In Stock Market Today, Nifty reaches 21,450, Sensex gains 230 points; metal and power sectors rise, while IT sector lags behind.

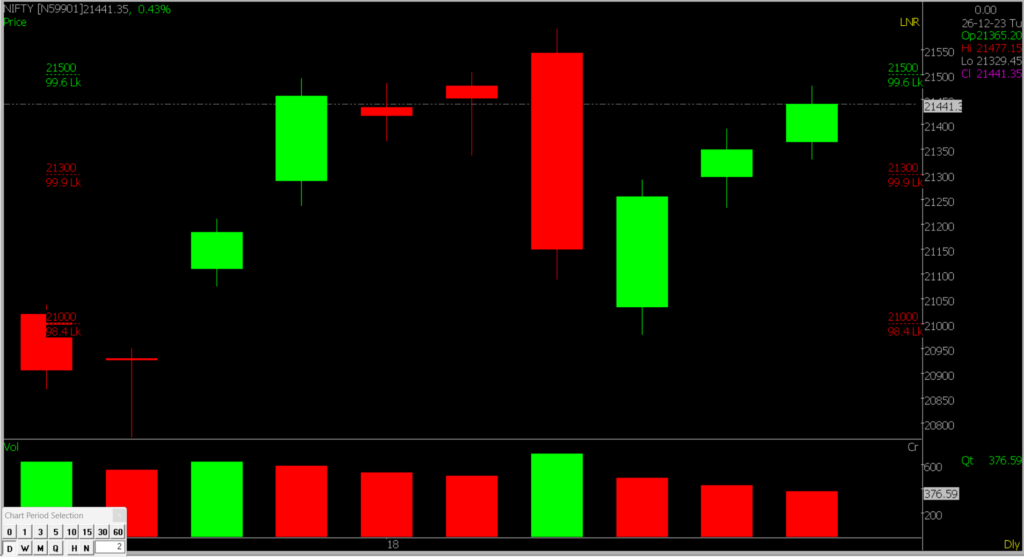

Stock Market Nifty Chart Prediction.

Markets close higher for the third straight day on December 26, with Nifty at 21,450. Sensex gains 230 points to reach 71,336.80. Divis Laboratories, Hero MotoCorp, Adani Enterprises among top Nifty gainers. Bajaj Finance, Infosys, TCS among the losers. Except for IT, all other sectors trade in the green, with oil & gas, power, metal, auto, and healthcare up 1 percent each. BSE midcap index adds 0.7 percent, and smallcap index is up 0.5 percent.

Stock Prediction for 27th Dec 2023

1) APOLLOHOSP: Good Above 5644, Weak Below 5588

2) BIOCON: Good Above 553, Weak Below 448

3) AMBUJACEM: Good Above 510, Weak Below 505

4) IGL: Good Above 415, Weak Below 410

Prediction For Wednesday NIFTY can go up if it goes above 21500 or down after the level of 21300 but all depends upon the Global cues.

Nifty began the day with a steady start but gained momentum, closing at 21,441.35 with a 0.43 percent intraday rise. Despite the initial sluggishness, the indices demonstrated positive movement, suggesting market resilience and a potential bullish sentiment. The crucial support is at 21,300, while the resistance stands at 21,500. Any breakout may lead to movements beyond both support and resistance levels.

| Highest Call Writing at | 21500 (99.6 Lakhs) |

| Highest Put Writing at | 21300 (99.9 Lakhs) |

Nifty Support and Resistance

| Support | 21300, 21200 |

| Resistance | 21500, 21550 |

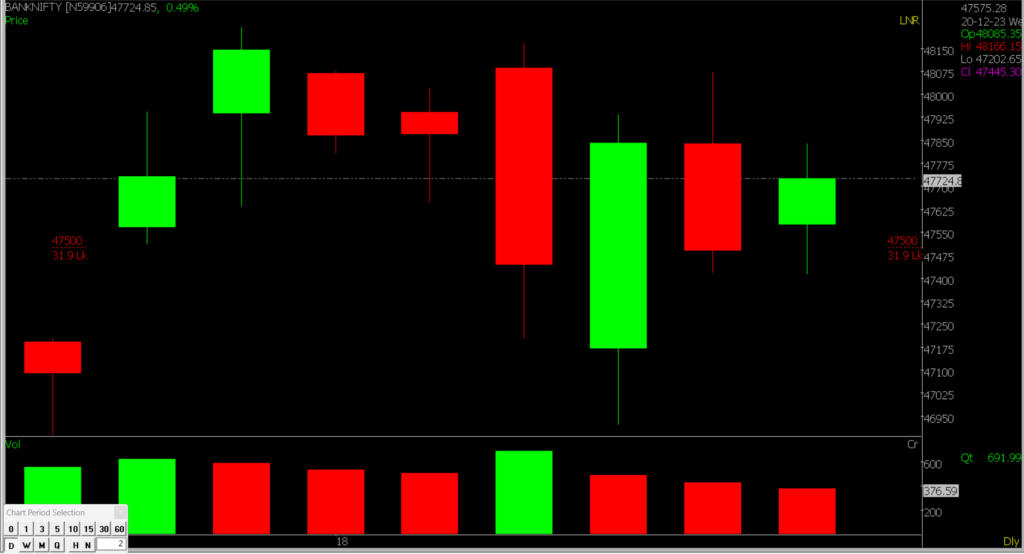

Bank Nifty Daily Chart Prediction

Prediction For Wednesday Bank NIFTY can go up if it goes above 48000 or down after the level of 47500 but it all depends upon the Global cues.

Bank Nifty ended on a positive note, rising by 0.49 percent to settle at 47,724.85. The index traded positively throughout the session, mirroring Nifty’s positive movement. This reflects the market’s overall resilience and potential bullish sentiment. Bank Nifty has support levels at 47,500-47,300, with resistance at 48,000 and 48,220.

| Highest Call Writing at | 48000 |

| Highest Put Writing at | 47500 (31.9 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47500, 47300 |

| Resistance | 48000, 48220 |

Also, check our Article on how Rounding Top Pattern is formed on various stocks.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.