Option Trading can help you to earn good amount of side income. Some of the benefits of trading option are Income Generation.

What is Options Trading?

Options trading involves buying and selling contracts on assets like stocks, bonds, commodities, or indices to capitalize on price movements. It provides traders with the opportunity to profit from price movements in these assets without actually owning them. Options are derivative contracts that grant the buyer (option holder) the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (strike price) within a specified period (expiration date). Call options allow buying, put options allow selling of the underlying asset.

Buying Calls

Buying call options involves purchasing options with the anticipation of the underlying asset’s price increasing, as a strategy in options trading.

When you buy a call option, you are acquiring the right, but not the obligation, to buy the underlying asset at a specified price (strike price) within a predetermined period (expiration date). By purchasing call options, you can participate in the potential upside movement of the underlying asset while limiting your risk to the premium paid for the options contract.

Buying call options can provide leverage and the potential for substantial returns if the underlying asset’s price increases as expected. However, it’s essential to carefully assess market conditions, perform thorough analysis, and manage risk effectively when implementing this strategy. It’s also advisable to seek guidance from a financial professional or conduct extensive research before engaging in options trading.

Buying Puts

Put options provide investors with the opportunity to profit from a decline in the value or price of an asset. They function in the opposite direction from call options, offering a way to benefit from downward price movements.

One advantage of using put options is that they allow investors to lower the risk associated with short selling an asset. Short selling involves borrowing and selling an asset with the expectation of buying it back at a lower price in the future, but it carries unlimited risk if the asset’s price rises significantly. By purchasing put options instead, investors can limit their potential losses to the premium paid for the options contract.

Selling call

Selling options is an options trading strategy where investors sell call options to earn premium income as option sellers. When selling call options, the investor commits to selling the underlying asset at a predetermined price if the option is exercised by the buyer.

Selling call options can be an income-generating strategy, particularly in a sideways or bearish market. However, it requires careful analysis, risk management, and an understanding of the potential obligations involved. It’s recommended to consult with a financial professional or conduct thorough research before engaging in options trading, including selling call options.

Selling put

Selling put options is a strategy in options trading where an investor (option seller) writes and sells put options to earn premium income. By selling put options, the investor takes on the obligation to buy the underlying asset at a predetermined price (strike price) if the buyer of the put option chooses to exercise it. Selling put options can be an income-generating strategy, particularly in a sideways or bullish market. However, it requires careful analysis, risk management, and an understanding of the potential obligations involved. It’s recommended to consult with a financial professional or conduct thorough research before engaging in options trading, including selling put options

Benefits of trading options:

Trading options offers several benefits to investors. Here are some key advantages of trading options:

Flexibility: Options offer flexibility in terms of strategies and trading approaches. Investors can employ various strategies, such as buying calls or puts, selling options, or combining multiple options to create more complex strategies like spreads or straddles. This flexibility allows investors to tailor their trades to market conditions and their specific objectives.

Hedging: Options can be used as a hedging tool to protect investment portfolios against adverse price movements. By buying put options, investors can limit potential losses on their existing positions if the market declines. This helps to manage risk and provide a form of insurance for their investments.

Income Generation: Selling options, such as covered call strategies, can generate income through the collection of premiums. By selling call options on securities they already own, investors can earn premiums while potentially benefiting from capital appreciation if the underlying asset’s price remains below the strike price.

Diversification: Options trading allows investors to diversify their portfolios beyond traditional asset classes. They can trade options on stocks, bonds, commodities, indices, and other financial instruments, providing opportunities to gain exposure to various market segments and potentially reduce overall portfolio risk.

Potential for Profit in Any Market Direction: Unlike traditional investing, options trading can offer opportunities to profit in both rising (bullish) and falling (bearish) markets. Depending on the trading strategy employed, investors can benefit from correctly predicting the market direction or even profit from neutral market conditions.

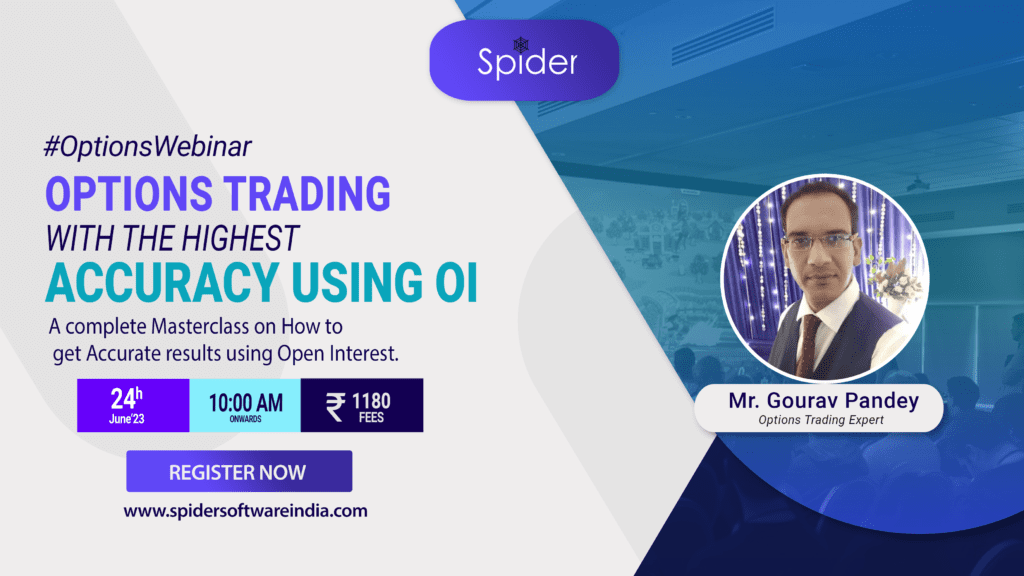

Get a chance to learn how to use Open Interest giving Highly Accurate Options Trading Results.

Also, Check out our article on Beginner’s Guide to Profitable Options Trading.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.