As the savings account is used for saving the money in the bank, Demat account is used to Hold our shares and other securities in the stock market.

Introduction to Demat Account

Traders used to use physical certificate for trading in Stock Market in the early 90’s which resulted in problems like paperwork, loss, and theft.

To address the challenges of physical certificates in the early 1990s, NSDL and CDSL were established, allowing investors to hold and trade securities electronically.

This led to the introduction of Demat Accounts which transformed the Indian stock market making it accessible, efficient, and secure.

Currently, millions of investors use Demat Accounts to trade various securities (Shares), contributing to the growth of the Indian economy.

What is Demat Account?

A Demat Account is a dematerialized account which means not in a material format. In other words, whatever shares, stocks, bonds, and other financial securities you have are in an electronic form rather than a ‘material’ or hard copy form.

Demat Account securities are:

1. Equity Shares

2. E-Gold

3. Bonds

4. Government Securities

5. IPOs

6. Exchange Traded Funds

7. Non Convertible Debentures

8. Mutual Funds

It is same as the bank account that you have in which you can view all your statements related to transactions, your credit, and debit, available funds, and where one can maintain all the finances electronically.

Maintaining Demat Account does not require minimum value holdings.

Even if an investor holds a small number of securities, they can still open and maintain a Demat Account without any minimum balance requirement.

However, some DPs may charge a fee for maintaining the account.

Even if the balance is Zero in your account you can still open it and that can be accessible for a lifetime.

How to open a Demat Account?

To start trading in the stock market, you need three accounts:

1. Bank account,

2. Demat account,

3. Trading account.

A Demat Account holds your securities, while a trading account allows you to buy and sell stocks, commodities, derivatives, and e-gold.

Managing three accounts can be inconvenient, so you can opt for a three-in-one account that combines all three accounts.

This way, you can save time and never miss out on a good trading opportunity.

Essentials for Opening Demat Account

The essential things you require for Demat Accounts are:

1. Account opening form: The initial form to open a Demat Account requires personal and contact information, bank account details, and the chosen depository participant (DP).

2. Unique Demat account number (UAN): The depository assigns a unique 16-digit number to each Demat Account, which serves as a reference for all future transactions and holdings.

3. Depository participant (DP): The depository authorises to offer Demat Account services to invest called as DP which is a financial institution.

4. Dematerialization request form (DRF): To transfer physical securities into an electronic format and move them to the Demat Account, one needs to use a DRF.

5. Security transactions: Investors can buy and sell securities, such as stocks, bonds, and mutual funds, using the account, through the account.

6. Annual maintenance charges (AMC): DPs may charge an annual fee to maintain the Demat Account, which may vary based on the value of holdings and services provided.

Overall a Demat Account eliminates the need for physical certificates and paperwork, and is a convenient and secure way to hold and trade securities in electronic form.

Other functions in Demat Account

Apart from holding and trading securities, a Demat Account provides various other functions and facilities, such as:

1. Initial public offerings (IPOs): Investors can apply for IPOs directly through their Demat Account and receive allotted shares credited to their account.

2. Bonus and rights issues: The Demat Account automatically receives the shares issued through bonus and rights issues.

3. Dividend payments: Companies directly credit dividends declared to the Demat Account, removing the requirement for physical cheques.

4. Online access: Investors can access their Demat Account online to view holdings, transactions, and account statements dependent.

5. Pledging of securities: If need any loans against securities then they can get the loan against the holdings in their Demat Account as Collateral.

6. Nomination facility: In the case of a Nomination facility an investor can nominate any person close to them and that person can avail all the holdings of the investors in case of their demise.

Overall, a Demat Account offers a range of facilities and conveniences beyond holding and trading fan securities, making it an essential tool for investors in the modern financial landscape.

Different Types of Demat Accounts

A Person can open three types of Demat Accounts in India depending on their residential status.

1. Regular Demat Account: All Indian investors can open a regular Demat Account with any depository participant of their choice. It is a basic type of account that provides essential facilities such as holding and trading securities, but it doesn’t offer extra features like international fund transfer.

2. Repatriable Demat account: NRI individuals who do not hold a Non-Resident Rupee Account (NRE) can open this type of account. International fund transfer is available in this account.

3. Non-repatriable Demat account: Non-Resident Indians (NRIs) with a Non-Resident Ordinary Rupee (NRO) account can open this type of Demat Account. However, this type of account does not permit the international transfer of funds.

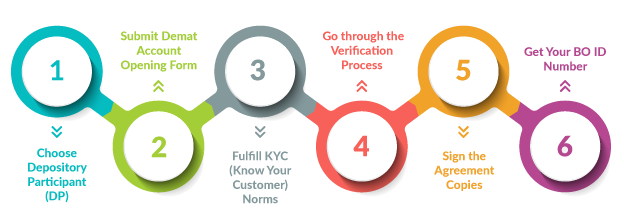

Steps to Open a Demat Account

There are two ways to open a Demat Account: offline and online.

Demat Account in the offline method:

- Select a Depository Participant (DP) based on your requirements and preferences.

- Fill out an application form with your details and submit a list of KYC documents such as Identity Proof, Address Proof, PAN card, and Bank details.

- The DP will conduct an in-person verification of your KYC documents and explain the rules and regulations associated with holding a Demat Account. You will have to pay a fee, which varies from DP to DP.

- After completing the verification and formalities, the depository participant will open your new Demat Account and assign a Unique Identification Number for your account.

Demat Account in the Online method:

Opening a Demat Account online is a convenient option. Follow these steps to open a Demat Account online:

- Visit the official website of your chosen Broker.

- Fill in a lead form with your name, phone number, and city of residence, and then enter the OTP received on your registered mobile number.

- Provide your KYC details, including your date of birth, PAN card details, contact details, and bank account details.

- The depository participant will send you the details of your demat account, including the account number, through email and mobile after opening it.

Accepted KYC documents for Demat Account

- Proof of identity: passport, driver’s license, voter’s ID, PAN card, etc.

- Proof of address: Voter’s ID, passport, driving license, bank statement, etc

Key Takeaways

- For trading and investing in stock market, it is necessary to have a Demat Account.

- When opening a Demat Account, it’s important to select a Depository Participant (DP) that suits your needs, fill out the application form with required KYC documents, complete the verification process, and pay any necessary fees.

- The DP will then open the account, and you will receive a unique identification number.

- It’s also important to note that an investor can have multiple Demat Accounts, as long as they provide the required KYC details for all applications.

- Non-resident Indians can also open a Demat Account but with certain restrictions under SEBI.

- Additionally, it’s essential to provide proof of identity and proof of address when opening a Demat Account, and the accepted documents for these proofs are provided by the DP.

Click Here to know How To Add Nominee to Your Demat Account on Different Platform

Don’t miss out on our Free Webinar on Creating & Preserving Wealth for Investors.

Register now and take your stock market game to the next level. *Click Here To Register*

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.