Before initiating an investment in a particular stock, we examine various factors like technical, fundamental, and futures and options parameters. Among these, the importance of Open Interest is a significant future parameter.

What is Open Interest?

It’s essentially the count of all open contracts in the futures market.

A contract involves both a buyer and a seller, for Future Market. The total number of active contracts is referred to as open interest.

Open interest can change during the trading day or by the end of the day. This change can be positive or negative, indicating the fluctuations in the number of contracts for each stock.

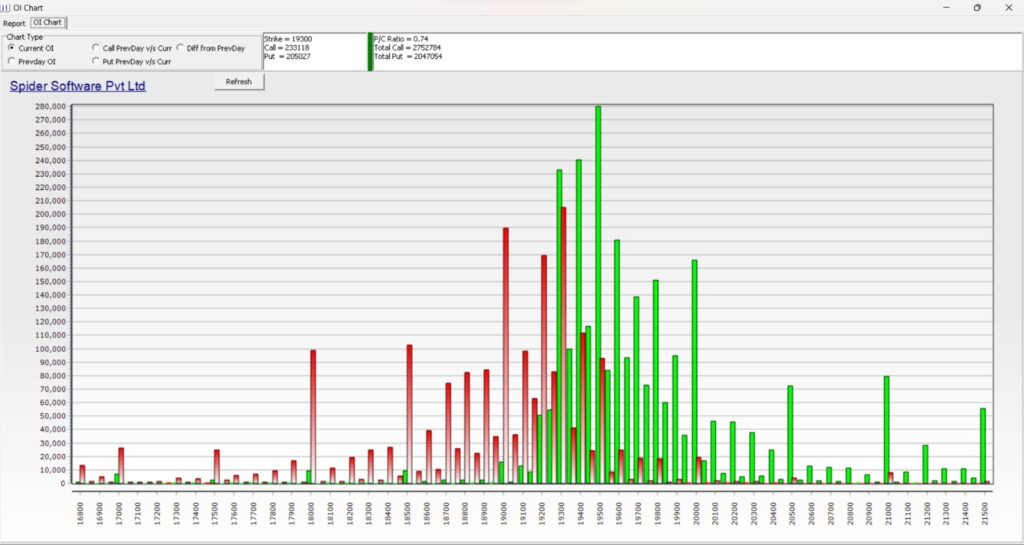

The Open Interest Chart is from Spider Software.

Importance of Open Interest in the Future Market

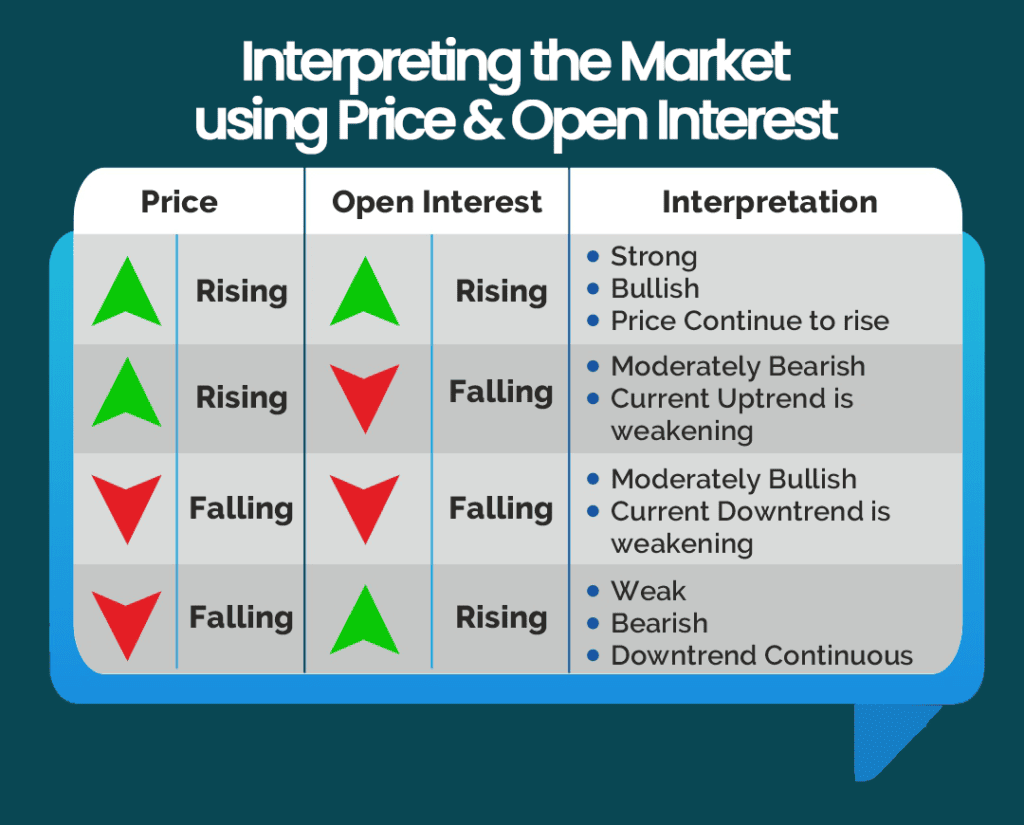

Open interest in the futures market serves a key role in indicating market strength or weakness. When the price rises along with increased open interest, it’s a bullish sign, signaling more buyers are actively participating. Conversely, if the price rises but open interest drops, it’s a bearish signal, often due to short covering and money leaving the market.

Following short covering, prices tend to fall. On the other hand, if prices drop alongside rising open interest, it suggests new short positions are being taken. A decrease in both price and open interest indicates a bearish outlook.

How to Calculate Open Interest?

Open interest is determined by adding the contracts from opening trades and subtracting those from closing trades. Imagine three traders (A, B, and C) trading Nifty Futures:

Here’s an example of it.

Imagine you have three friends: A, B, and C. Here’s how it works:

Friend A starts with 0 toys.

Friend A gets 1 new toy. Now the open interest is 1.

Friend B comes and gets 4 new toys. Now the open interest is 5.

Friend A gives away 1 toy. Now the open interest is 4.

Friend C enters and gives away 4 toys. Now the open interest is 8.

The open interest increases when someone gets new toys (opens a trade) and decreases when someone gives away toys (closes a trade). Sometimes, both friends will open trades, and it goes up. Other times, one closes while the other opens, and it stays the same. And sometimes, both friends close trades and it goes down. This helps us see how many trades are happening in the toy trading game.

How does Open Interest help in identifying trends in the market?

Open interest acts like a clue that guides us in understanding the possible direction of a market trend.

When open interest rises along with the price of a stock or commodity, it can suggest that more traders are showing interest and entering new trades. This frequently occurs when the market is strongly moving in a specific direction. It implies that the trend could continue.

Conversely, if open interest increases as the price declines, it could indicate traders are closing their positions or exiting the market. This might indicate a weakening trend or a potential reversal.

In summary, open interest helps us determine whether more participants are joining or leaving a trend, providing insights into where the market could be headed.

Conclusion

Open interest holds a vital role for traders engaged in futures and options markets. It imparts valuable insights, reinforcing market strength and aiding in the assessment of market dynamics for shaping effective trading strategies. The open interest ratio can be a beneficial tool for traders.

The calculation of open interest entails adding the contracts tied to opening trades and subtracting those related to closed trades. These calculations influence traders in deciding whether to buy or sell contracts. By integrating open interest with other forms of analysis, one can make well-informed investment decisions in the stock market.

Also, Check out our article on Top of Cryptocurrencies to look for in 2023.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.