The hammer candlestick pattern is a technical analysis pattern that can be used to identify potential bullish reversals in financial markets

What is hammer candlestick pattern:

The hammer candlestick pattern is a technical analysis pattern that can be used to identify potential bullish reversals in financial markets. the hammer candlestick pattern can be described as a bullish reversal pattern that can signal a potential change in trend. Traders can use the hammer candlestick pattern to identify potential buying opportunities, as it suggests that sellers may be losing momentum and buyers are starting to take control

How to use hammer candlesticks pattern:

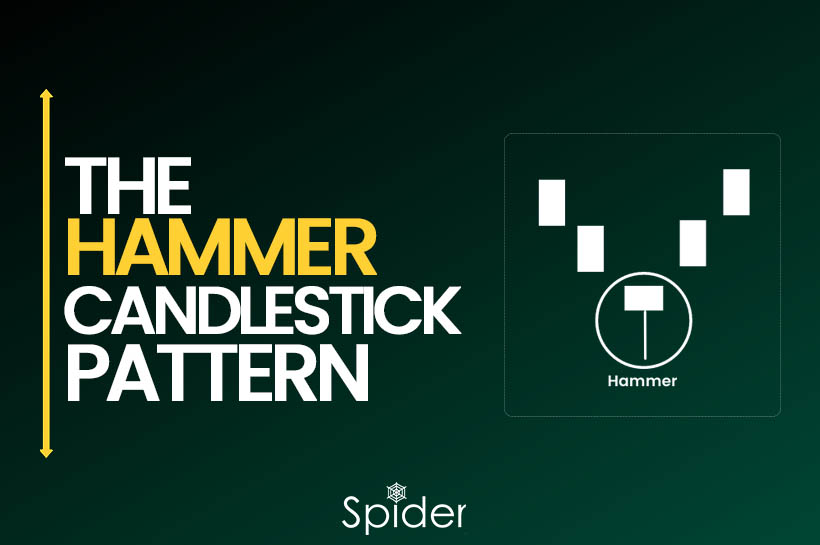

Identify the pattern: Look for a candlestick chart pattern that looks like a hammer. The hammer candlestick pattern is characterized by a small real body at the upper end of the trading range, a long lower shadow, and little or no upper shadow.

Define the criteria: Define the criteria for the hammer candlestick pattern. For example, the real body should be at least half the size of the lower shadow, and there should be little or no upper shadow.

Placing Stops and Taking Profits in hammer candlesticks pattern:

When trading using the hammer candlestick pattern, it is important to have a clear plan for placing stops and taking profits. This can help to minimize losses and maximize gains, and can be done using a variety of technical analysis tools and strategies.

Traders may use a variety of methods to set stop loss levels, such as placing stops below the low of the hammer candlestick or using support and resistance levels to determine exit points. For taking profits, traders may use a variety of methods as well, such as setting profit targets based on key technical levels, using trailing stops to lock in gains, or using price action signals to exit trades.

Limitations of Using Hammer Candlesticks:

False signals:

Like any technical analysis tool, the hammer candlestick pattern can sometimes produce false signals. This can occur when a hammer candlestick forms, but the market does not reverse as expected. Traders need to be aware of this risk and use other technical indicators to confirm the signals given by hammer candlesticks.

Market context:

The hammer candlestick pattern is most effective when it occurs in the context of a larger trend or market condition. If the market is in a strong downtrend, for example, a hammer candlestick may not be enough to signal a trend reversal. Traders need to consider the larger market context before making trading decisions based on hammer candlesticks.

Lack of precision:

While the hammer candlestick pattern can provide useful information about potential market reversals, it is not a precise tool. Traders need to use other technical indicators and analysis tools to fine-tune their trading decisions and maximize their chances of success.

Psychology of the Hammer Candlestick Pattern:

The psychology of the hammer candlestick pattern is important to understand when using it as a trading tool. The pattern suggests that during a downtrend, the bears were in control at the beginning of the period, pushing prices down to new lows. However, by the end of the period, the bulls were able to push prices back up, creating the small real body and long lower shadow characteristic of the hammer pattern.

Traders who understand the psychology of the hammer candlestick pattern can use this information to make informed trading decisions. By recognizing the shift in market sentiment that occurs when the hammer pattern forms, traders can look for other technical analysis tools and indicators to confirm the potential trend reversal. They can also use this information to set stop loss and take profit levels, minimizing risks and maximizing gains.

Overall, understanding the psychology of the hammer candlestick pattern is a key part of using this tool effectively in trading. By recognizing the market sentiment shift that occurs when the hammer pattern forms, traders can make better trading decisions and improve their chances of success.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.