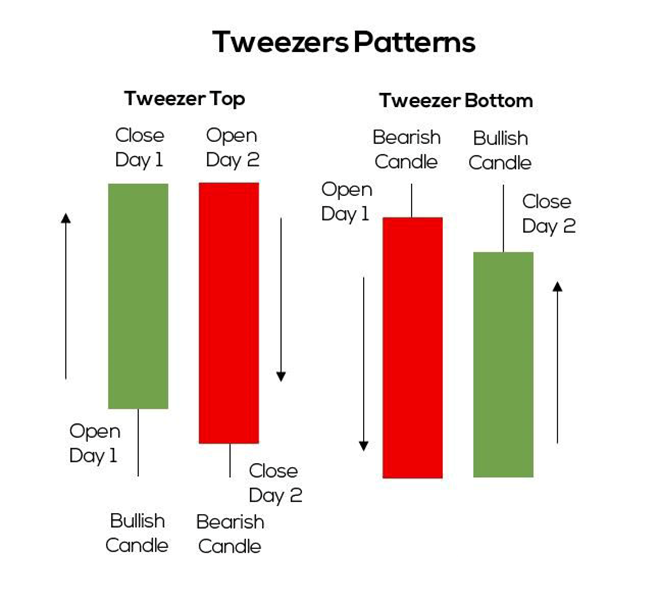

Tweezer candlestick patterns signal trend changes. Tweezer Top indicates a potential shift to bearish, while Tweezer Bottom suggests a shift to bullish.

Tweezer candlestick patterns are signals of trend reversals, showing when a trend might change direction. Tweezer Top suggests the trend could become bearish, while Tweezer Bottom hints it might become bullish.

Tweezer Top happens when the highs of two candles are nearly identical after the price has been going up.

Tweezer Bottom appears when the lows of two candles are almost the same after the price has been going down.

Tweezer Top

The Tweezer Top pattern signifies a potential shift in market sentiment from bullish to bearish and typically emerges at the conclusion of an upward trend. This pattern consists of two candlesticks, with the first being bullish and the second bearish. Both candles in the tweezer formation exhibit nearly identical heights.

Tweezer Bottom

The Tweezer Bottom candlestick pattern signals a potential shift from bearish to bullish sentiment, often appearing at the conclusion of a downtrend. This pattern comprises two candlesticks, with the first being bearish and the second bullish. Both candles in the tweezer formation exhibit nearly identical lows.

How to Identify Tweezer Top and Bottom Candlestick Patterns

To Identify Tweezer Top Candlestick Pattern

The Prior trend should be a Bullish

The initial day of the pattern formation should feature a bullish candlestick.

The following day should feature a bearish candlestick with a high matching that of the prior day.

To Identify Tweezer Bottom Candlestick Pattern

The Prior trend should be a Bearish

A bearish candlestick should be observed on the first day.

The subsequent day should reveal a bullish candlestick with a low matching that of the prior day.

What does the Tweezer Bottom Candlestick Pattern tell us?

When you see a Tweezer Bottom candlestick pattern, it means the trend before was downwards.

First, there’s a candlestick that shows the trend continuing down.

Then, the next day, there’s a candlestick that shows the price won’t go lower.

When the lowest points of these candles are almost the same, it means there’s strong support, and the trend might change to go upwards.

Because of this, buyers start buying more, pushing the price up. The next day, if there’s another candlestick going up, it confirms the trend change.

Conclusion

The Tweezer Top and Bottom candlestick patterns signify potential trend reversals, each consisting of two candlesticks. Tweezer Top suggests a bearish reversal, while Tweezer Bottom indicates a bullish reversal. When traders spot these patterns on charts, they should exercise caution as a reversal may be imminent. It’s advisable for traders to verify the presence of Tweezer candlestick patterns using other technical analysis indicators.

Also, check our Article on Difference Between Interim Budget and Union Budget 2024.

Join our Upcoming Trading Session on Nifty and Bank Nifty Streaming Live on YouTube. Click Here To Join.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.