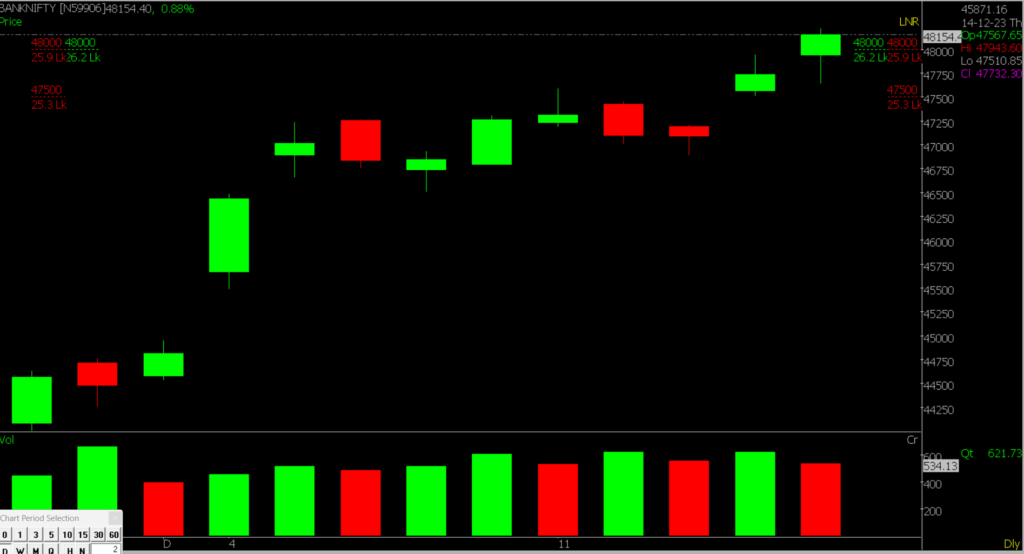

Bank Nifty Daily Chart Prediction

Prediction For Monday Bank NIFTY can go up if it goes above 48500 or down after the level of 47500 but it all depends upon the Global cues.

Bank Nifty bulls are keeping up their impressive run, driving the index past the 48,000 mark. The overall market mood is positive, with a strong support base at 47,500. If it breaks this then might fall downward. Although, there’s a speculation that the index is expected to continue its upward trajectory, with a potential target of 48500-49000, signaling sustained confidence among market players.

| Highest Call Writing at | 48500 (26.2 Lakhs) |

| Highest Put Writing at | 47500 (25.3 Lakhs) |

Bank Nifty Support and Resistance

| Support | 48000, 47500 |

| Resistance | 48500, 49000 |

Also, check our Article on the Top Traded Strategies used in Bank Nifty.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.