In Stock Market Today, breaking the streak, Nifty dropped to 21,150, Sensex fell 931 points, and all sectors were in the red.

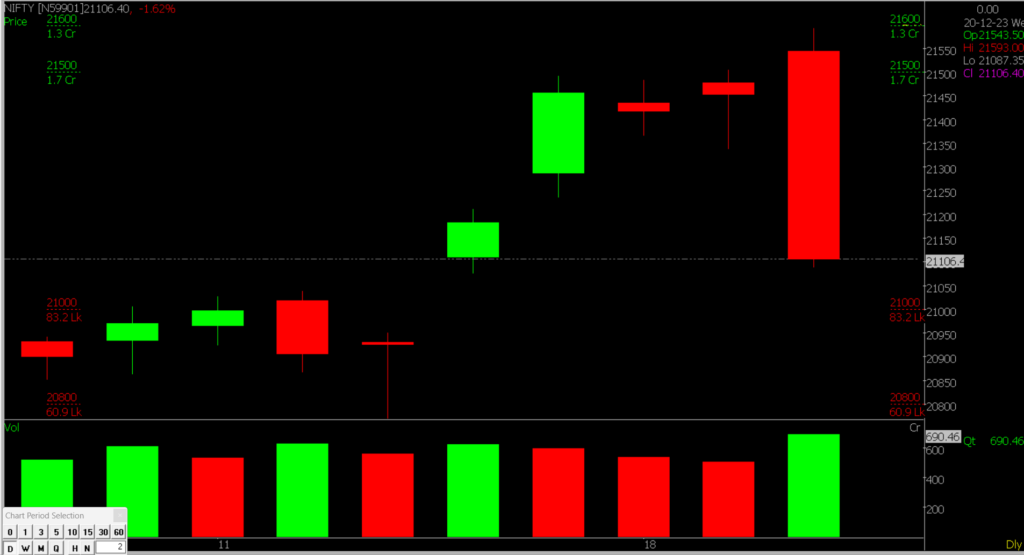

Stock Market Nifty Chart Prediction.

On December 20, Nifty closed at 21,150 as benchmark indices ended in the red. Sensex dropped 930.88 points (1.30%) to 70,506.31, and Nifty fell 302.90 points (1.41%) to 21,150.20. Declines were widespread, with sectors like auto, capital goods, metal, pharma, oil & gas, power, and realty down by 2-4 percent. BSE Midcap and Smallcap indices each declined over 3 percent. Notable losers included Adani Ports, Adani Enterprises, UPL, Tata Steel, and Coal India. Gainers were ONGC, Tata Consumer Products, Britannia Industries, and HDFC Bank.

Stock Prediction for 21st Dec 2023

1) TATACONSUM: Good Above 980, Weak Below: 961

2) LT: Good Above 3440, Weak Below 3390

3) RADICO: Good Above 1600, Weak Below 1560

4) AUBANK: Good Above 760, Weak Below 745

Prediction For Thursday NIFTY can go up if it goes above 21500 or down after the level of 21000 but all depends upon the Global cues.

Bears dominated the Stock Market, causing a correction after Nifty hit 21,593. The Index closed at 21,150.15, down 302.95 points. All sectors ended in red, with Media and PSU Banking major losers. Broader indices (Mid and Smallcaps) plunged over 3.20%.

While a strong bearish candle suggests a short-term bearish trend, a hidden bullish divergence in the lower timeframe is possible. If the index reverses from the support zone of 21,000-20,800, a limited recovery to 21,500 (resistance level) may occur.

| Highest Call Writing at | 21500 (1.7 Crores) |

| Highest Put Writing at | 21000 (83.2 Lakhs) |

Nifty Support and Resistance

| Support | 21000, 20800 |

| Resistance | 21500, 21600 |

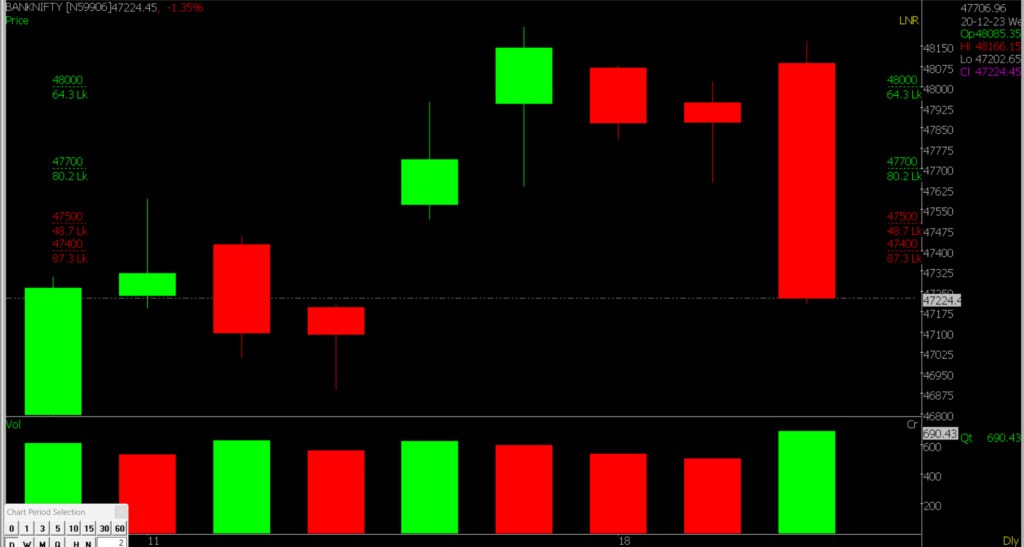

Bank Nifty Daily Chart Prediction

Prediction For Thursday Bank NIFTY can go up if it goes above 47700 or down after the level of 47000 but it all depends upon the Global cues.

Bank Nifty mirrored the Nifty chart, with bears in control. The indices closed at 47,224.4. Starting in a downtrend, it rapidly fell after breaking the 48,000 mark, eventually reaching below 47,500. 47,000 is a crucial support, and if it bounces back, 47,000–48,000 will be the resistance level for Bank Nifty.

| Highest Call Writing at | 47700 (80.2 Lakhs) |

| Highest Put Writing at | 47000 (87.3 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47100, 47000 |

| Resistance | 47700, 48000 |

Also, check our Article on how and when to use the Band Bollinger Indicator.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.