SIPs can be a great way to start investing and create wealth over the long term, especially if you are a new investor or want to invest regularly without worrying about timing the market.

What is SIP?

A systematic investment plan (SIP) is an investment strategy that allows investors to regularly invest a fixed amount of money at predetermined intervals, typically monthly, in a mutual fund or exchange-traded fund (ETF). With SIPs, investors can establish an automated investment plan where a fixed sum of money is debited from their bank account every month and invested in the chosen mutual fund or ETF.

SIPs offer several advantages, such as disciplined investing, the power of compounding, and rupee-cost averaging. They are a popular investment option in India, where mutual fund companies offer them as a way for investors to invest in equity or debt instruments, irrespective of market conditions.

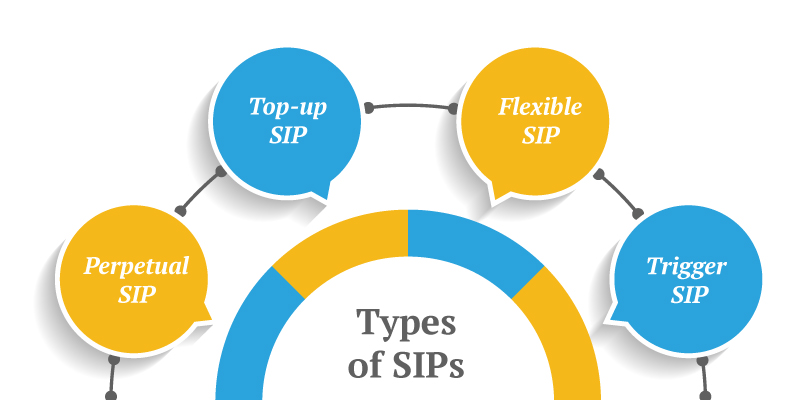

Types of systematic investment plan

Perpetual SIP: It is an open-ended investment option where investors can invest for an indefinite period.

Top-up SIP: This involves increasing the investment amount at regular intervals and is suitable for investors who want to increase their investment amount periodically.

Flexible SIP: This type of SIP allows the investor to increase or decrease the amount of investment depending on the market conditions or financial situation.

Trigger SIP: Here, the investment amount is triggered based on market conditions or fund performance. For example, if the NAV of the fund falls below a certain level, the investor can choose to increase their investment amount

How does an SIP work?

Choose a mutual fund or ETF: The first step is to choose a mutual fund or ETF based on your investment goals, risk tolerance, and investment horizon. You can research various funds and compare their performance, fees, and other factors before making a decision.

Determine the investment amount: Next, decide on the fixed amount of money you want to invest every month. The amount can vary based on your budget and investment goals. Many fund companies allow investments as low as Rs. 500 per month.

Set up the SIP: Once you have selected the mutual fund or ETF and determined the investment amount, you can set up the SIP by providing your bank details and selecting the investment date. The fund company will then automatically deduct the investment amount from your bank account on the specified date every month and invest it in the selected fund.

Monitor your investments: You can monitor your SIP investments through your mutual fund or ETF account. You will receive regular updates on the fund’s performance and the value of your investment.

Make changes if necessary: You can make changes to your SIP, such as increasing or decreasing the investment amount, pausing or stopping the SIP, or switching to a different fund, depending on your investment goals and market conditions.

Why start an SIP ?

Disciplined investing: SIPs encourage disciplined investing by making it easy to invest a fixed amount of money at regular intervals. This helps develop a habit of saving and investing regularly.

Power of compounding: SIPs allow you to benefit from the power of compounding, which means earning interest on both the principal amount and the accumulated interest. Over time, compounding can result in significant wealth creation.

Rupee-cost averaging: SIPs follow the rupee-cost averaging approach, which involves investing a fixed amount of money at regular intervals regardless of market conditions. This helps average out the cost of investment, resulting in lower average purchase prices and potentially higher returns over time.

Long-term wealth creation: SIPs are a long-term investment option and can be ideal for investors looking to create wealth over a period of time. They enable you to invest regularly, regardless of market conditions, and take advantage of the power of compounding to build wealth.

Advantages of SIP

Flexibility: SIPs offer flexibility in terms of investment amount and duration. Investors can start with as little as Rs. 500 per month and choose the investment period based on their financial goals.

Professional management: SIPs are managed by professional fund managers who have expertise in selecting and managing investments, which helps to reduce the risk of losses due to market fluctuations.

Transparency: SIPs provide regular updates on the fund’s performance and the value of the investor’s investment, which helps them to monitor their investments and make informed decisions.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.