In Stock market today Nifty dipped below 19,700 points, with the Sensex losing 551 points, as banks and power sectors declined, while the pharmaceutical sector showed strength.

Stock Market Nifty Chart Prediction.

On October 19, the benchmark indices closed lower for the second consecutive session, with Nifty slipping below the 19,650 mark.

At the close, the Sensex registered a decline of 247.78 points, equivalent to 0.38 percent, closing at 65,629.24. The Nifty, meanwhile, ended the day 46.40 points lower, marking a 0.24 percent drop, closing at 19,624.70. Among the total listed stocks, 1810 shares advanced, 1759 shares declined, and 129 shares remained unchanged.

Within the Nifty index, notable losers included Wipro, Tech Mahindra, UPL, Bharti Airtel, and Hindalco Industries, while gainers featured Bajaj Auto, LTIMindtree, Nestle India, Hero MotoCorp, and UltraTech Cement.

In terms of sectors, the banking, metal, power, realty, oil & gas, and pharma sectors saw declines ranging from 0.3 to 0.9 percent, while the auto index witnessed a 0.5 percent increase. The BSE Midcap and Smallcap indices concluded the session with minimal changes

Prediction For Friday NIFTY can go up if it goes above 19700 or go down after the level of 19600 but it all depends upon the Global cues.

Nifty started the day with a drop but managed to recover. However, a late sell-off pushed it into negative territory. Nifty seems to struggle around the 19,840-19,850 range and might head lower after a minor recovery. On the upside, it could face obstacles in the 19,650-19,700 range, while support might be found in the 19,600-19,500 range.

| Highest Call Writing at | 19,700 (1.6 crores) |

| Highest Put Writing at | 19,600 (2.4 crores) |

Nifty Support and Resistance

| Support | 19,600 & 19,500 |

| Resistance | 19,650 & 19,700 |

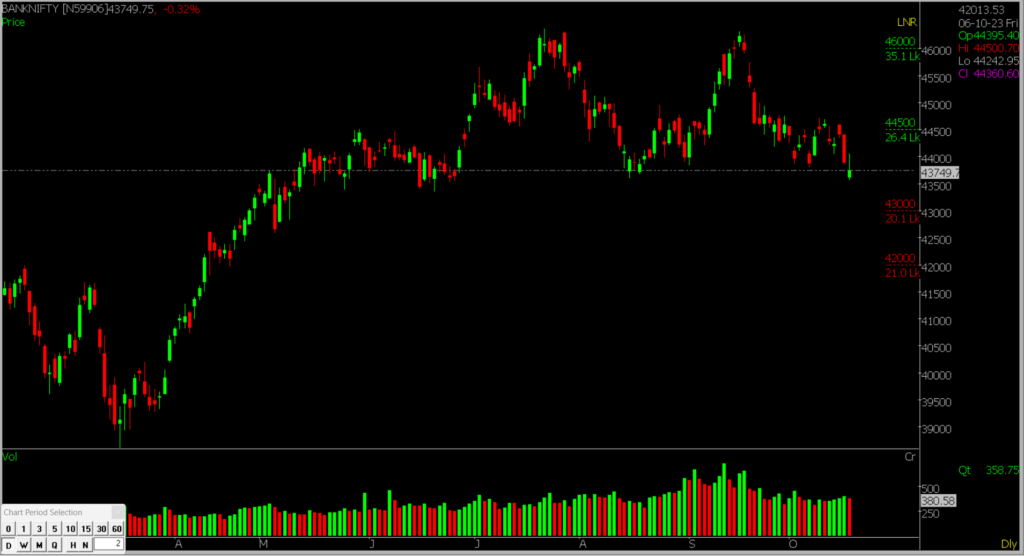

Bank Nifty Daily Chart Prediction

Prediction For Friday Bank NIFTY can go up if it goes above 44100 or go down after the level of 43000 but it all depends upon the Global cues.

The BANKNIFTY index, currently at 43,749.7 points, followed a pattern similar to Nifty. However, it experienced selling pressure later in the day, causing it to settle in the 43,860–43,749 range. Bank Nifty has the potential to bounce back, with resistance at 44,100, and if it surpasses this level, it could rise up to 44,500. Conversely, if it heads downward, it may find support at 43,000-42,500.

| Highest Call Writing at | 44500 (26.4Lakhs) |

| Highest Put Writing at | 43500 (21.1 Lakhs) |

Bank Nifty Support and Resistance

| Support | 43,000 & 42,500 |

| Resistance | 44,100 & 44,500 |

An Opportunity to Learn Live Trading and Training on Monthly Expiry by Clicking Here

Also check out the Upcoming IPO’s.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.