Swing trading is a trading method where people buy & sell stocks over a few days or weeks to make money from price changes during that time. They try to benefit from both price increases & decreases.

What is Swing Trading ?

Swing trading is a strategy employed by traders to profit from price movements in the same direction as the prevailing trend. It involves buying or selling assets and holding them for a short to medium-term period, typically over a few days or weeks. The goal is to take advantage of price swings within the trend to generate gains in the market.

A swing low is when the price makes a low that is followed by two consecutive higher lows. On the other hand, a swing high is when the price makes a high followed by two consecutive lower highs.

Swing traders analyse market trends through technical analysis tools like chart patterns, candlestick patterns, trends, and potential trend reversals within a short timeframe.

It’s important to understand that swing trading is distinct from day trading. Day trading involves buying and selling stocks within the same day, while swing trading involves holding trading positions for a few days to a few weeks.

How Does Swing Trading Work ?

A swing trader likes to trade stocks that have a lot of activity and big price movements. They look for stocks that are popular and have been moving a lot in the past year. This way, they can try to make money by buying low and selling high when the stock goes up and down.

Find a Stock

It’s essential to understand the basics of the stocks you plan to invest in. Analysing the fundamentals of a stock will help you gain confidence in your swing trading decisions and increase your chances of achieving good returns in the short term.

Analyse the chart

Once you’ve selected a stock to trade, analyse its chart using different indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Volume, and Trend Lines. This historical performance analysis will give you insights into how the stock has behaved in the past. Additionally, reading news articles about the company and industry will help you understand potential factors that could influence its future performance.

Decide Your Entry

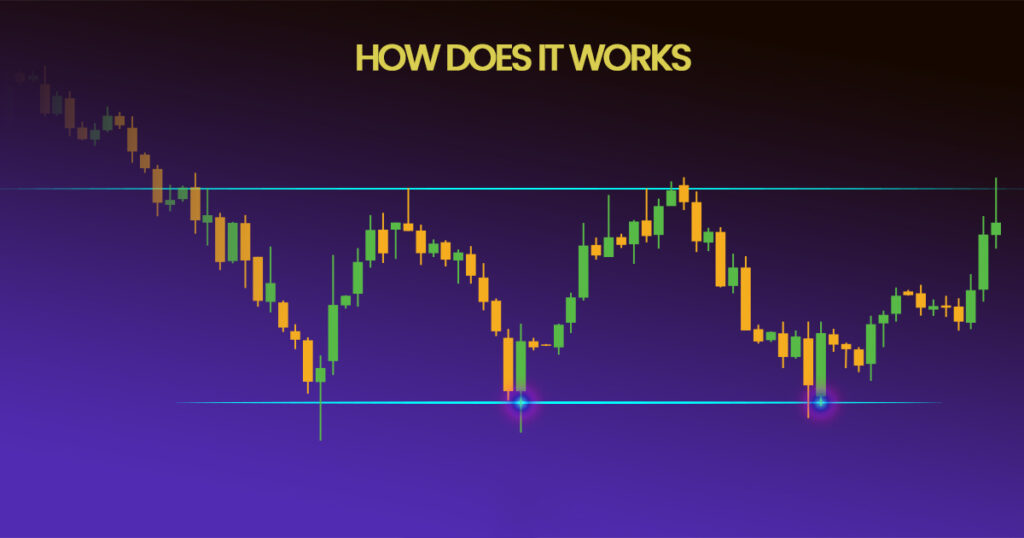

In swing trading, a common strategy involves placing a stop-loss order at 5% below the entry price and setting a target price at 20% above the entry price. where it tends to bounce off its support level and move upwards before dropping when it reaches its resistance level. A swing trader takes advantage of this movement by buying at the support level and selling at the resistance level.

Conclusion

Swing trading is a highly active trading method, involving holding positions for more than one day. It has gained popularity in the Indian market, with brokers offering convenient access from anywhere. Swing trading offers potential for significant leverage and returns, but it comes with inherent risks. Many traders end up losing their hard-earned money if they don’t grasp the ins and outs of swing trading. To avoid making costly mistakes, it’s crucial to understand the reasons, timing, and methods of swing trading thoroughly. By doing so, traders can mitigate risks and make more informed decisions to improve their chances of success.

Check out our live steam LIVE BANK NIFTY & NIFTY TRADING | ZERO TO HERO

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.