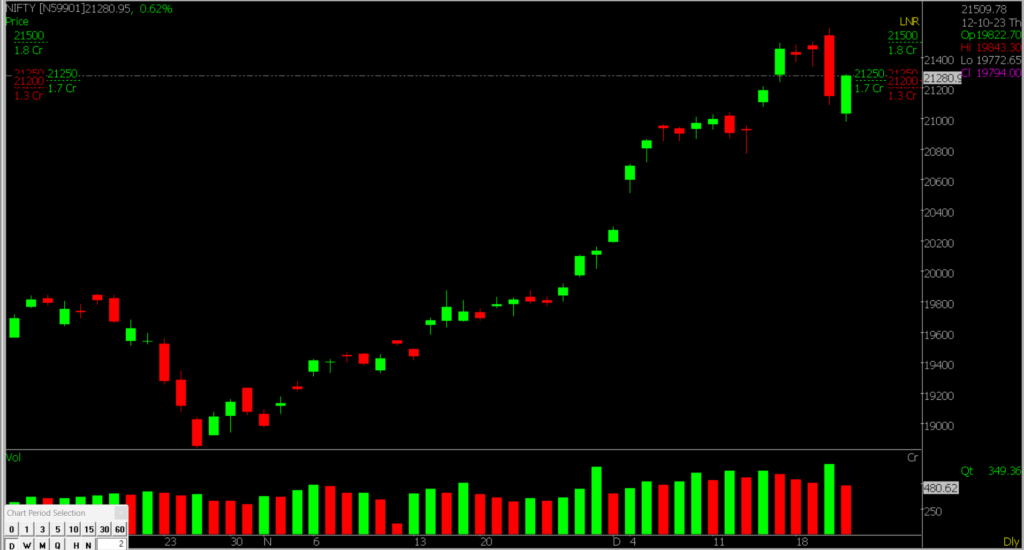

In Stock Market Today, Nifty closed above 21,250, and Sensex has gained 359 points, with all sectors showing positive trends.

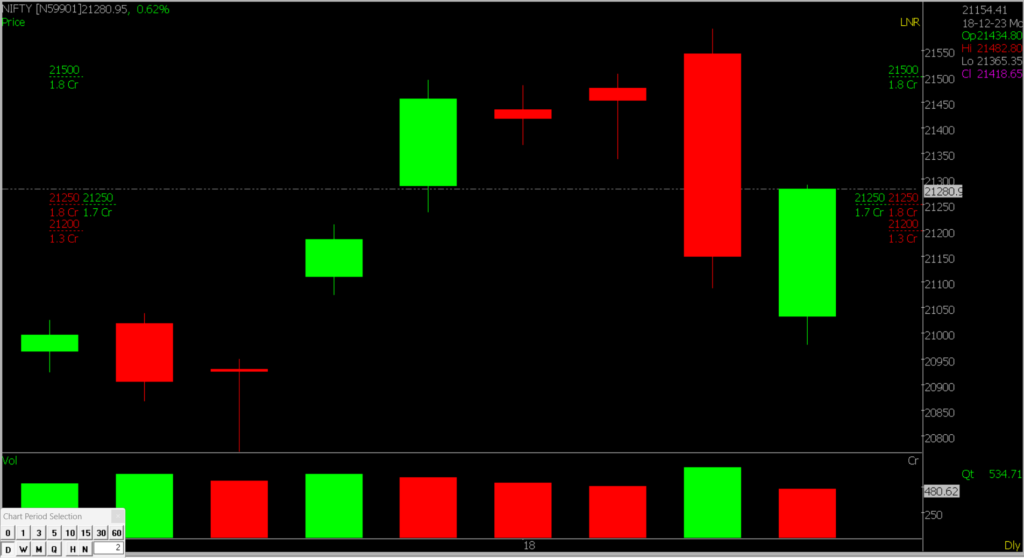

Stock Market Nifty Chart Prediction.

On December 21, benchmark indices closed higher with Sensex gaining 358.79 points (0.51%) and Nifty rising by 104.80 points (0.50%). Top gainers included BPCL, Power Grid, Britannia, HDFC Bank, and Hindalco. Sectors like IT, Banking, and FMCG each rose by 0.5%, while metal, pharma, realty, power, oil & gas, and capital goods saw gains of 1-2%. BSE Midcap and Smallcap indices both rose by 1.5%.

Stock Prediction for 22nd Dec 2023

1) SIEMENS: Good Above 4000, Weak Below: 3940

2) KOTAKBANK: Good Above 1871, Weak Below 1840

3) ONGC: Good Above 206, Weak Below 202

4) CROMPTON: Good Above 303, Weak Below 298

Prediction For Friday NIFTY can go up if it goes above 21500 or down after the level of 21250 but all depends upon the Global cues.

After a brief dip, markets rebounded by almost half a percent, with Nifty settling around 21,250. Energy, metal, and banking were top gainers, and broader indices saw a 2% increase. Expecting consolidation, trading opportunities lie in stock-specific movements. If the market opens above 21250, then it can go up and resist at 21500. Levels between 21250 – 21200 will be a crucial support. Watch the US markets for the next directional cue.

| Highest Call Writing at | 21500 (1.8 Crores) |

| Highest Put Writing at | 21250 (1.8 Crores) |

Nifty Support and Resistance

| Support | 21250, 21200 |

| Resistance | 21500, 21600 |

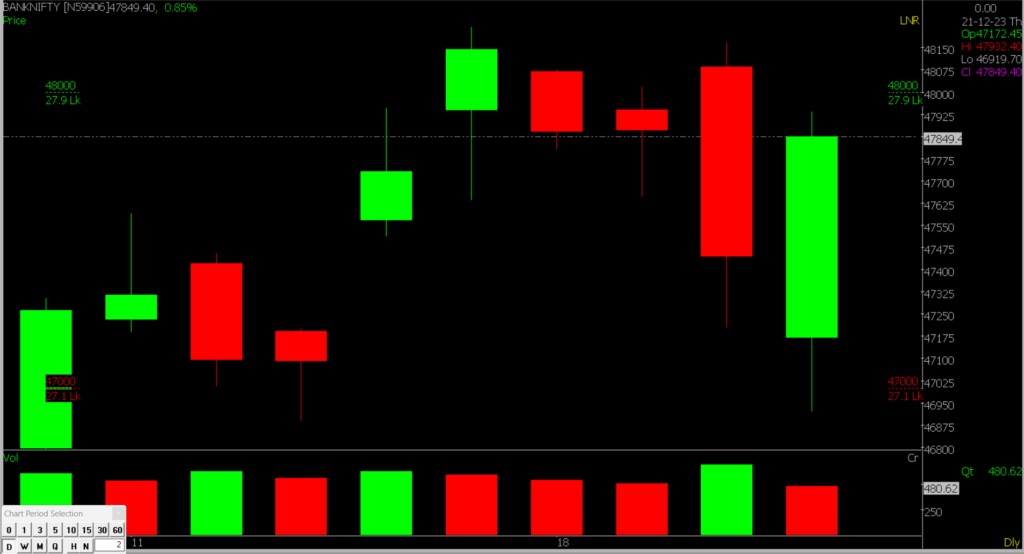

Bank Nifty Daily Chart Prediction

Prediction For Friday Bank NIFTY can go up if it goes above 48000 or down after the level of 47000 but it all depends upon the Global cues.

Bank Nifty also bounced back in the second half, ending at 47,852.7 with a gain of 394.85 points. The crucial support is at 47,000, and if maintained, Bank Nifty is anticipated to continue moving upward to 48,000 and if breaks the resistance level then can go up to 48,200. The overall trend is positive. But everything depends on the Global indications.

| Highest Call Writing at | 48000 (27.9 Lakhs) |

| Highest Put Writing at | 47000 (27.1 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47000, 46900 |

| Resistance | 48000, 48200 |

Also, check our Article on how and when to use the Band Bollinger Indicator.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein. ![]()