The Spinning Top Candlestick signifies market indecision with a brief central body flanked by long upper and lower shadows, suggesting potential price reversals.

What is a Spinning Top Candlestick?

A spinning top is a candlestick pattern showing uncertainty in the market. It features a short central body and long upper and lower shadows, indicating a lack of dominance by either buyers or sellers.

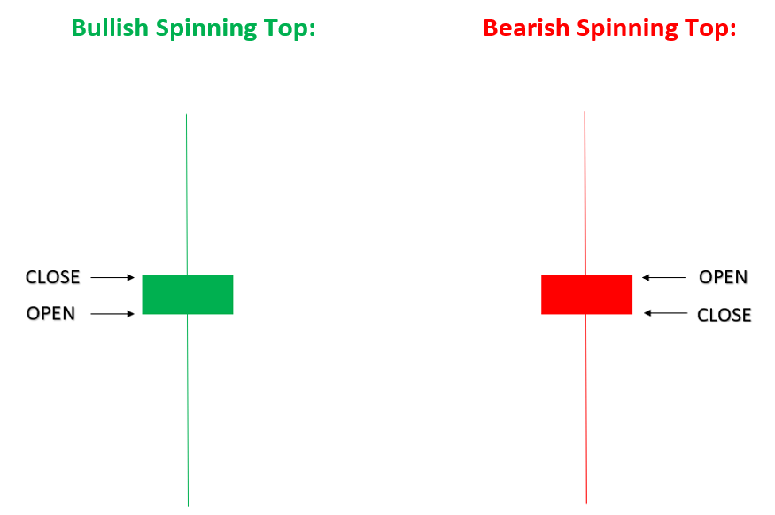

This pattern forms when buyers and sellers are active during a certain period, but the closing price ends near the opening price. After a significant price move, a spinning top could signal a potential reversal, particularly if the following candle confirms it. A spinning top typically has opening and closing prices close to each other.

If the spinning top occurs at the top of an uptrend, it could suggest a bearish reversal. Conversely, if the spinning top occurs at the bottom of a downtrend, it could signal that a bullish reversal may happen.

How the Spinning Top Candlestick Pattern is formed?

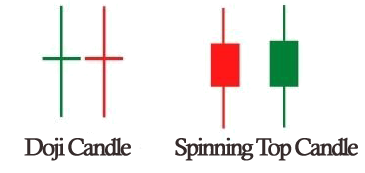

A Spinning Top candlestick indicates a standoff between buyers and sellers, leading to a close price near the open. It’s an easily recognizable pattern, signifying market indecision. Traders pushed prices up and down during the period, but it ended where it started. It’s similar to the Doji but has a larger candle body, implying more price movement during the period. This pattern doesn’t require much time to identify, making it a valuable tool in trading strategies.

How does the Spinning Top Candlestick Pattern help you?

Spinning tops are candlestick patterns that signify uncertainty in the market. They occur when the open and close prices are close together, with long upper and lower shadows. This indicates that although there was some back-and-forth between buyers and sellers, the price ultimately didn’t change much.

Spinning tops can suggest either continued sideways trading when found within an established trading range or a potential trend reversal if they follow a significant price move. It’s crucial to wait for confirmation from the next candle to interpret these patterns accurately. For a more reliable analysis, traders often combine spinning tops with other technical indicators or support and resistance levels.

The difference between Doji Candle and Spinning Top Candle

Dojis and Spinning tops share a common trait – they reflect market indecision. Unlike dojis, which have small bodies and short upper and lower shadows, spinning tops feature longer shadows. These patterns occur frequently and can serve as potential reversal signals following substantial price movements. However, it’s crucial to emphasize the importance of confirmation. The true direction of future prices becomes clearer with the movement in the subsequent candlestick, making it more significant than the doji or spinning top pattern by itself.

Difficulties of Trading when Spinning Top is formed

Spinning top candlestick patterns are frequent occurrences, often observed during times of uncertainty or when prices move sideways. However, it’s important to note that not all spinning tops lead to reversals, making it challenging to predict their outcomes. Successful trading around spinning tops can be tricky due to their wide price ranges, potentially leading to unfavorable risk-reward ratios. Moreover, spinning tops do not provide specific price targets or exit strategies, necessitating the use of other indicators or strategies for effective trade planning.

Bottom Line

The Spinning Top Candlestick Pattern signifies indecision in the market. It often requires confirmation for potential trend reversals. Trading with spinning tops can be challenging due to their large price range, leading to a high-risk, low-reward scenario. Effective exit strategies, indicators, and complementary techniques are essential for successful trading.

Also, we are back with our On-Demand “ZERO TO HERO” Trading Strategy Webinar. Click Here To Register!

Also, Check our Article on Strike Price in Options Trading.