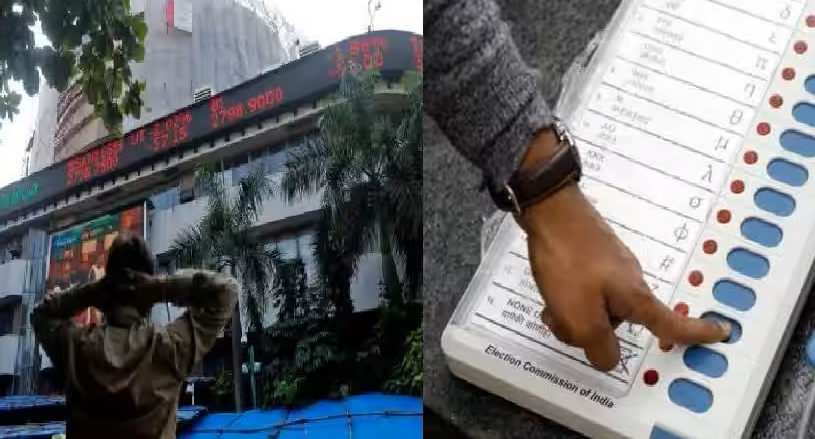

Karnataka’s outcome may not impact market sentiment if it aligns with exit poll predictions.

It’s hard to predict how Karnataka’s election results will impact the market due to factors like victory margin, investor reaction, and global economy. Historical election results impacted the market, especially if unexpected or causing a change in politics. Positive Karnataka election outcome may boost investor confidence and lead to a stock market rise. Conversely, a negative or uncertain result could lead to a decline in the market.

Numerous factors influence the stock market, including global economic conditions, company performance, and investor sentiment, among others. Election results may impact the market short-term, but other factors dictate the market’s long-term direction.

Karnataka legislative assembly election results 2023 Update:

Initial trends show Congress leading in 114 seats, BJP in 73, and Janata Dal (Secular) in 30 seats in the high-stakes Karnataka assembly elections held on May 10. Close election between BJP and INC, JD(S) as potential kingmaker in case of hung assembly.

Karnataka Election Resultinfluence on market sentiment:

It is likely that a Congress win in Karnataka may not have a significant impact on the domestic market sentiment. The current positive momentum of the market is mainly due to sustained capital inflow by foreign investors, in-line March quarter earnings, and healthy macroeconomic indicators. These factors are likely to have a greater influence on the market than the outcome of a single state election.

Political instability or unexpected election results could have a short-term impact on market sentiment. The market may also react differently depending on the margin of victory and the reaction of investors. The stock market is influenced by numerous factors, including global economic conditions, company performance, and investor sentiment, among others, making it challenging to predict with certainty how a single event will impact the market. Predictable Karnataka election results are unlikely to significantly impact domestic market sentiment.

Karnataka election results matching pre-poll predictions may not impact the market as it’s expected. “However, if there is a deviation from the exit poll projections, it could impact the market.

If the Congress wins decisively and can rule without the support of JDS, it may be a setback for the BJP, and the ruling dispensation may need to adopt more populist policies, which could negatively impact the market. On the other hand, if the BJP springs a surprise and wins the election, it could be a shot in the arm for the ruling government, which could have a positive impact on the market.

Overall, the market may react differently based on the actual election outcome and the margin of victory.

Various factors affect the stock market, such as global economic conditions, investor sentiment, and company performance, among others. A range of other factors will influence the long-term direction of the market despite the potential short-term impact of the election results.

What should investors do on Monday after Karnataka Election Result?

A combination of various factors, including global economic conditions, monetary policies, geopolitical events, company performance, and investor sentiment, among others, typically determines the long-term trajectory of the stock market, and while election results can impact the market in the short term, it is important to maintain a holistic view of the market and avoid overemphasizing the significance of a single event.. Keeping a holistic view of the market and not overemphasizing the significance of a single event such as an election outcome is essential.

Want to Learn How to do Trading in Live Market? With systematic Trading Strategy on the Day of Expiry. *Click Here To Know*

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.